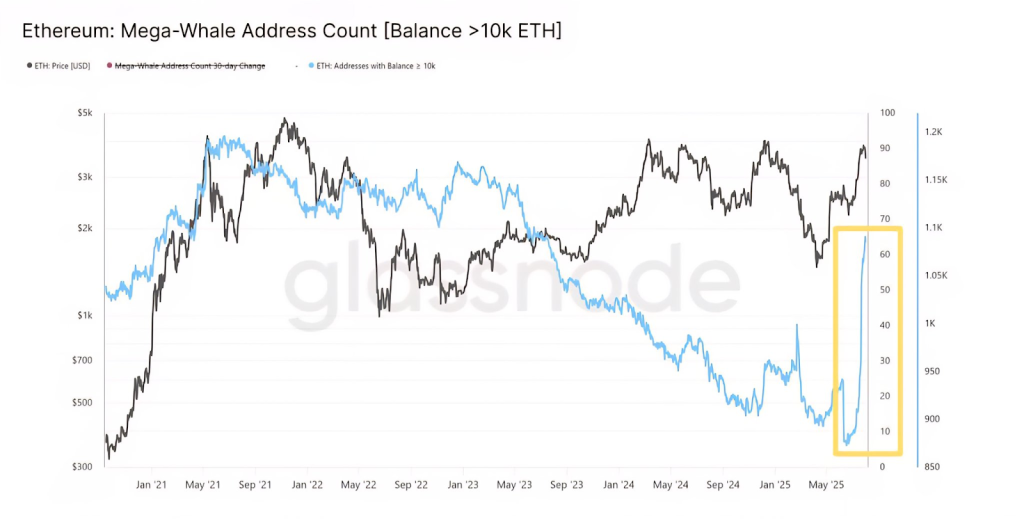

In the shadowy corners of the digital ether, the Ethereum whales have embarked on their most audacious buying spree since the last great famine in 2018. Data from our digital crystal ball, provided by the seers of Glassnode and Lookonchain, reveals a curious incident: wallets hoarding between 1,000 to 10,000 ETH have fattened up on a hefty 818,410 ETH, which translates to a whopping $2.5 billion, in just four innocuous months. This ballooning of their wealth marks the grandest accumulation since the depths of the 2018 bear market. What’s more, those holding between 10,000 to gargantuan amounts of ETH have bloated their ranks to around 1,200 addresses! 🐋 A sight not seen since the euphoric days of the 2021 bullish cavalcade. This indicates, with no small amount of irony, that institutional gluttons and long-term hoarders sense an approaching banquet.

Ethereum Exchange Reserves: The Emperor’s New Clothes?

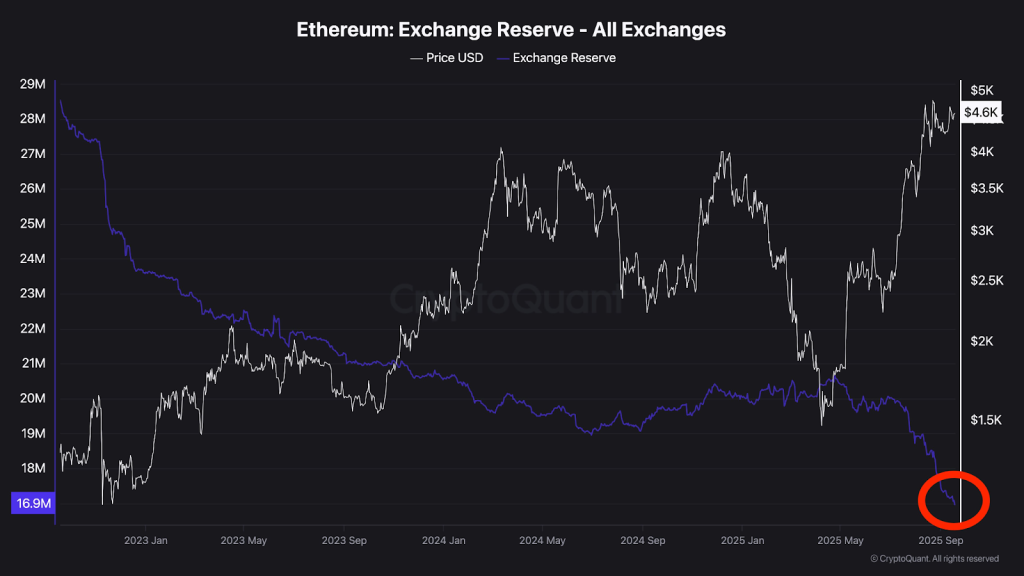

The on-chain evidence is both startling and suspicious: Ethereum exchange reserves are dwindling to their lowest levels not witnessed since records began. Here we see those fabled experts boil over with talk of a so-called “supply shock.” With a dearth of coins making their way to the exchanges and the incessant buying pressure exerted by these titanic whales and their ilk, the market tightropes on a tightrope of scarcity.

We find echoes of the past in this cycle, recalling when the Ethereum whales gorged themselves at the market’s nadir in 2018. That period, dear reader, preluded the meteoric rise of ETH from a meek $80 to a robust $4,800. It would appear that these whales are refusing to let history slip into anonymity without first replicating it with their own finesse.

Whole Institutions Pour On the Inflow

Ethereum ETFs are already boasting over $1 billion in inflows, an unambiguous gesture of swelling institutional intrigue. When coupled with the relentless accumulation by whales, a dawning clarity in the murky swamp of regulation, and Ethereum’s undeniable essential qualities, we are nudged closer to the edge of significant price discovery.

Ethereum in Search of the Five-Digit Mirage?

At present, Ethereum sits at a modest $4,410, a mere 9% shy of its yet unsurpassed peak. Analysts ogle over charts and squint at numbers, suggesting that should the whales and their current binge follow the nostalgic script of 2018, ETH could very well vault into uncharted territories, notching a sum of digits quaintly referred to as “five.” Tom Lee, a man who seemingly wields a telescope in place of an analyst’s calculator, has prognosticated a future where ETH might flirt with the lofty ranges of $15,000 to a dizzying $25,000 by the year 2025.

Meanwhile, the Ethereum whales, always as astute as they are insatiable, along with their institutional comrades, continue their aufgang-buying with a ferocity not witnessed since the days of old. With the reserves on exchanges in a free fall and demand climbing suitcases, one could jestingly predict that we’re all about to be invited to the grandest launch pad this side of the upcoming Ether-ball in a century. 🚀

Stay Tuned to the Whimsical World of Crypto!

Puzzle together breaking news, the pretentious proclamations of self-proclaimed analysts, and real-time updates on the latest trends weaving through the tapestry of Bitcoin, altcoins, DeFi, NFTs, and the countless other utopias and dystopias brewing therein.

FAQs

Why are the Ethereum sharks biting at such an impressive rate these fine days?

The current frenzy is the grandest we’ve observed since that season of want in 2018. Our whales and institutional behemoths, with inscrutable forethought or perhaps mere folly, are likely placing their bets upon what they envision to be a renewed era of growth, driven by the twin engines of dwindling exchange reserves and a burgeoning interest from the halls of institutions.

Is it conceivable that Ethereum’s value will leap into the stratosphere of 15 grand or beyond?

Analysts, with an air of gravitas that fails to camouflage their unabashed excitement, suggest that should the present banquet follow the venerable 2018 feast, ETH could indeed dance among the stars into the rarefied lands of prices we now fathom only with the help of our wildest imaginations. Tom Lee, in moments of prophetic delirium, has envisioned a range from $15,000 to $25,000.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Silver Rate Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Tokenization: The New “Mutual Fund 3.0” You Didn’t Know You Needed

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-09-20 13:37