Well now, gather ’round, folks, for a tale of the wild and woolly world of Ethereum, that sprightly little cryptocurrency that just can’t seem to sit still. In a mere thirty days, it has pranced about, adding a whopping 50% to its value, leaving the bears scratching their heads and wondering if they ought to have brought a picnic instead of a short position. 🐻💸

$500 million in shorts erased: Brutal week for Ethereum (ETH) bears

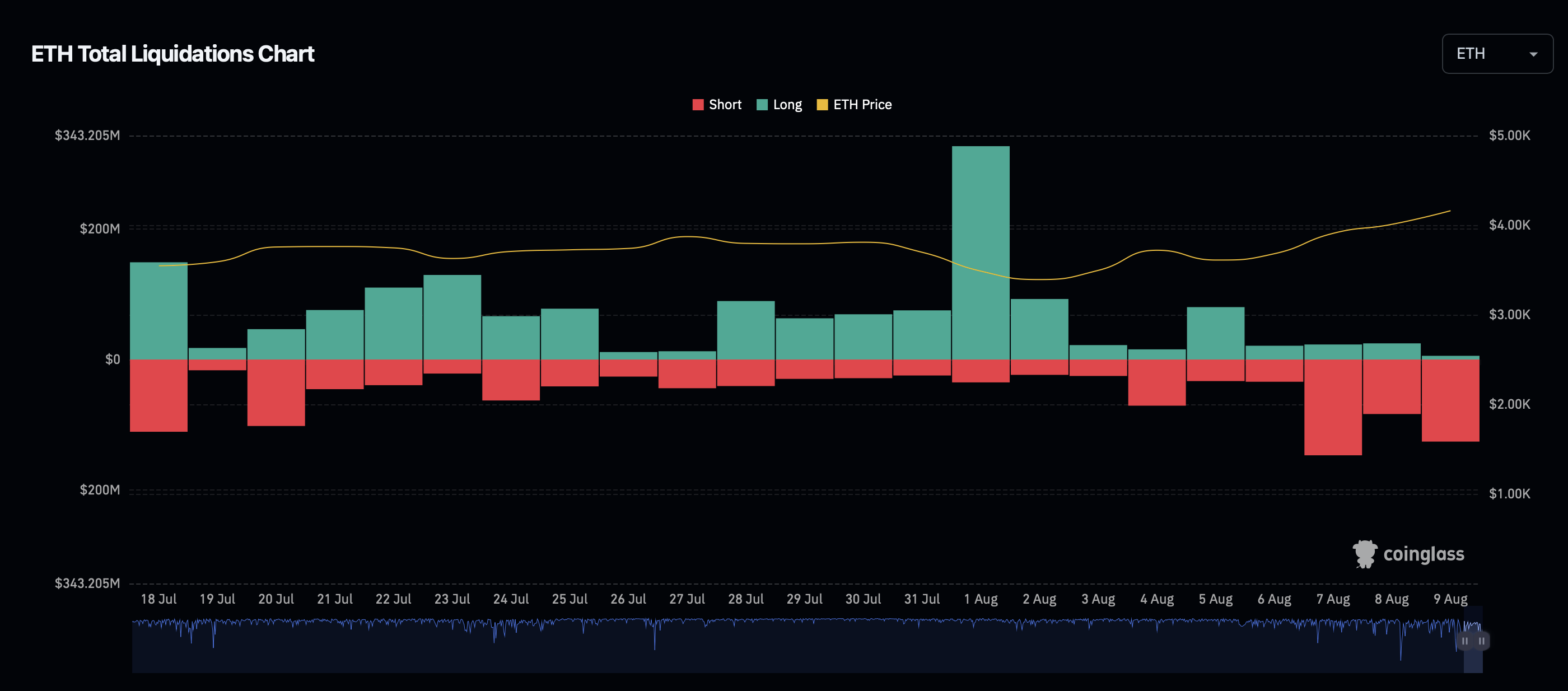

In the last week, those poor bears found themselves in a right pickle, losing nearly half a billion dollars faster than a cat can lick its ear. The last three days were particularly savage, as CoinGlass data reveals. With Ethereum leaping above the $4,000 mark for the first time in 2025, it seems the trend is gaining more steam than a locomotive on a downhill slope.

In just three sessions, the bears saw their losses soar past $355 million. Meanwhile, the market is sending mixed signals like a confused rooster at dawn. On August 1, when crypto took a nosedive thanks to another round of U.S. tariff debates, a staggering $326 million of ETH long positions vanished into thin air in just 24 hours. Poof! 💨

Now, to put this in perspective, our old friend Bitcoin (BTC) bears only lost a paltry $112 million during the same stretch, thanks to Bitcoin’s stubbornness in holding its ground like a mule in a mud pit.

As if that weren’t enough, the Ethereum spot ETFs in the good ol’ U.S. of A. have seen a decent influx of cash. With $462 million pouring into Ethereum spot ETFs just yesterday, their total assets under management have ballooned to over $23.3 billion. Why, that figure has more than doubled in just a month, according to SoSoValue data. Talk about a growth spurt! 📈

Fidelity’s FETH and BlackRock’s ETHA funds are the heavyweights behind this massive inflow, accounting for a staggering 82.6% of the total, while the likes of VanEck, Franklin Templeton, and 21Shares are just sitting there, twiddling their thumbs.

Ethereum versus Bitcoin: “Flippening” season comes again?

As the optimism in the Ethereum camp swells like a hot air balloon, more and more voices are proclaiming that Ether is starting to outshine Bitcoin on the grand stage of time. 🎤✨

Brantly Millegan, a seasoned sage of the Ethereum ecosystem, has noticed that ETH/BTC is now surging on seven out of eight TradingView time periods. Why, it’s like watching a turtle outrun a hare!

holy shit ETH just flipped BTC on year to date 😅. only 1 red left to flip (1 year) until ETH has outperformed BTC on all time periods on tradingview

– brantly.eth (@BrantlyMillegan) August 9, 2025

In a series of posts shared with his 53,900 followers, he confessed that just a month ago, ETH/BTC was as red as a ripe tomato on nearly all time frames. What a difference a month makes!

As we speak, Ethereum’s price is making a valiant attempt to leap above $4,200, having added another 8% in just 24 hours. It’s like watching a frog trying to jump over a log-will it make it? Only time will tell! 🐸💰

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Pump.fun’s Record Volume: Is Solana’s Meme Coin Renaissance Here? 🚨

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- USD KZT PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Oops! User Accidentally Burns $75K Worth of PUMP Tokens! 🔥

- ETH Shorts Bloodbath: Half Billion Wiped Out Last Week

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

2025-08-09 13:32