In the grand theater of the financial world, where fortunes are made and lost with the flick of a wrist, the price of Cardano has begun to exhibit a semblance of strength, as if it were a weary traveler finally finding a path through the dense forest of uncertainty. A golden cross, that rare and illustrious event, has taken shape upon its chart, where the 50-day moving average ascends above the 200-day, heralding the dawn of what history suggests may be a prolonged bullish phase. It is as if the stars have aligned, whispering sweet nothings to the buyers, urging them to take up arms against the sellers.

The Golden Cross: A Beacon of Hope for Cardano’s Price

Our astute analyst, The Long Investor, has pointed out with the fervor of a prophet that Cardano’s price chart has indeed confirmed this golden cross. This technical marvel signifies a shift in the long-term trend, favoring the bulls, much like a well-timed joke that lightens the mood in a tense gathering. This signal, coinciding with a breakout from a double bullish wedge, creates a rare alignment of technicals, suggesting that momentum is beginning to transition into a sustained upward phase, much to the delight of those who have dared to dream.

The confluence of the golden cross with this wedge breakout provides Cardano with a robust technical foundation as it strides into the weeks ahead. Historically, such setups have paved the way for multi-month expansions, especially when supported by steady volume and the formation of higher lows. Should ADA manage to hold its breakout and build above the $0.85 to $0.90 zone, the probability of reclaiming the elusive $1.00 and perhaps even extending towards $2.00 grows significantly stronger, like a well-cooked borscht that warms the soul.

The Cardano Chart: A Tightly Wound Spring

As we observe ADA’s price, it continues to compress within a symmetrical triangle, with buyers valiantly holding the rising support trendline while sellers defend the ceiling near $0.98, as if they were knights guarding a castle. The setup reveals a tapering volume as the apex approaches, signaling that a breakout decision is drawing near, much like the suspenseful moment before a grand reveal. The presence of the 50-day moving average just below adds further strength to the $0.89 support zone, reinforcing it as the key level to watch, akin to a watchful guardian.

As momentum builds, a clean move above $0.98 could clear the path towards $1.05 to $1.10, while losing $0.89 risks inviting a sharper retrace into prior demand zones, much like a clumsy dancer stepping on toes. Analyst Sssebi notes that when such patterns appear alongside recent bullish triggers like the golden cross, the odds typically favor an upward resolution. If ADA maintains its structure, this consolidation could provide the foundation for a strong leg higher through August, much to the chagrin of the pessimists.

Cardano’s Open Interest: A Bullish Case Unfolds

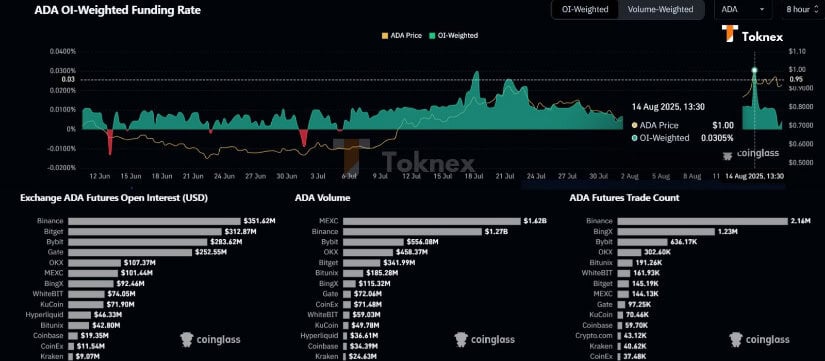

Fresh derivatives data from Toknex reveals that ADA’s futures positioning is beginning to align with its bullish technical backdrop. Open interest across major exchanges now comfortably exceeds $1.0B, with Binance and Bybit leading the charge, much like a well-organized army. Alongside this, funding rates remain positive but not overheated, indicating that traders are leaning bullish without extreme leverage in play. This type of balance often creates room for sustainable rallies, particularly when spot market participation and on-chain metrics are showing strength, like a well-timed punchline in a comedy routine.

On-chain volume trends add weight to the picture, with ADA futures trade counts crossing 2.1M and spot volumes on MEXC and Binance surging past $1.7B combined. This rise in activity coincides with ADA pressing against key resistance near $1.00, while market watchers note that $1.01 and $1.15 remain the next checkpoints, much like the next chapters in a gripping novel.

Whale Accumulation: A Sign of Confidence

Fresh data from Mintern shows whale activity in ADA climbing to its strongest levels in months, even after recent market pullbacks. Large holders have continued to accumulate, signaling confidence that extends beyond short-term volatility, much like a wise elder who knows that patience is a virtue.

This consistent buildup suggests that whales are positioning for the next expansion phase, using dips as opportunities to increase exposure. When such activity aligns with technical improvements like the golden cross seen earlier, it often provides a powerful base for broader market moves, akin to a well-laid plan coming to fruition.

ADA Dominance: A Steady Ascent

The latest dominance chart highlights ADA’s steady climb, with Cardano holding firm above the 0.85% mark. The structure reflects resilience, as dominance continues to trend upward alongside the 50-day moving average, a sign that Cardano is gradually carving out more space in the broader crypto market. The volume and RSI base suggest consolidation before the next leg, giving bulls a chance to reset without breaking structure, much like a well-timed pause in a symphony.

Sssebi points out that this setup looks increasingly bullish as dominance stabilizes at higher lows, creating a foundation for further expansion. If Cardano maintains this trajectory, growing dominance could amplify price momentum once key resistance levels are cleared, much to the delight of the faithful.

Final Thoughts: The Tension of Anticipation

Cardano’s price chart now stands at a crossroads where excitement and caution intertwine. The golden cross, rising dominance, and whale accumulation provide ample reason for optimism, yet the price must still prove its mettle above the $0.90 zone. Breaking through $1 with genuine conviction could flip sentiment across the market, setting ADA up for a stronger recovery phase, much like a phoenix rising from the ashes.

For now, the balance between patient consolidation and sudden breakout is in play. If momentum carries, the move could extend towards $1.15 and beyond, leaving us all to ponder the whims of fate and fortune.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- LINK Soars Higher: Whales Go Wild, Market Goes Bananas! 🐳🚀

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

2025-08-20 18:40