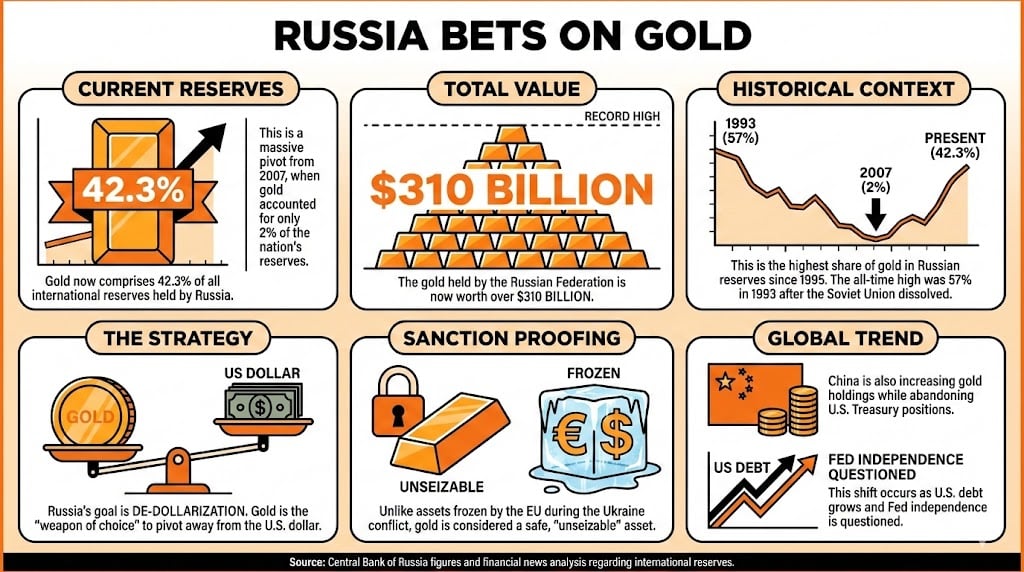

They speak of figures, pronouncements from the Central Bank. $310 billion in gold, a “record,” they call it. A record of what? Of a nation finally acknowledging the precarity of paper, of the hollow promises whispered by the West? It is not a blossoming of faith in finance, but a quiet, desperate turning toward the earth itself. 42.3%…a neat, bureaucratic percentage masking a deeper unease.

A Glimmer in the Darkness: Russia and the Allure of the Yellow Metal

The Official Account

They tell us Russia is “diversifying.” Diversifying away from what? From the very foundations of a system built on assurances that now ring with the hollowness of a cracked bell. To “bet heavily on gold” – such a clinical phrase! Sounds almost cheerful, doesn’t it? As if placing a wager at a gentlemen’s club rather than bracing for the inevitable.

According to reports emanating from the Central Bank – a source as trustworthy as a politician’s promise – gold now constitutes 42.3% of all the nation’s holdings. A mere 42.3%? They act as though it is a considerable leap, but let us recall…1993, the wreckage of a fallen empire, 57%. A more honest figure, perhaps, a starker admission of the post-Soviet reality. And before that? A brief, foolish flirtation with abandoning it altogether, allowing it to dwindle to a pathetic 2%. Oh, the arrogance of those times!

Now, they boast of surpassing 1995 levels. A milestone, they claim. A milestone built on…what? On the slow, creeping realization that Western sanctions are not mere inconveniences, but a blatant confiscation of assets? A violation of the implicit contract of international trade? They hoard gold not by choice, but by necessity. 🧐

Over $310 billion, they say. A number, a cold, abstract quantity. Better to picture it: mountains of ingots, locked away in vaults, gleaming faintly in the darkness. A mute, golden protest.

The Real Meaning

This “lust for gold,” as they so quaintly put it, is not enthusiasm; it is a retreat. A frantic search for something…real. Something that cannot be extinguished with a keystroke, frozen by a decree, or subject to the whims of distant, self-serving powers. The EU’s sanctions… ah, those “sanctions.” A polite term for theft. And gold, you see, is considerably more difficult to steal.

De-dollarization. Another carefully chosen word. Sounds so…clinical. As if one simply discards a currency like an old coat. It is, in truth, a desperate act of self-preservation. A declaration of non-confidence. And they are not alone. China, too, stirs… a slow, deliberate distancing from the U.S. Treasury, a cautious accumulation of the very metal they once scorned. It is a subtle rebellion, a growing chorus of skepticism.

And What of Tomorrow?

More gold, of course. The logic is inescapable. The pressure unrelenting. As long as the world remains a place of shifting alliances, broken promises and…shall we say… unforeseen circumstances, the Russian Federation will continue to bury its treasure in the earth, seeking a sliver of genuine security. As well they should. 😇

Questions from the Waiting

-

What game is Russia playing with its reserves?

Russia, with a sigh and a shrug, is allocating nearly half its holdings to gold – 42.3%, to be precise. It’s not a game, my friend; it’s damage control. 😔 -

How does this echo the past?

This is the highest proportion of gold since 1995, but a far cry from the 57% during the chaotic days of 1993. History, it seems, rhymes…and often with a mournful tune. -

Why now, all of a sudden, this golden infatuation?

Sanctions, dear reader, sanctions. The cold, hard realization that assets can vanish into thin air. Gold, at least, has weight. -

Is this a sign of things to come in the world of finance?

China is mirroring this trend, suggesting a looming distrust of the U.S. dollar. A crack in the facade? Perhaps. Or merely a tremor before the storm. 🤨

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: Ripple’s Legal Boss Warns of an Endless Puzzle of Regulatory Nonsense

- Dogecoin’s Dramatic Dance: Surges, Secrets & a Fed-Fueled Frenzy! 🚀🐶

- XRP Stands at $2.96-Is it the Final Battle or Just a Whimper? 🚨

- Is OKB’s Price Surge Just a Mirage? Find Out Why It Might Plummet to $65! 😱

- 😱 $91M Vanishes in Crypto Farce: ZachXBT Unveils the Absurdity! 🕵️♂️

- SOL to $500?! 🤪 It’s Possible!

2025-12-08 11:59