As though the heavens themselves had conspired, within mere days, Aave Horizon bedazzled the financial cosmos with deposits totaling $50 million. The air, electrified by the scent of early lending efforts amounting to $6.2 million, was saturated with the pure, unbounded optimism of USDC enthusiasts. How delightful!

- Aave Horizon, in an astonishing display of eagerness, attained $50 million in deposits scarcely moments after its debut, with RLUSD and USDC revealing themselves to be the true faces of success.

- Borrowing activity, a more temperate affair, assembled at a modest $6.2 million, with USDC enthusiasts embodying nearly the entirety of these transactions.

Only days into its existence, Aave Labs’ shining beacon of institutional lending, Horizon, found itself basking in the warmth of $50 million in deposits. Borrowing activity, leaning towards the more reserved with a count of $6.2 million, is a testament to the burgeoning allure for tokenized treasures and the intricacies of on-chain credit spires. RLUSD ($26.1M) and USDC ($8M) emerged as the financial titans of this new era, with USDC near-monopolizing the borrowing realm at $6.19 million, as decreed by the live market oracle. Yet, lesser-known entities like GHO, the tokenized chandeliers of U.S Treasuries, and the peculiar kingdoms of collateralized loan obligations, watch from the wings, waiting for their audience.

📜 Behind the Curtain: The Mechanics of Aave Horizon

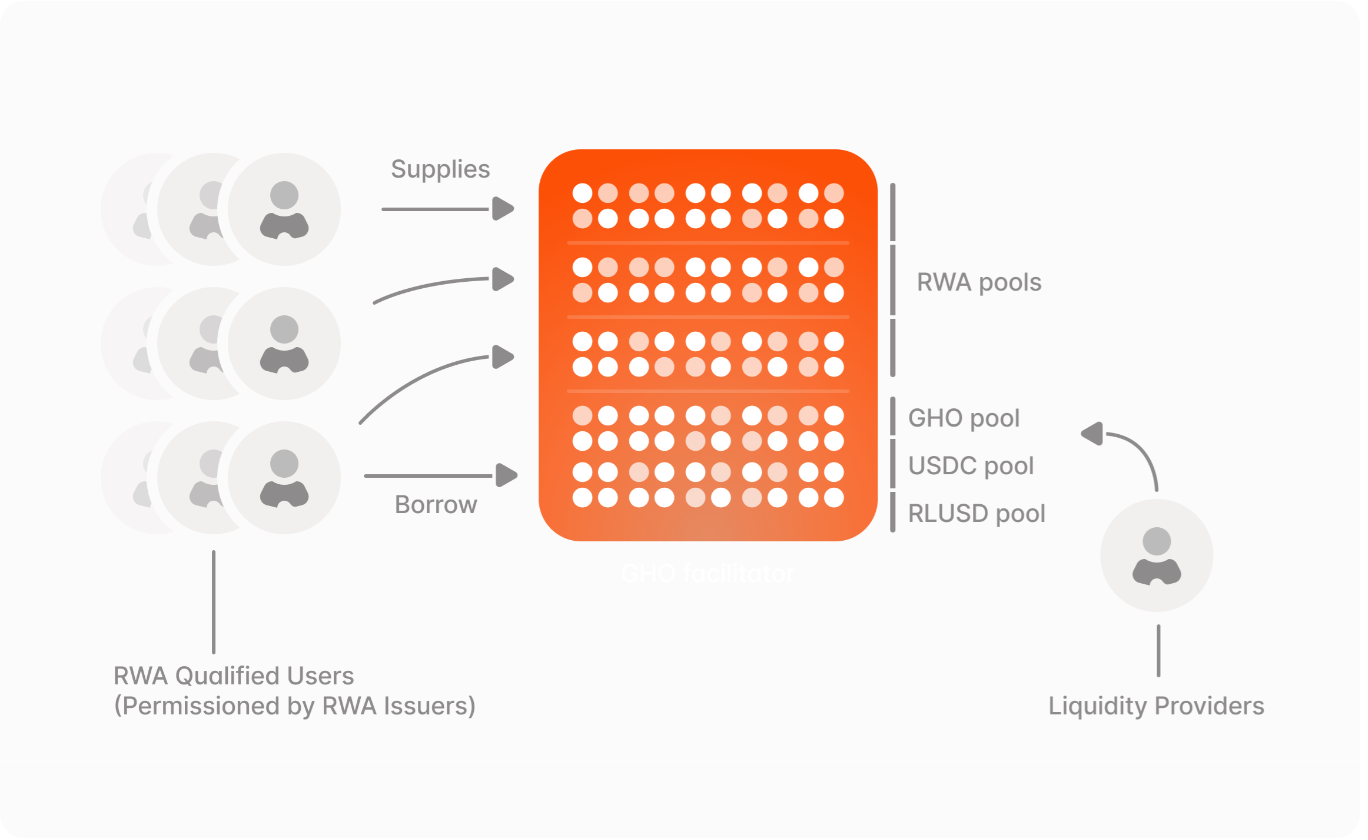

And what magic occurs behind the gilded curtain? Horizon operates with a dualistic flair, managing separate pools for the regal tokenized Guaranteed Real World Assets (RWAs) and the more pedestrian stablecoin liquidity. The elite, those stalwarts granted permission by the RWA scribes, may pour their tokenized riches-be it USTB/USCC by the illustrious Superstate or JTRSY/JAAA by the visionary Centrifuge-into the majestic RWA pools. There, these assets-secure as a state edict-grant the holder the privilege of borrowing stablecoin currencies such as USDC, RLUSD, or simply GHO, all while the paradigm of USDt-b, carried aloft on the wings of Ethena’s synthetic, yield-bearing stabilizers, is being welcomed into this grand hall.

For the laymen and liquidity purveyors-those delightful, permission-free souls-the system unfolds like a theatrical standing ovation. They supply their stablecoins into the lending pools, reaping the harvest of yield curated by finicky institutional borrowers. In an elegant ballet, institutional-grade collateral pirouettes in from the sanctified halls of regulated entities, while the broader DeFi ecosystem asserts itself, pooling in stablecoin liquidity that reinforces the cyclical splendor of it all.

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Ark Invest Splurges $21.2M on Bullish Shares and $16.2M on Robinhood – Crypto, Anyone?

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

2025-09-01 11:41