Oh hey, Bitcoin-that cryptocurrency that enjoys more drama than a daytime soap opera-is trying to make a comeback from that $110,000 nosedive. But let’s be real, it seems like going for coffee and coming back to find out you don’t even have a wallet-hello, $90,000? Move over, Hole-in-the-Wall Jim.

Bitcoin Takes a Little Siesta

Long goodbye to the $110,000 cushion, Bitcoin. You’ve been flirting with the $108,700-$119,500 zone for months or so, and look where you are now-at $107,900, which sounds suspiciously like a clearance sale. Investors are biting their nails so hard, they’re practically reenacting the movie “Jaws” on their keyboards. Oof.

Crypto expert Ali Martinez, who probably knows way more about Bitcoin than I know about, thinks our dear Bitcoin is showing the same signs of “crypto fatigue” as a teenager on a summer road trip. I mean, the crypto Dominance is cracking-not unlike my enthusiasm the day after a pumpkin spice latte shortage.

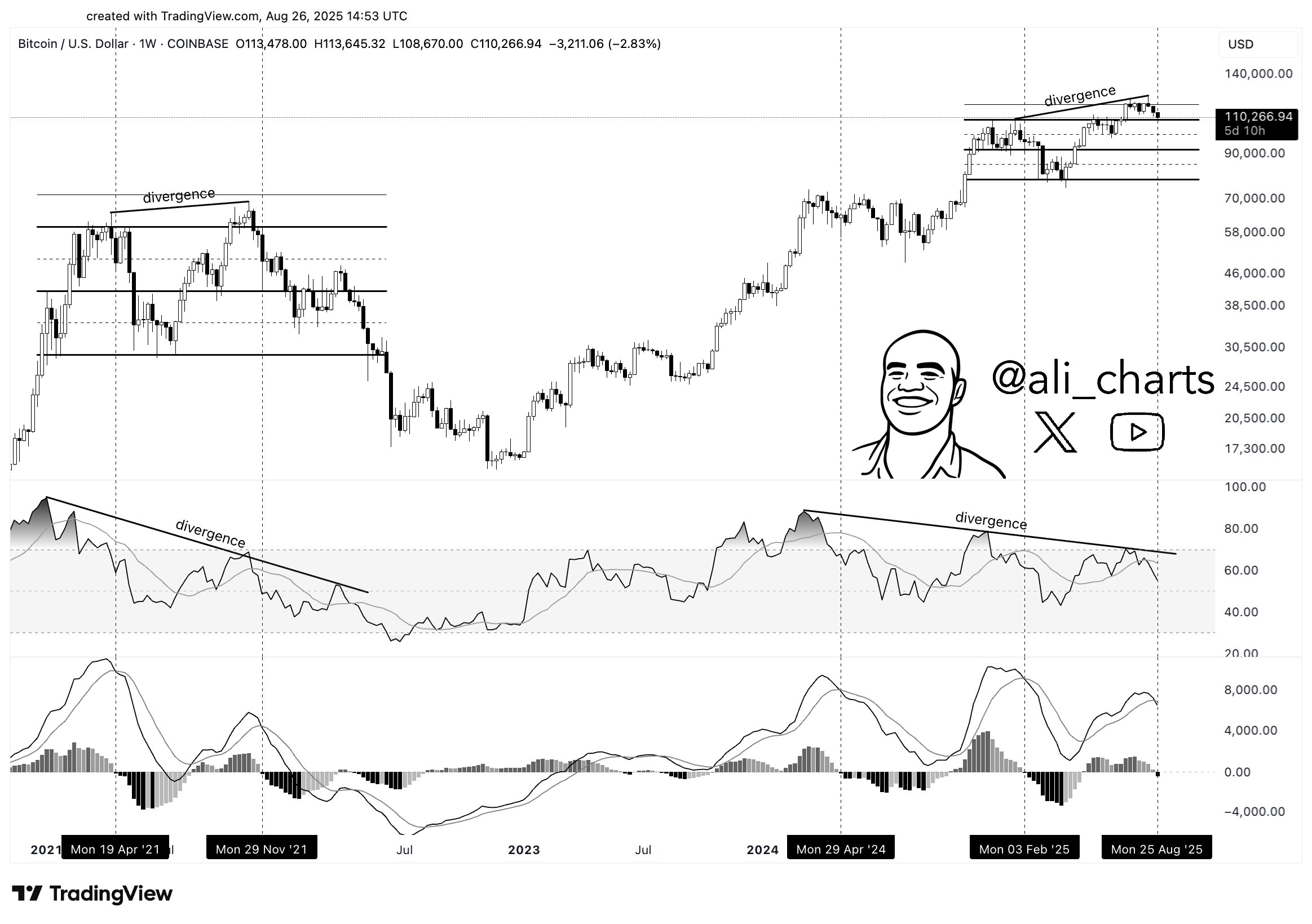

To the uninitiated, Martinez sees Bitcoin as a repeat offender, mirroring an old-school 2021 look: a peak of $60,000, a doozy of a crash, and another teeny rally that ended in a faceplant before the bear market began. It’s like watching a 2000s TV reboot-some kind of meta, isn’t it?

This time, Bitcoin is stalking us with a déjà vu of higher highs while its RSI plots lower lows. It’s the Cryptocurrency Tarantino making you wait with your popcorn.

The MACD just tossed its bearish party invite this week, reminding us that all that razzmatazz could come crashing down. Meanwhile, Bitcoin’s MVRV Momentum indicator is flirting with a “nope” and signaling a macro trend switch-up. Who invited donnybrook to this dinner party?

Martinez is overdrinking on the on-chain evidence, insinuating that Bitcoin might have hit “pause” for a little nap, as the bearish bias is jokey but serious, darkly so, meaning we might see it swan dive back to lower support levels.

A Precarious Peak?

Martinez keeps throwing shade at $108,700 as Bitcoin’s linchpin. A weekly dip below this means we might be looking at a rerun of 2021’s not-so-great adventure. Remember when it toppled over the $58,000 golden fence, dove to a rerun of almost every support wall possible, and decided to essentially camp at the macro range’s bottom? Yeah, that vibe.

If Bitcoin taps out its breakdance here, the $104,500 and $97,000 queues are tough-looking, but who knows-it could end up testing the $94,000 ground. Welcome to “Where Did All My Bitcoins Go?”

Altcoin Sherpa and Ted Pillows chime in like oracles: there’s hope between $103,000-$108,000, while Ted spots a $124,000 ceiling teasing the future. He fondly remembers Bitcoin’s bottoms visiting its 60 EMA, resting around the $92,000 spot, which he calls the crash cushion. It turns out historic Twitter rants might have had some not-so-subtle hints.

“In this scenario, Bitcoin will reverse after 3-4 weeks and hit a new ATH by November/December,” Ted graciously predicts, as if forecasting a unicorn’s return. Colour me intrigued.

As of today, Bitcoin trades at $107,947, feeling 7.5% weaker, probably lamenting how hard it is to maintain weight-or wealth-without consistency. 🙄

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Brent Oil Forecast

- USD HKD PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- 🚀 Ethereum’s Grand Farce: Developers Flock, Bitcoin Yawns, Solana Whirls! 🎭

- Bitcoin’s Wild Ride: $135K by August? 🤑💸

2025-08-30 07:18