Ah, El Salvador! That tiny nation full of dreams, chaos, and now, a healthy dose of crypto madness. The government, in its infinite wisdom-or perhaps despair-has just unleashed a new Investment Banking Law, granting private banks permission to hoard $BTC and other digital wizardry. Because what could possibly go wrong when finance meets blockchain in a country that barely knows how to tie its shoelaces? 🥴

But, here’s the kicker: these banks must conjure up a cool $50 million in capital-because apparently, billionaires are the only ones worthy of monkeying around with digital gold. Once licensed, they’ll cater to “accredited investors”-or as they’re called here, the ‘sophisticated elite’-offering services like custody, trading, and perhaps even… running as Bitcoin banks. Yes, you heard that right: banks that run entirely on Bitcoin. Imagine the chaos! 🤡

This audacious move makes El Salvador the latest playground for institutional greed, attracting a tsunami of money so mighty it could ripple through the crypto cosmos. For those chasing meme coins or utility-driven projects, the time to pay attention is now-before the whole thing turns into a digital circus. 🎪

Contextualizing El Salvador’s Financial Revolution

This law isn’t some random whimsy; it’s a carefully crafted structural change, separating investment banks from commercial ones-because who needs clarity when you can have chaos? By granting Bitcoin-holding privileges to these new digital monsters, El Salvador positions itself as the wild-west of crypto, a place where the rules are written in sand and the law is often just a suggestion.

The country’s Digital Assets Commission (CNAD) has boldly declared that with a PSAD license, a bank could operate entirely in Bitcoin-no more fiat intermediary nonsense-because apparently, why not? President Nayib Bukele, that enigmatic ruler, continues his quest to embed Bitcoin into every facet of Salvadoran life. International partnerships? Sure! Bolivia? Why not! Pakistan? Just a casual chat about mining policies-no big deal. 🌎

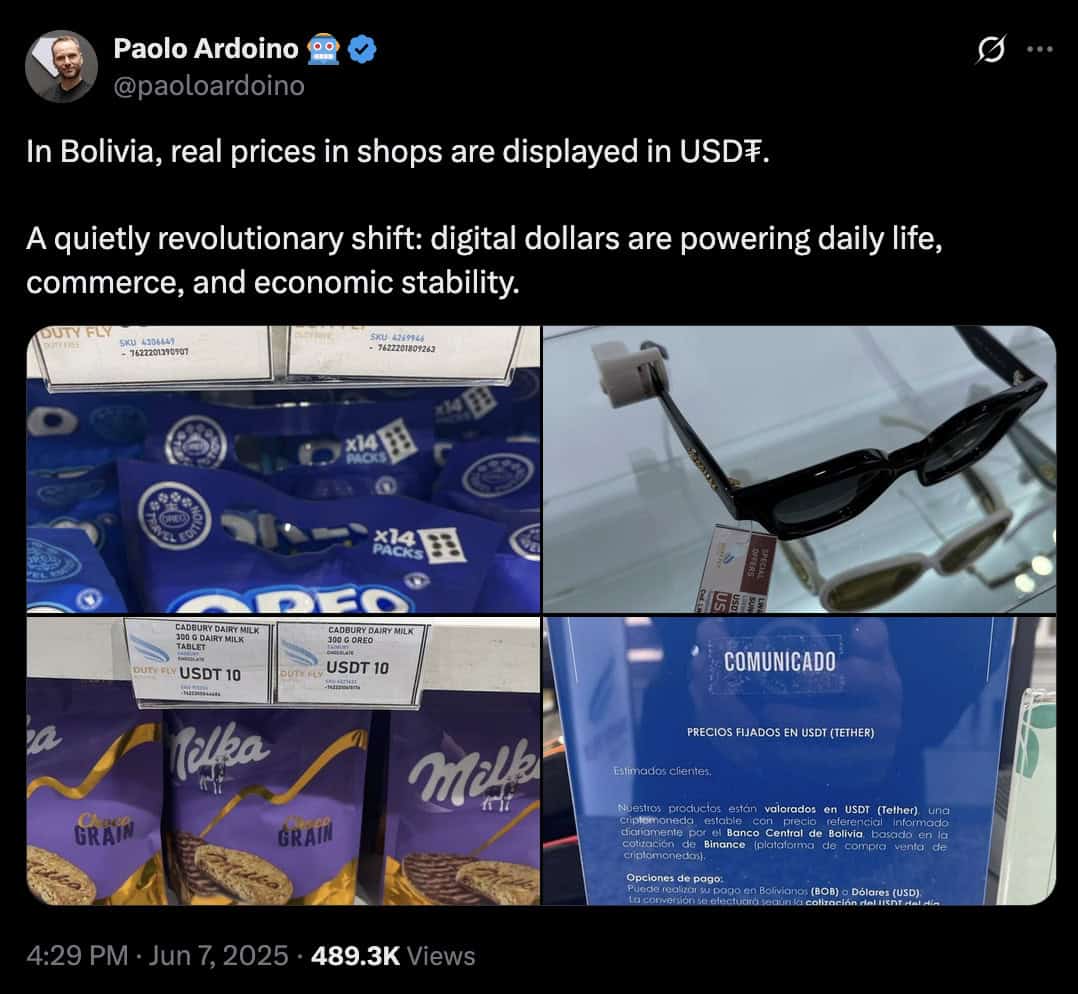

Meanwhile, Bolivia, battling economic upheaval, is already making digital moves-airport stores in La Paz are displaying prices in Tether ($USDT). Paolo Ardoino, Tether’s CEO, called it a “quietly revolutionary shift”-and who’s to argue? Maybe the revolution is just quietly paying for snacks at the airport. 🛫

El Salvador’s play: transforming itself into a crypto hub-because nothing screams stability like a nation riding the rollercoaster of Bitcoin. Big investments there could fuel a burgeoning ecosystem of altcoins and wild projects. Or so they hope. 🚀

1. Bitcoin Hyper ($HYPER) – Scaling up the Salvadoran Crypto Dream

Now, in the midst of this chaos, Bitcoin Hyper ($HYPER) emerges-because what El Salvador really needs is a Bitcoin Layer-2 that doesn’t suck. Not a tired sidechain or some half-baked solution, but the fastest, most glorious way to turn Bitcoin into a utility-sub-second transactions, near-zero fees, and cross-chain interoperability. Oh, and it’s powered by Solana’s Virtual Machine-because, why not mix speed with security? 😅

It’s a playground for meme coins, DeFi protocols, and dApps-Bitcoin finally playing in the big leagues. With $0.0126 per token and $7.8 million already raised, Bitcoin Hyper is positioning itself as the backbone for El Salvador’s crypto future-because who doesn’t want their financial infrastructure built on “hyper-speed” now? 🤑

2. TOKEN6900 ($T6900): The Meme Coin That Takes the Cake (and the memes)

As El Salvador embraces institutional money, the stage is set for meme coins to make a glorious splash. TOKEN6900 ($T6900)-a self-aware, utility-free meme token-thrives on internet chaos and collective silliness. Priced at exactly $0.0069 (yes, on purpose) with over $1.7M raised-because nothing screams “serious investment” like a meme coin that’s all about memes. 🎉

Inspired by early web jokes and internet nostalgia, but with a twist-more tokens, more chaos, more memes. Nothing about GDP, earnings, or AI; just pure, unadulterated internet fun. And with 80% sold in presale, cap at $5M, and no hidden mints-honesty is the best meme. 🥸

If mainstream Bitcoin gets more mainstream, coins like $T6900 might just explode, turning internet culture into a financial fortress. Or a complete mess-either way, fun times ahead! 🎭

3. The Graph ($GRT): The Data Lifeline for Bitcoin Banks

As El Salvador’s banks scramble to run Bitcoin and crypto services, they’ll need reliable, lightning-fast on-chain data-because nothing screams “trust us” like ready access to blockchain info. Enter The Graph ($GRT): the decentralized data-organization protocol designed to turn chaos into order.

Developers whip up subgraphs-kind of like digital blueprints-to query blockchain data seamlessly. With real-time pipelines, token metrics, and support across chains-Ethereum, Solana, Polygon-you name it, The Graph is the Swiss Army knife. Perfect for compliance dashboards, trading tools, and all those annoying regulatory reports. 😉

At $0.09764 per token and proven in the wild, $GRT is the unsung hero behind the scenes-waiting to keep El Salvador’s Bitcoin banks afloat amid the digital storm. ⚓

How These Projects Might Just Save – or Doom – El Salvador’s Crypto Dream

When big institutional players wade in, the entire crypto landscape shifts-demand surges, new tech emerges, and chaos reigns. Bitcoin Hyper could give speed, TOKEN6900 might inject some much-needed meme chaos, and The Graph will keep the data flowing-because even in a crypto revolution, someone’s gotta keep the lights on. 💡

Certainly, everyone’s eyeing the best crypto to buy, but beware: in this game, nobody’s safe, nobody’s innocent, and the only thing predictable is unpredictability. Dive in-or stay on the sidelines and enjoy the show. 🎭

And always remember: this is not advice. Do your own research, or just enjoy the circus. 😉

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- USD IDR PREDICTION

- CNY RUB PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Crypto Cash Floods Trump’s PAC: $21M and Counting! 🚀💸

- Bitcoin’s $94K Tango: Will It Break or Shake? 🕺💸

- White House Slams Stablecoin Yields: ‘Achieves Nothing!’ 🤯

2025-08-10 14:32