Well, folks, it seems that Bitcoin ETFs are having a rougher time than a cat in a room full of rocking chairs. With a staggering outflow of $166 million for the third day in a row, one can only wonder if someone accidentally set off the “panic button” at Blackrock.

Solana and XRP Take the Spotlight While Bitcoin and Ether Slide Downhill

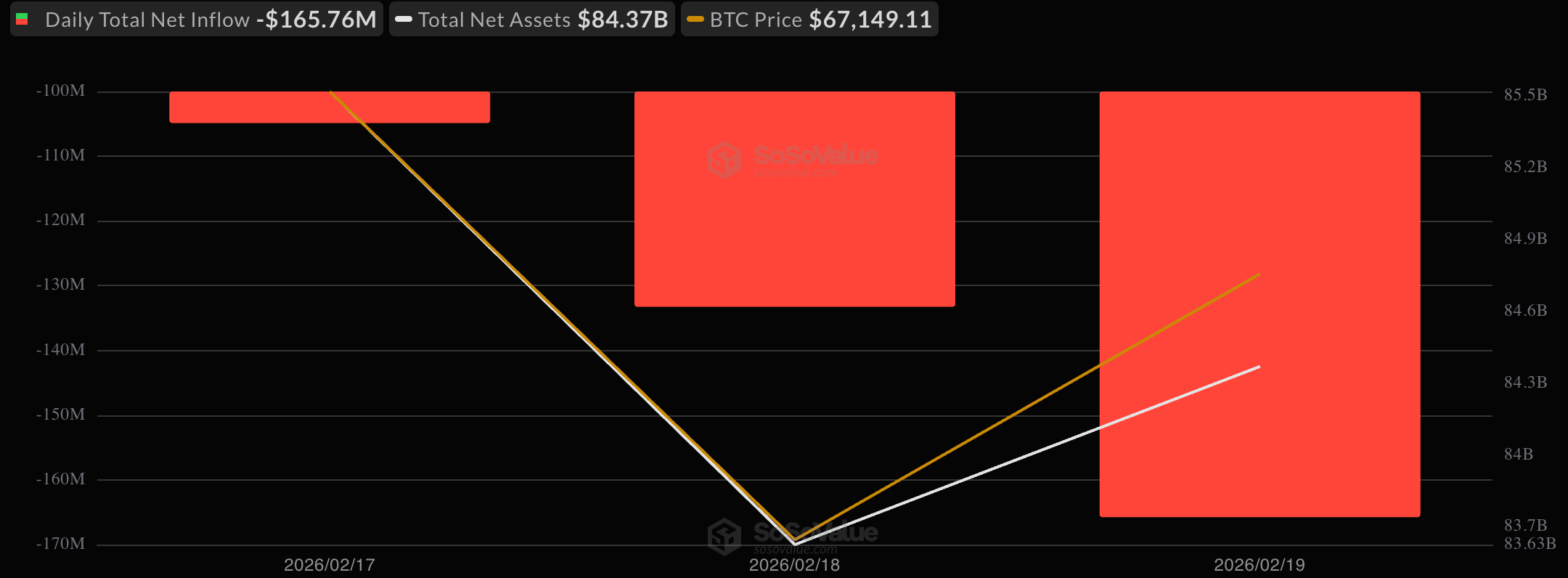

Another day, another financial bloodbath for Bitcoin funds. On Thursday, February 19, Bitcoin ETFs reported net outflows of $165.76 million. Clearly, investors are not just taking their chips off the table; they’re throwing the whole table out the window.

The pain was mostly courtesy of Blackrock’s IBIT, which was responsible for a jaw-dropping $164.06 million in exits. Talk about a dramatic exit-this isn’t just a walk-out; it’s a full-on sprint! Valkyrie’s BRRR managed to squeak out just $1.70 million in outflows, probably wondering why it even bothered. Despite a trading frenzy of $2.40 billion (which is like finding a dollar in the couch cushions), total net assets across Bitcoin ETFs have settled at a cozy $84.37 billion.

Ether ETFs felt the burn even more, with a hefty $130.19 million in outflows. Blackrock’s ETHA led the pack, shedding $96.80 million as if it were a snake trying to get rid of an unwanted skin. Grayscale’s Ether Mini Trust was close behind, losing $18.44 million, while Fidelity Investments’s FETH and Bitwise’s ETHW collectively lost enough to buy a small island-$11.62 million and $3.34 million, respectively. Meanwhile, trading volume hit $677.01 million, but net assets dipped to $11 billion, which is still quite a bit, unless you’re a financier with champagne tastes.

In a twist worthy of a soap opera, XRP ETFs actually welcomed some new cash into the fold with $4.05 million in net inflows, fueled by Bitwise’s XRP with $2.52 million and Franklin’s XRPZ adding another $1.53 million. It’s like watching the underdog win a race, only this time, nobody cares about the trophy-just the cash. Total value traded stood at $7.98 million, with net assets closing at a cool $1.01 billion.

Solana ETFs also seem to be on a roll, pulling in $5.94 million in inflows, led by Bitwise’s BSOL with $5.46 million. Fidelity’s FSOL contributed $481,830-enough to buy lunch for a small family. Trading volume came in at $21.43 million, pushing total net assets up to $710.27 million. Not too shabby for a market that feels like a roller coaster ride gone completely off the rails.

Overall, Thursday’s session reflected a lot of caution around Bitcoin and ether exposure, with concentrated redemptions that would make any investor cringe. Meanwhile, investors are strategically shifting their attention to XRP and Solana ETFs, suggesting a tactical shift rather than a full retreat from crypto-linked funds-kind of like deciding to order a salad instead of fries while still eating a burger.

FAQ📊

-

Why did Bitcoin ETFs record a third straight day of outflows?

The bulk of the redemptions came from Blackrock’s IBIT, indicating that institutions may be selling off their shares like they just found out what’s really in hot dogs. -

How significant were Ether ETF outflows on February 19?

Ether ETFs saw $130.19 million in withdrawals, led by Blackrock’s ETHA, highlighting sustained pressure on large-cap crypto exposure. It’s like watching a slow-motion train wreck. -

Which crypto ETFs saw inflows during the session?

XRP ETFs recorded $4.05 million in inflows, while Solana ETFs attracted $5.94 million, signaling selective demand for alternative crypto assets. Who knew being picky could be so profitable? -

What were the total assets under management after trading closed?

Bitcoin ETFs ended with $84.37 billion in net assets, ether ETFs with $11 billion, XRP ETFs with $1.01 billion, and Solana ETFs with $710.27 million. So, if anyone asks, yes, there’s still money in crypto-at least for now.

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Logan Paul’s $16M Pokémon Scandal: The Price of Greed

- XRP: Déjà Vu All Over Again? 🧐

- XRP’s Wild Thrilling Orphan Adventure to $70? Find Out!

- Silver Rate Forecast

- PUMP Pumped or Plundered? Traders Beware the Bull! 🤦♂️

- Bitcoin’s Golden Quest: 20 Years or a Midnight Snack?

- BNB Hits $883 ATH – Can It Break $1K Despite THIS Hurdle?

- You Won’t Believe Michael Saylor Just Spent $168 Million on Bitcoin Again!

2026-02-20 20:29