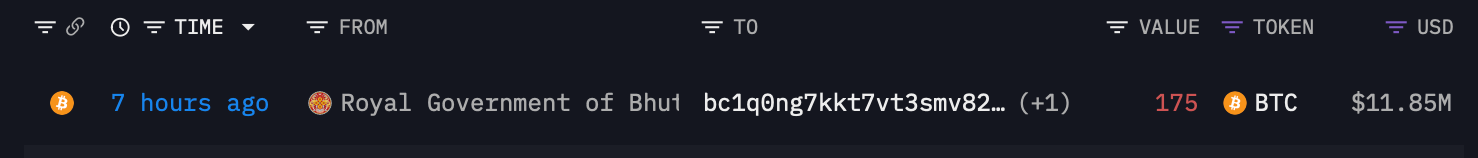

Bhutan’s Cryptic Bitcoin Ballet: $11.85M Vanishes in a Digital Puff!

Behold, the onchain oracles at Arkham Intelligence have spied Bhutan’s latest caper: 175 BTC, a paltry $11.85 million, spirited away with the grace of a yeti evading a tourist’s camera. Bhutan, that quaint member of the crypto aristocracy, mines its digital gold rather than pilfering it from the open market-how quaintly self-sufficient!