Ah, behold the grand spectacle of Ethereum (ETH), that digital prima donna, pirouetting upon the stage of Binance! After reaching its zenith of $4,956 on the glorious 23rd of August, it hath since confined itself to a modest range, oscillating betwixt $4,200 and $4,500, leaving the audience in suspense. Yet, lo! The whispers from the exchange data suggest a supply crunch doth approach, like a plot twist in a farcical comedy! 😏

Ethereum’s Price: A Stoic Actor Amidst Declining Supply

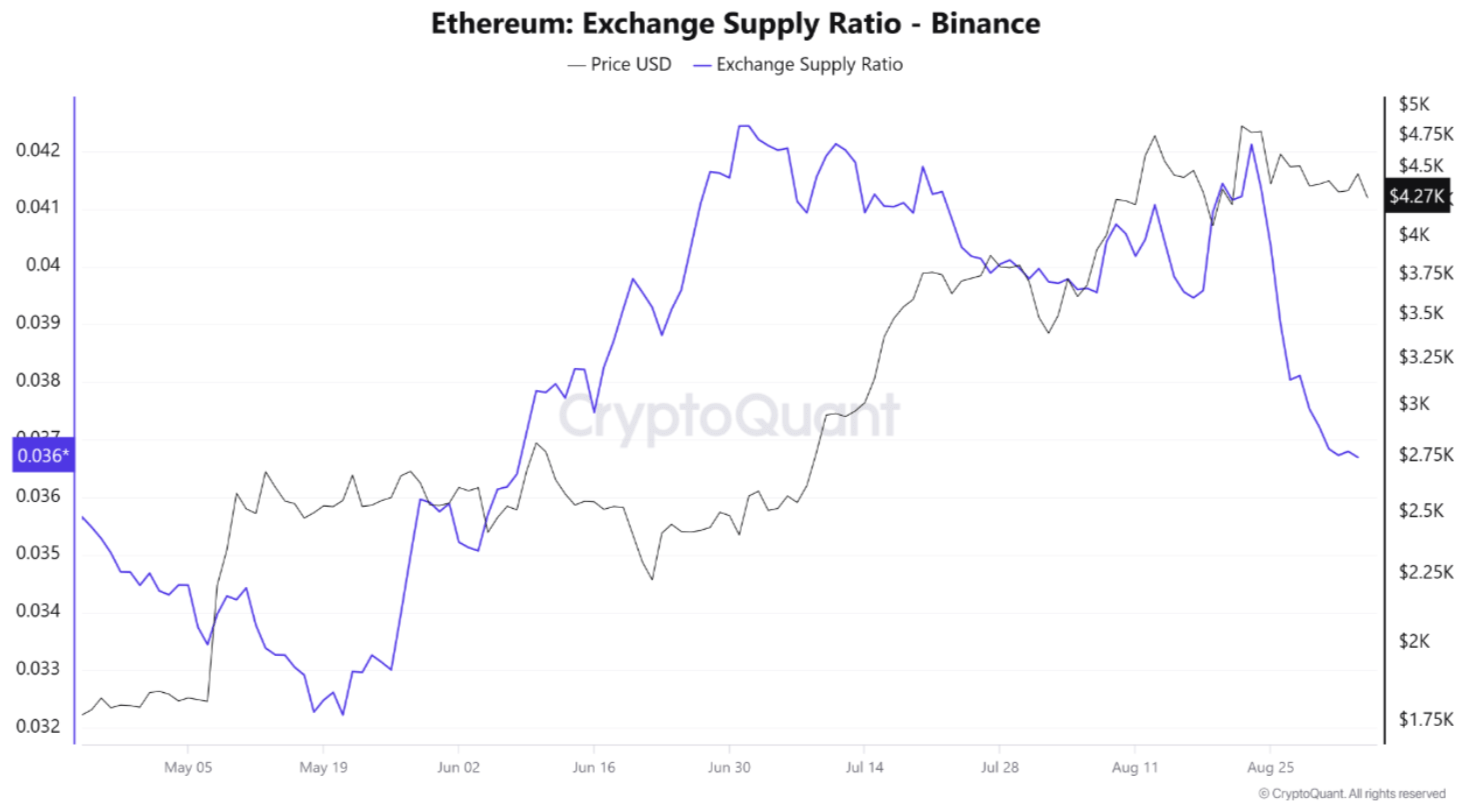

Mark well, dear reader, the sage observations of Arab Chain, a CryptoQuant luminary, who doth proclaim that from the 16th of August to the 3rd of September, Ethereum’s Binance Exchange Supply Ratio (ESR) hath plummeted with dramatic flair! Though ETH’s price remaineth steadfast in the mid-$4,000 realm, its ESR hath tumbled from 0.041 to 0.037, a decline most precipitous, all within a fortnight! 🕊️

Observe, if thou wilt, that ETH’s price hath remained as stable as a philosopher’s argument, trading near $4,400 at the period’s end. The CryptoQuant analyst doth opine that this stability revealeth two truths. First, investors are fleeing exchanges-Binance included-with haste, as if escaping a poorly written tragedy. Second, ETH holders grow ever more confident, opting for self-custody in cold wallets, lest their treasures be lost to the whims of exchanges. 🧊

Arab Chain, with wit as sharp as a courtier’s tongue, remarketh that the stable price, declining exchange supply, and robust ETF inflows all herald a dwindling sellable supply, while demand remaineth as steadfast as a loyal servant. They add, with a flourish:

“Declines in ESR have historically preceded upward moves as grand as a royal procession, for lower exchange liquidity doth shackle sellers’ ability to depress prices. The current ESR levels have retreated to pre-June figures, suggesting the market hath ‘flushed out’ profit-taking scoundrels and now reaccumulate supply into long-term wallets.” 🎩

Doth ETH Enter a New Bull Cycle?

The analyst concludeth, with the air of a soothsayer, that should ETH’s ESR continue its descent without a corresponding price decline, it would signify the dawn of a new bull cycle, led by institutional investors. Three metrics, as clear as a well-crafted soliloquy, support this prophecy:

First, the ETH market hath witnessed a drop in leverage, indicating fewer speculative traders. Second, perpetual futures markets display neutral funding rates for ETH contracts. Lastly, on-chain activity by ETH whales hath subsided, suggesting long-term holders are content to hold their treasure. 🦋

Let us not forget the improving fundamentals of the Ethereum blockchain. Recent data reveal that 36 million ETH hath been staked, increasing the likelihood of a supply shock. Moreover, Ethereum daily transactions have reached a 12-month high, a testament to its growing utility. Amid these bullish developments, even the most seasoned experts dare to predict ambitious prices for ETH. At the time of this scribbling, ETH tradeth at $4,295, down 1.7% in the past 24 hours. 📈

Read More

- Gold Rate Forecast

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

- USD HKD PREDICTION

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- EUR HUF PREDICTION

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

2025-09-06 10:39