Ah, the Pi Coin price. It’s like that one friend who always shows up late to the party and then proceeds to trip over the rug. In the past 24 hours, it’s slipped nearly 1%, and over the past week, it’s down a whopping 6.5%. Underperforming the broader market? You could say that again. Or you could just sigh dramatically.

While most tokens enjoy their fleeting moments of glory during corrections-like a toddler proudly holding up a slightly lopsided drawing-technical and on-chain signals suggest PI’s downtrend is more stubborn than a cat refusing to get off your keyboard. Far from over, indeed.

Buyers Try, Fail, and Probably Order Pizza Instead 🍕

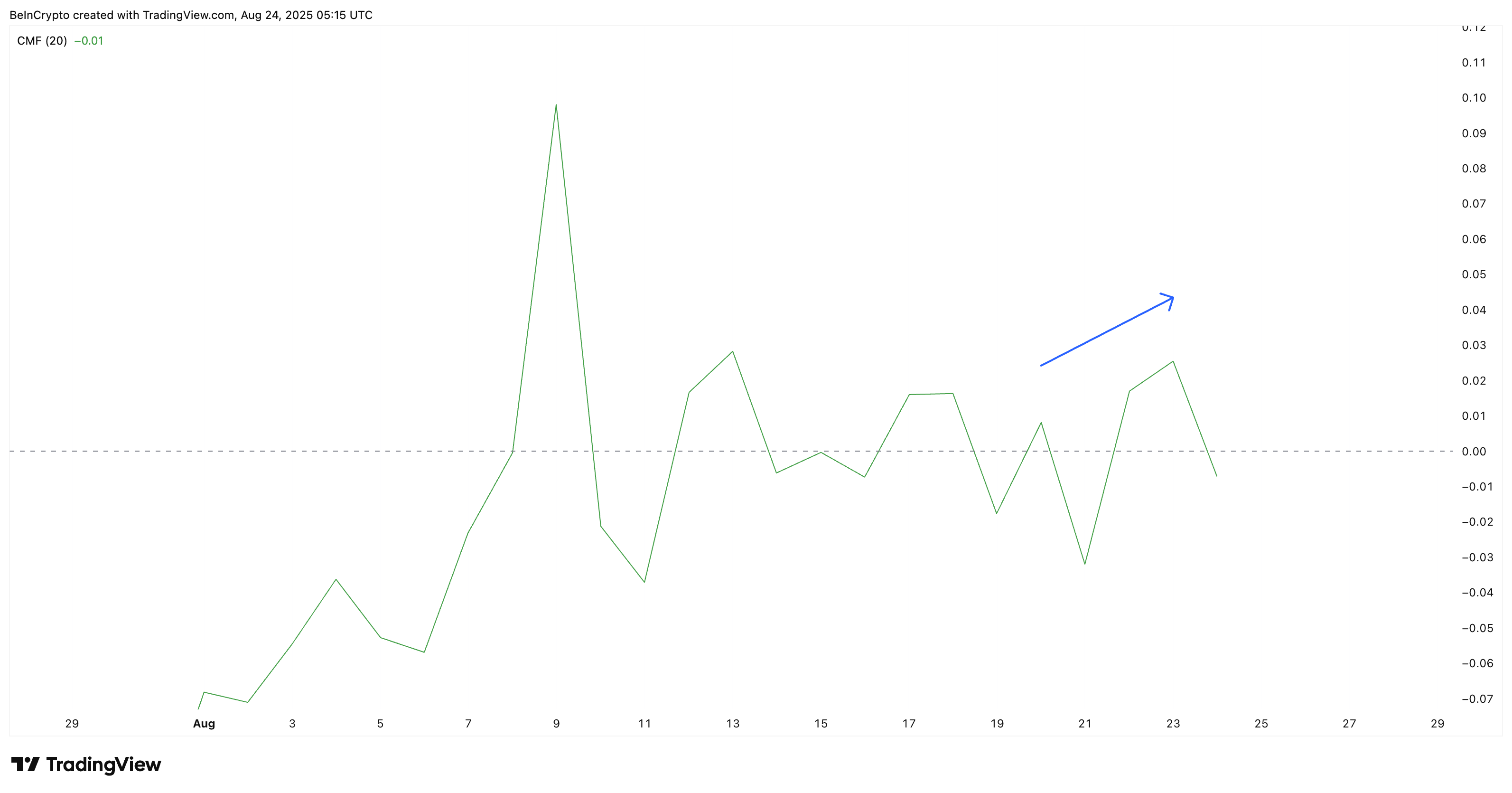

The Chaikin Money Flow (CMF), which tracks capital inflows and outflows (because apparently, money needs a flowchart too), briefly perked up earlier in August. For a moment, it looked like demand might rise like a phoenix from the ashes-or at least from under a pile of discarded takeout menus. But alas, the latest reading has plummeted back below zero, confirming that selling pressure still reigns supreme.

For PI, this shift suggests buyers tried to stage a comeback but gave up faster than someone trying to fold a fitted sheet. They attempted to regain control, sure, but sustaining it? Not so much.

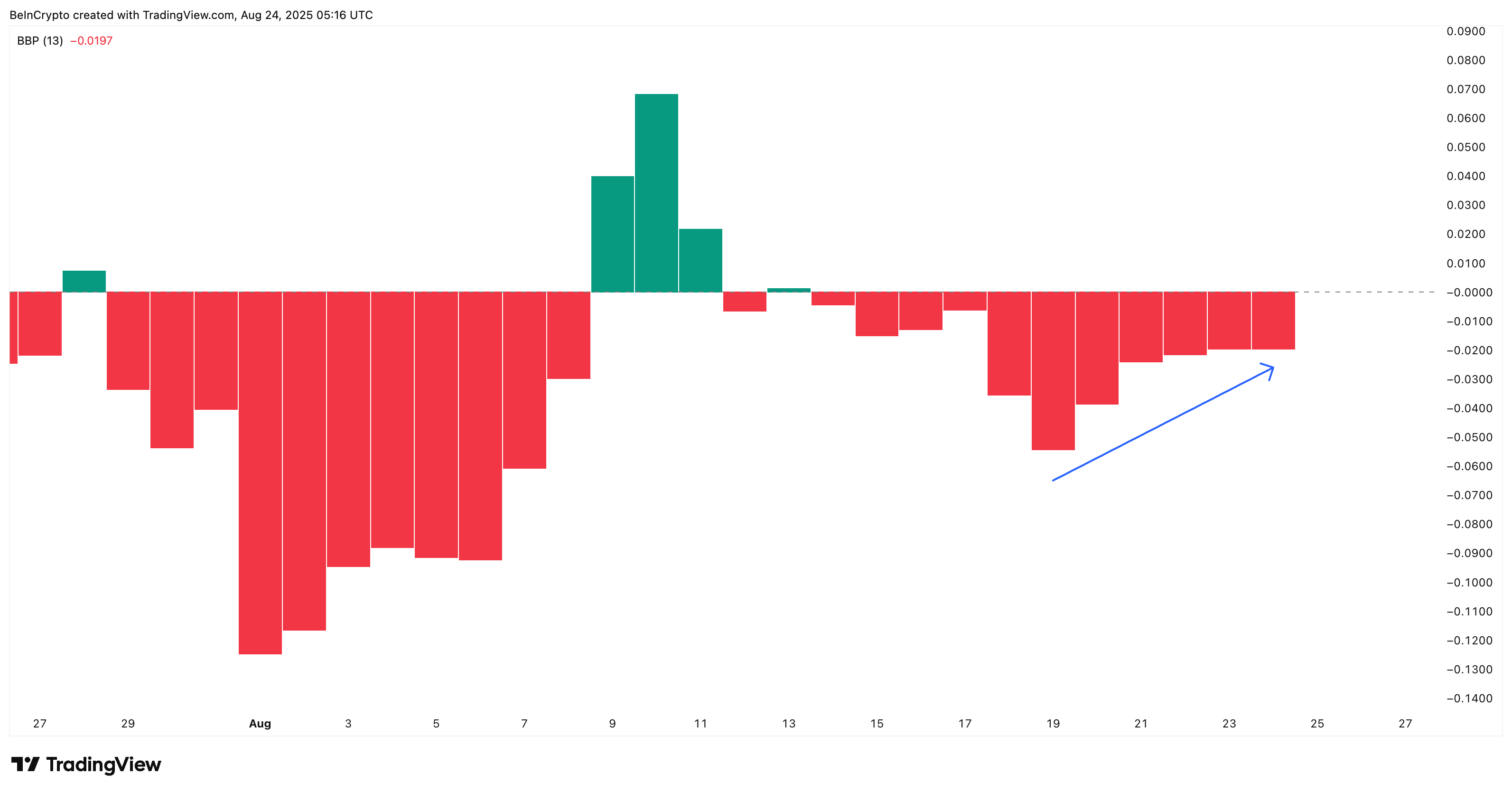

The Bull Bear Power (BBP) reinforces this bleak narrative. It’s an indicator that tells us whether buyers (bulls) or sellers (bears) are running the show. Spoiler alert: the bears are winning. While bearish strength has eased slightly, the last two sessions have been as exciting as watching paint dry. Bulls made a push, but sellers were having none of it.

Combine this with the CMF’s negative reading, and it’s clear that selling pressure is still firmly in charge. Buyers might as well pack up and go home-or at least grab some coffee while they regroup.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. Because why not add more chaos to your inbox?

Hidden Divergence: The Market’s Sneaky Little Secret 🤫

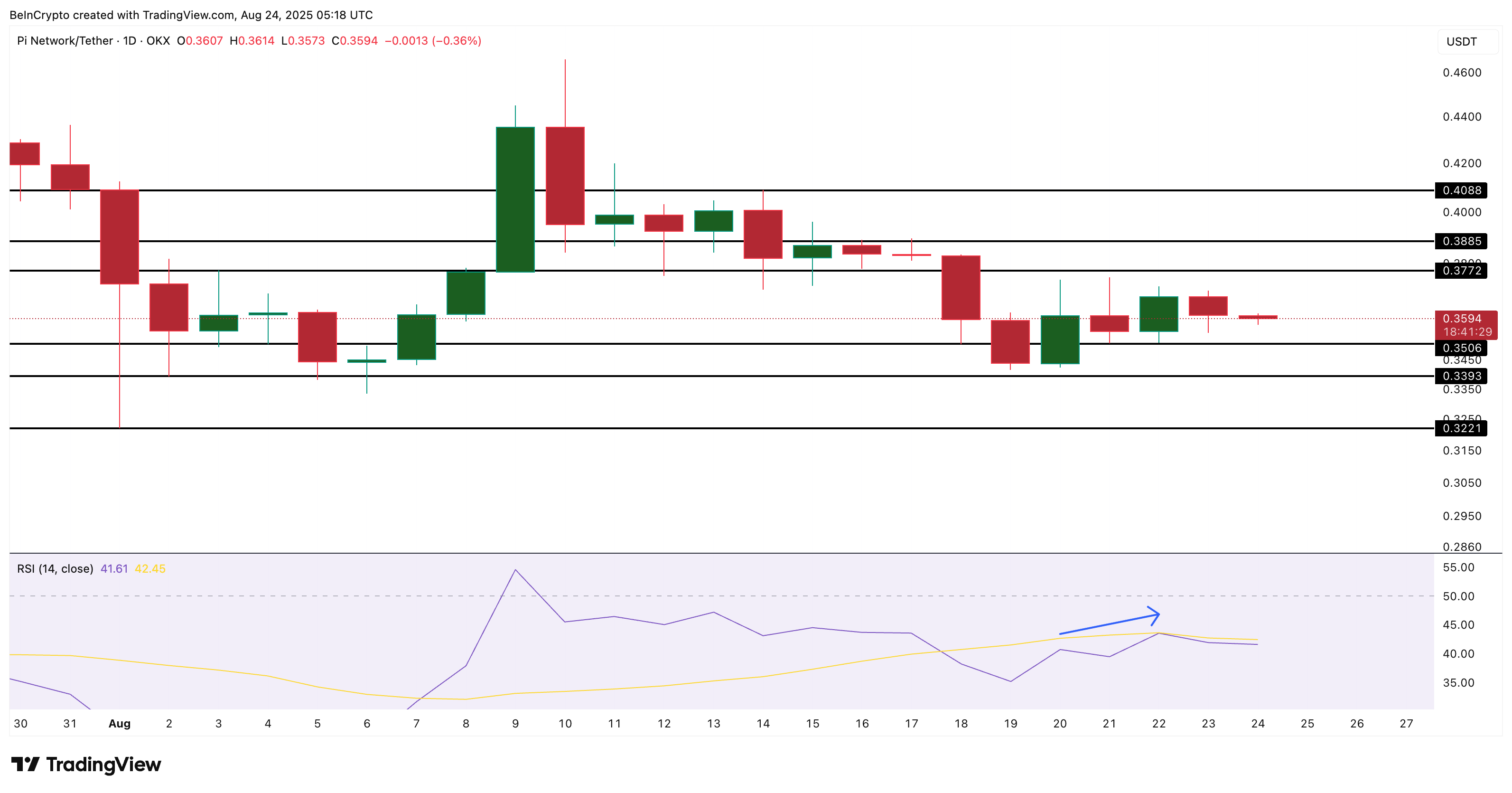

The weakness seen in CMF and BBP is echoed by momentum signals. The Relative Strength Index (RSI) has formed what’s known as a hidden bearish divergence. Translation: while PI’s price chart shows lower highs, the RSI posted higher highs near the mid-40s. This disconnect means momentum isn’t translating into upward price action, reinforcing the bearish bias.

For those who skipped the finance textbook, the RSI measures the speed and strength of price moves, showing whether an asset is overbought or oversold. A hidden bearish divergence occurs when the price makes lower highs while the RSI makes higher highs. Essentially, it’s like yelling louder but still losing the argument. Sellers are still in control, and the downtrend is likely to continue.

This kind of hidden bearish divergence screams “downtrend continuation” louder than your neighbor’s dog barking at 3 AM. The pattern flashing on the daily chart might be the reason why a new Pi Coin price low is imminent. Currently trading near $0.359, the PI price faces strong support at $0.350. A breakdown below this level could send it tumbling toward $0.339 and $0.322, with fresh all-time lows likely if $0.322 is breached.

On the upside, bulls would need to reclaim $0.377 and then $0.408 to reverse the structure. But let’s be honest, that seems about as likely as finding a unicorn riding a rainbow through the galaxy. Unless inflows return decisively, of course. But hey, stranger things have happened. Right?

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- CRV PREDICTION. CRV cryptocurrency

- Bitcoin’s Wild Ride: $79B Futures & Sky-High Options-Brace for Impact! 🚀💥

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Dogecoin’s Tragic Slide: Hopes, Fears, and Liquidations! 💸😱

- Ripple’s RLUSD Invades Japan: Crypto’s New Empire Begins?

- Worldcoin’s Wobbly Waltz: Traders Tiptoe Between Hope and Hesitation 🕺💰

2025-08-24 15:12