A shadow looms over Solana, the once-promising star of the cryptocurrency firmament. After plunging to depths unseen in eight months, it clings precariously to a fragile high-timeframe support, its fate swaying like a pendulum between hope and despair. Some voices whisper of an imminent rebound, while others warn of fleeting ascents destined to descend into the abyss.

The Mirage of Higher Grounds

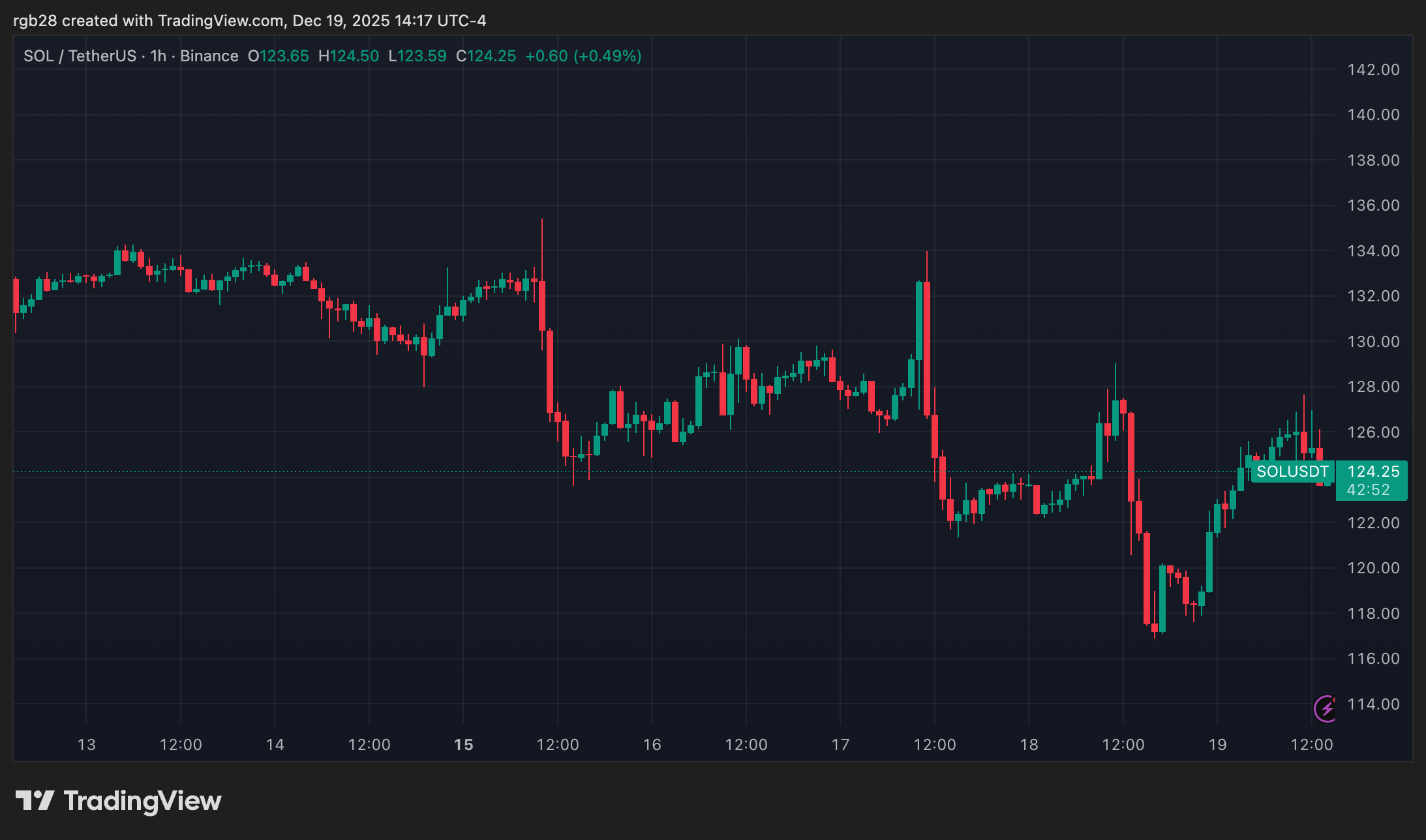

On Friday, Solana clawed its way back from the brink, surging 7.7% towards the $125 mark. Yet, this fleeting victory was preceded by a brutal fall of nearly 9% on Thursday, plunging its value to $116-a nadir not witnessed since April. Breaching the once-mighty $120 support, Solana now teeters on the edge, its future uncertain.

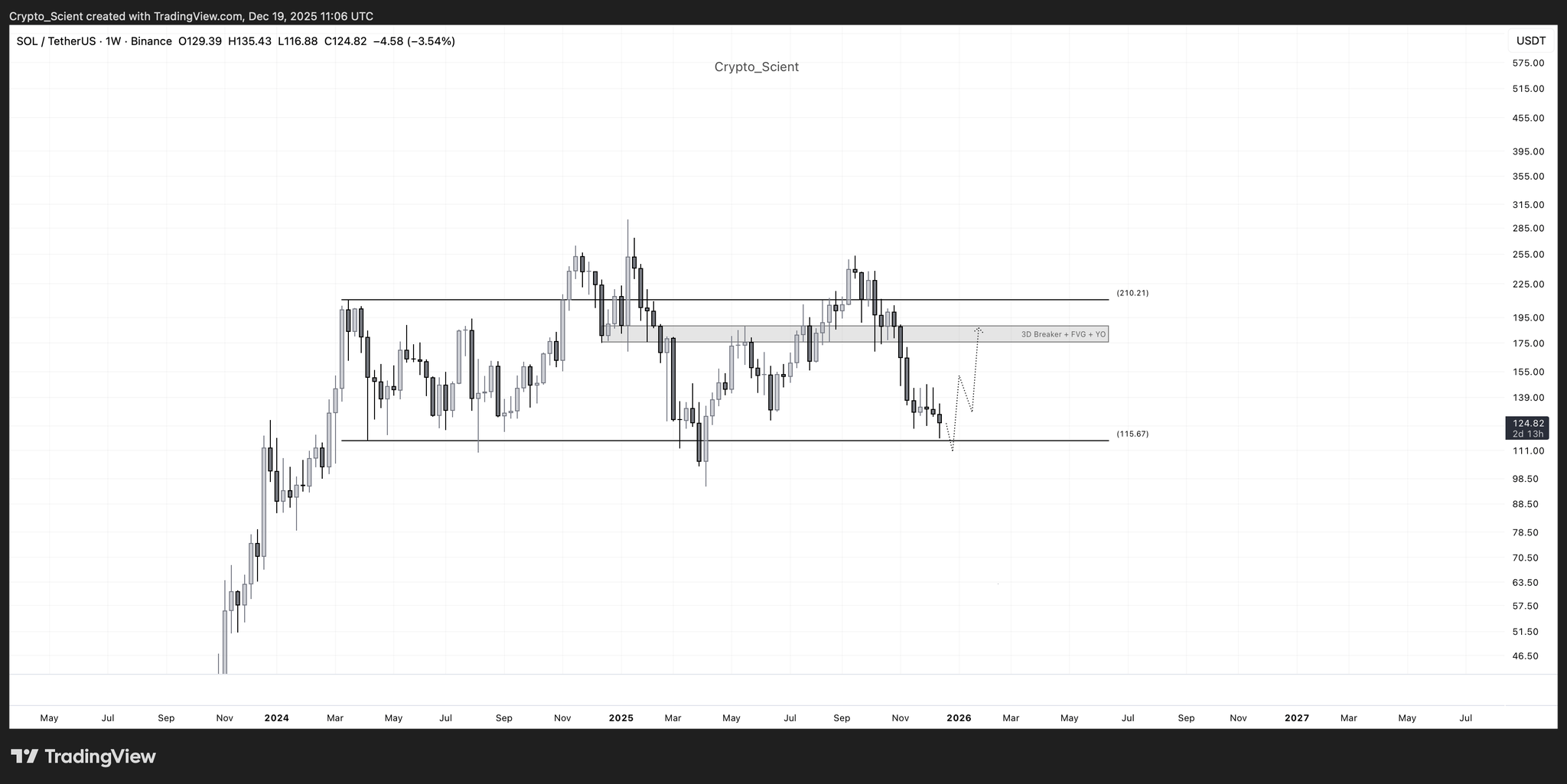

Crypto Batman, a weary sentinel of the market, observes that Solana “is not only at its major support level, the same one that has held price for the past 2 years.” A faint glimmer of hope emerges as a bullish divergence forms on the 3-day timeframe, eerily reminiscent of the prelude to a recovery rally earlier this year. But hope, as ever, is a fickle companion.

Another watcher, Crypto Scient, notes that Solana languishes at the range lows of its multi-year territory, having been repelled from the heights. “Range lows rarely break on the first attempt,” he muses, acknowledging the lingering liquidity between $175-$190 that must inevitably be tested, even amidst broader darkness. “A move higher to clean liquidity before any deeper downside would make far more sense,” he concludes, his tone tinged with weary pragmatism.

The December Crucible

Rekt Capital, a sage of the charts, declares the $123 horizontal support as Solana’s defining line-the Rubicon it must cross to avert catastrophe. Historical rebounds from this level have yielded gains of 140% and 100%, yet each resurgence grows weaker, the latest managing a meager 15%. “A sharp deceleration in upside responsiveness,” he notes, emphasizing the waning strength of this once-potent bastion.

The monthly close above this macro support could preserve Solana’s tenuous grasp on recovery. Yet, a descent below $123 would signal a grim unraveling, echoing the early phases of the Bear Market of 2022. “It would confirm how much this support has weakened since the last meaningful rebound,” Rekt Capital warns, his words heavy with foreboding.

As Solana trades at $126, a modest 3.4% decline in the weekly timeframe, its fate hangs in the balance. Will December herald a rebound, or will it mark the beginning of a deeper descent? Only time will tell, but the shadows grow longer, and the air grows colder.

Read More

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Gold Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- XRP’s Little Dip: Oh, the Drama! 🎭

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

2025-12-20 07:23