In the feverish taverns of the crypto bazaar, two ancient wallets, slumbering since the times when Bitcoin was a mere whiff of digital cabbage, have abruptly stirred! The startled townsfolk—meaning, of course, everyone with a chart obsession and too many browser tabs—are left clutching their ledgers while 20,000 BTC slip silently into the night after fourteen years of hibernation. Perhaps even Satoshi’s ghost spat out his tea. 🍵

Panic, drama, and enough speculation to drown an accountant! What wizardry or devilment could this mean for our beloved market? Is it the Second Coming of Satoshi, or merely an old babushka cashing out before her bridge club?

A $2 Billion Ballet and the Markets’ Fancy Imaginings 🩰

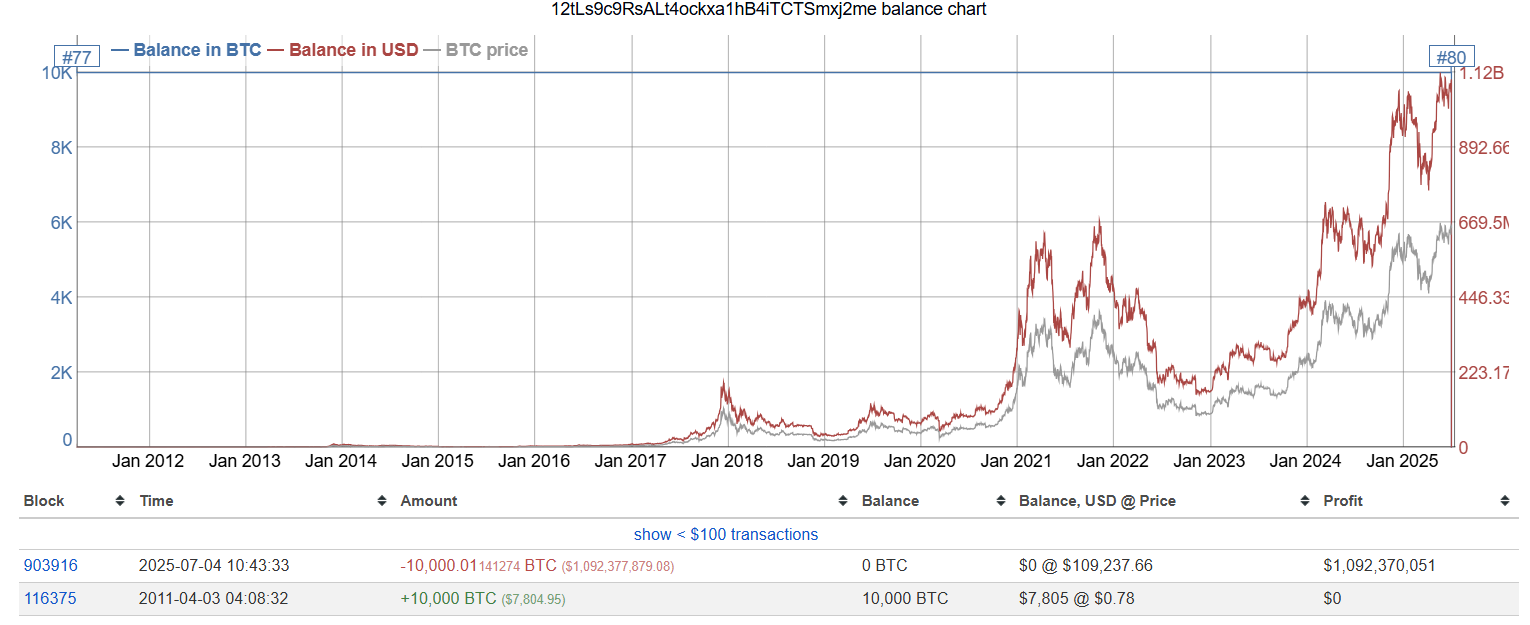

Let us consult the wise soothsayers at Lookonchain, who unearthed that one fateful wallet, cobbled together on April 3, 2011—back when Bitcoin cost less than a cup of dreadful railway tea—has bloomed with interest. Imagine: 10,000 BTC harvested for less than $7,805. A sum that wouldn’t even buy a proper goat in Kyiv!

For more than a decade, silence—a quiet like that of a bureaucrat’s office on state holiday, not a peep. Then, under the pale glow of July 4, 2025, the owner, perhaps wearing a musty ushanka, moves every last satoshi. The streets (of X.com) are abuzz.

Yet wait! Not one, but two wallets. Yes, another old coin chest, also stuffed to the brim with 10,000 BTC since 2011, pirouettes away with its cargo. Who says you can’t have two miracles before breakfast?

Together, these ancient digital matryoshkas have flung $2 billion worth of magic beans into new addresses. The streets of Crypto Petersburg echo with tales of these “Satoshi era” relics, using legacy enchantments that modern wallets only whisper of in frightful bedtime stories.

As Bitcoin’s price lounges lazily around $110,000 like an overfed government official, intrigue boils: Is this the great cash-out? A final exit before the vodka runs dry?

Some citizens on X (forever in search of a revolution or a meme) claim these are “OG hodlers” finally abandoning their twelve-year meditation to buy a small nation—or perhaps just a penthouse in Dubai.

“$7,805 to $1.09 Billion… that is the best investment decision of the century…,” muses Crypto Alpha, undoubtedly from a velvet chair, wearing socks with caviar stains.

Whispers of sabotage and digital burglary creep in—has a ne’er-do-well spirited away the coins? Or is it only sensible tidying up before the Bit-police come knocking? No one knows. The only certainty: a flurry of funds and a market suspiciously steady, like a bureaucrat’s heart rate. Bitcoin remains at $109,000, yawning at our melodrama.

The “Coin Days Destroyed” Carnival

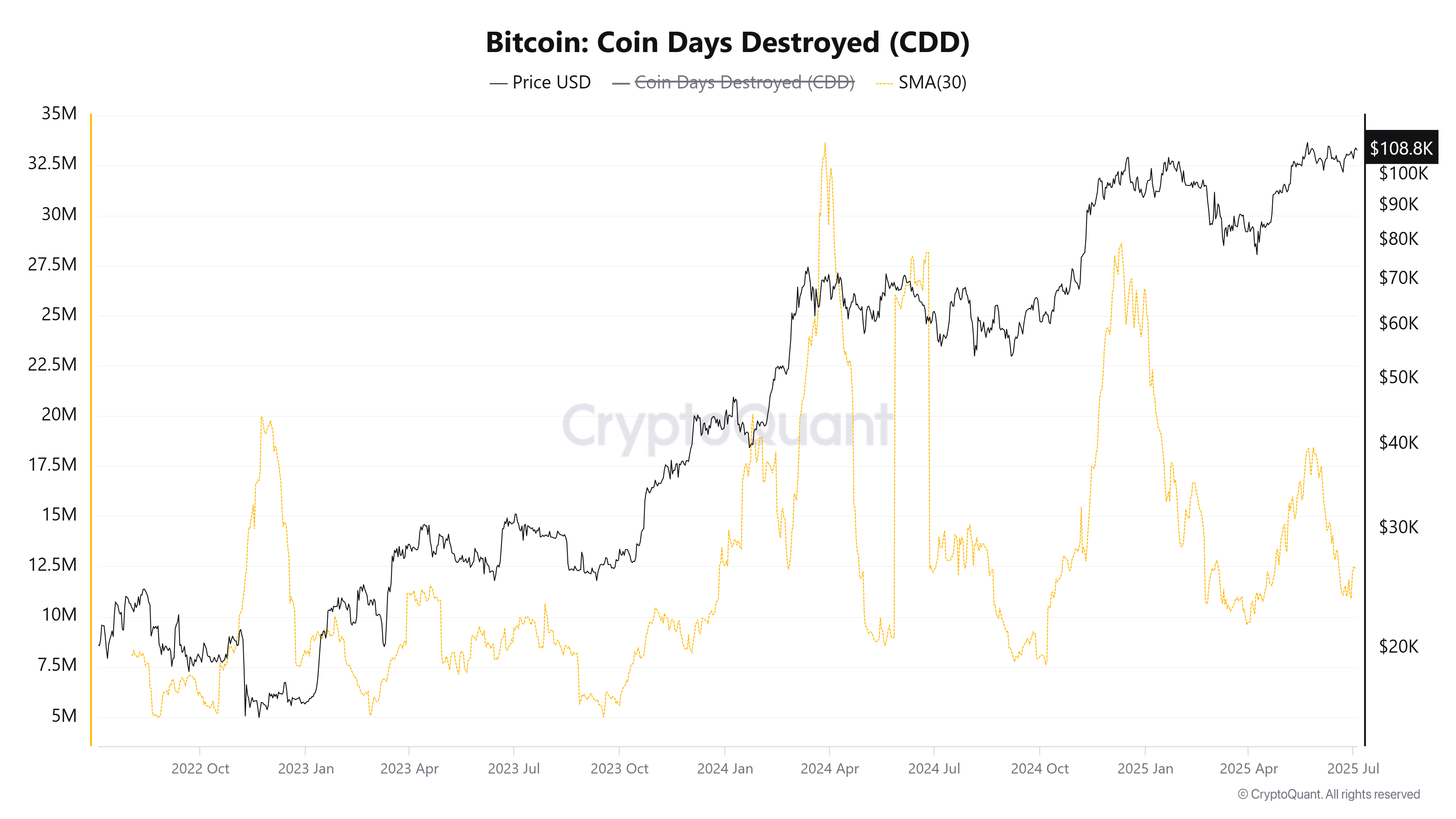

Let us now peer at the solemn “Coin Days Destroyed” (CDD) metric, which measures just how long these digital rubles snoozed in their cryptic cots. Because nothing says excitement like a blockchain calendar!

When CDD soars, it signals the ancients are moving their gold. Everyone gasps—and then checks their portfolio to weep or gloat accordingly.

Sages at CryptoQuant mumble that CDD trudged from 10 million to 17.5 million through the wilds of Q2, before slumping back to 11 million, exhausted and possibly hungover, in early July.

Should the great whales of Bitcoin awaken in droves and CDD leap, folklore tells us prices could plunge, wallets could weep, and influencers could panic-tweet until their thumbs fall off. But for now—the coins have moved, and the world (mostly) shrugs. Curtain.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

2025-07-04 11:06