Ah, the theatre of finance! VCI Global, that audacious darling of the digital realm, has unveiled a joint venture on the 19th of August, valued at a staggering $2.16 billion, backed by 18,000 Bitcoin (BTC $113,393, 24h volatility: 2.7%, Market cap: $2.26 T, Vol. 24h: $44.51 B). 🌟 What a spectacle! Their mission? To erect sovereign-grade infrastructure for digital assets, no less. How utterly divine! 🏛️

In this grand ballet of commerce, VCI Global shall pirouette with a 70% stake, while its partner, the custodian of Bitcoin reserves, remains firmly in the wings. Their focus? Tokenizing real-world assets, offering vault services, and entwining encrypted systems with AI computing. How très chic! 💎

According to VCI Global’s proclamation, the Bitcoin shall be ensconced in QuantVault, a platform boasting hardware encryption and quantum-resilient features. Ah, the folly of fearing quantum computing! But fear not, dear reader, for this setup promises to shield governments and institutions with secure digital frameworks. How reassuringly bourgeois! 🔒

This initiative, my dear, builds upon VCI Global’s dalliances in cybersecurity and AI, including the recent debuts of Qsecore and its V Gallant division for GPU hardware. Dato’ Victor Hoo, the group’s executive chairman and CEO, assures us that this partnership shall forge secure, scalable digital asset systems, all in harmony with regulations. How dreadfully proper! 🎩

“This partnership is a significant step toward making Bitcoin infrastructure sovereign-compliant and RWA-ready. By integrating encrypted vaulting, sovereign-grade computing, and Bitcoin reserves, we are building the foundation for a new generation of institutional-grade digital asset ecosystems that are secure, scalable, and regulation-aligned,” declared Victor Hoo, with all the gravitas of a man who knows his audience. 🗣️

With Bitcoin’s market cap surpassing $2.25 trillion at the time of this scribble, VCI Global finds itself in the company of Nasdaq-listed firms marrying vast Bitcoin holdings with advanced infrastructure. How utterly modern! 📈

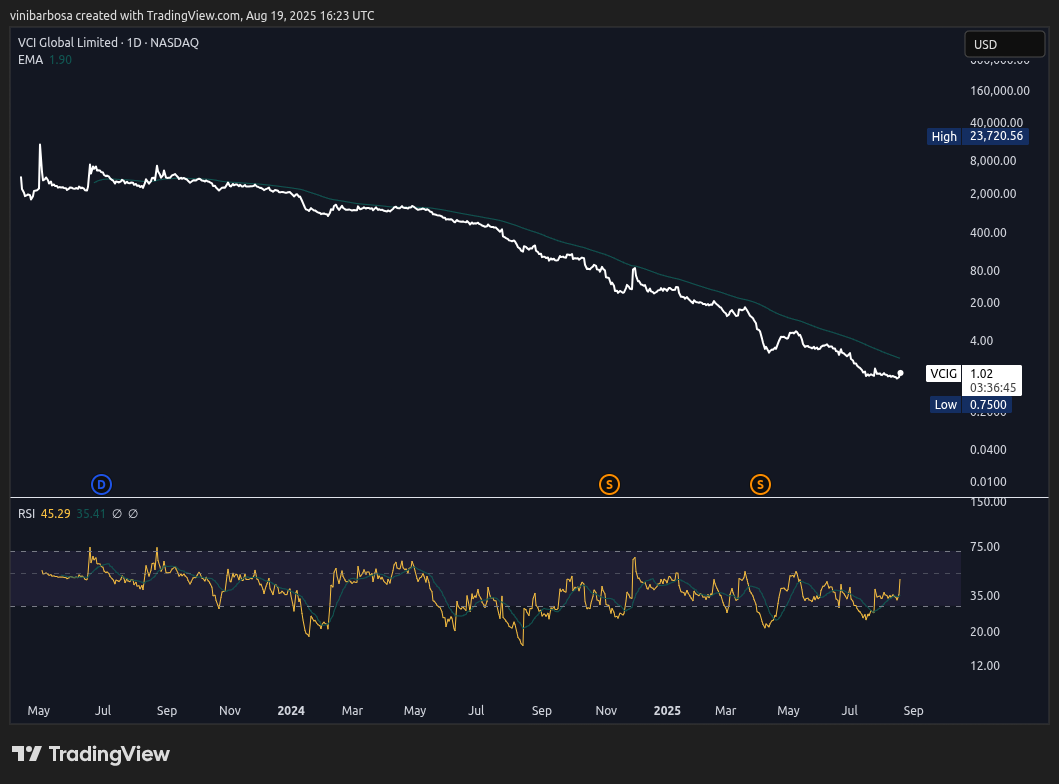

VCI Global (NASDAQ:VCIG) Price Analysis

VCI Global (NASDAQ:VCIG) shares were frolicking at $1.02 by press time, up 17.6% intraday, following the announcement. Yet, poor darling, VCIG has been wallowing in price performance since its NASDAQ listing, amassing 99.98% in losses from April 13, 2023, to its current valuation. How tragically Shakespearean! 😢

From a technical analysis perspective, the stock has been sashaying in a neutral-to-bearish momentum, according to the daily relative strength index (RSI), and its trend lingers far below the 50-day exponential moving average (1D50EMA). How dreadfully unglamorous! 📉

VCI Global (NASDAQ:VCIG) 1D historical price chart | Source: TradingView

Historically, companies like the erstwhile MicroStrategy, now Strategy (NASDAQ:MSTR), have employed a Bitcoin reserve strategy to rekindle market interest and positive price action, wagering on Bitcoin’s triumph against the dollar and other traditional assets. How delightfully audacious! 🎲

On a similar note, BitMine went a step further, announcing an Ethereum-based treasury reserve, also experiencing a flutter of positive price action post-announcement. Brevan Howard, one of the world’s largest hedge funds, recently disclosed a significant allocation in BlackRock’s Bitcoin ETF (IBIT), accounting for 21% of the fund’s portfolio. Another testament to the growing institutional infatuation with the leading cryptocurrency. How utterly predictable! 💼

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Cardano’s Rollercoaster Ride: From $1 to $1.54 (And Possibly Back Again)

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- USD CNY PREDICTION

2025-08-20 00:34