Oh, boy! It seems that the good folks over at DeFi Development Corp, the once real-estate-tech-now-crypto-chasing-wizards, have been busy little bees. They’ve somehow managed to pile up a whopping $263 million worth of Solana (SOL) tokens. How, you ask? Simple – they just decided to splurge $22 million on a colossal 110,000 SOL tokens, paying an average price of $201.68 each. 🤑

In their Friday press release, they couldn’t wait to tell the world that they’ve got around 1,420,173 SOL and its fancy-equivalent assets stashed away, which includes staking rewards and all those juicy on-chain yields. But wait, even after a slight slip – a 4% dip to $184 for Solana as of midday Friday – the value of their treasure chest still looks like a mighty mountain. 💸

Remember when they were called Janover? Yeah, that was back when they did the whole “real estate tech” thing. Now? They’ve transformed into the high-rolling Solana hoarders. Not only are they stacking SOL tokens like there’s no tomorrow, but they’re also providing staking services and making revenue from Bitcoin mining. As if that wasn’t enough, their magic formula for monitoring returns is their fancy “Annualized Organic Yield” metric. Which, when applied to their treasure trove, is projected to rake in about $63,000 a day in SOL terms. Yeah, you read that right. 💵

The cherry on top? DeFi Development’s latest move includes closing a mind-boggling $122.5 million convertible debt offering in July. The notes, which come with a 5.5% annual interest rate and a 2030 maturity date, also have a sweet 10% conversion premium tied to their July 1, 2025, closing price of $21.01. 🏦

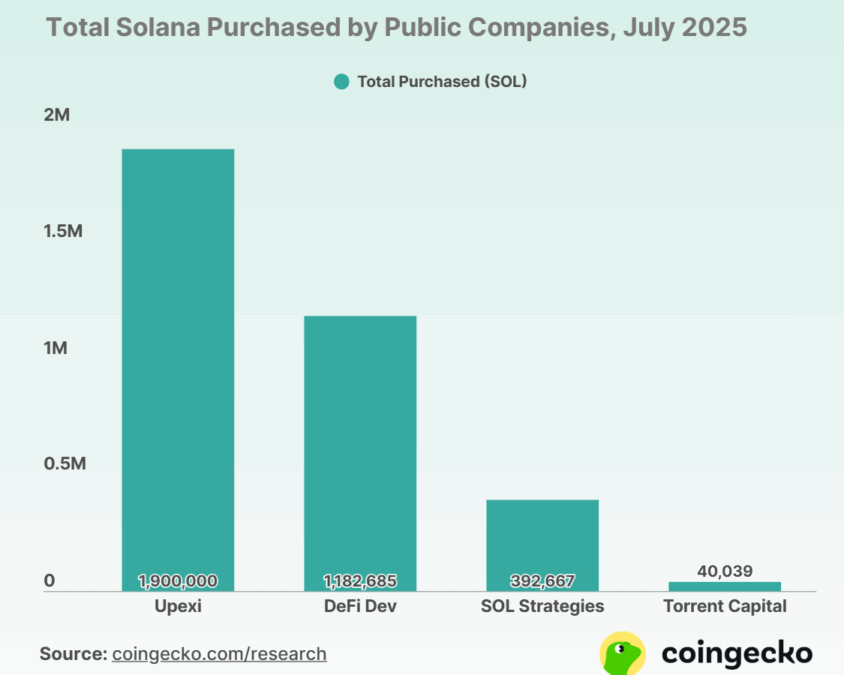

Other big players like Upexi and Sol Strategies also have a good chunk of SOL, but DeFi Development is clearly the big spender in the Solana space. They’re buying like they’ve never heard of a budget! 🛍️

Read More

- Gold Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Silver Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- Is This the End of Crypto? Jeff Park’s Shocking Revelation!

2025-08-15 23:18