Well, well, well, if it ain’t old AVAX causing a stir once more! It seems like the market’s got its eye on this critter, with signs pointing to a mighty breakout on the horizon. After biding its time at the demand zone, fresh on-chain data and technical signals are lining up like ducks in a row, all favoring the bulls. 🐂

AVAX Attempts Bottoming Against Bitcoin

Polaris_xbt, a keen observer of these digital wilds, notes that AVAX is trying to set a bottom against BTC after a long spell of falling prices. The chart shows AVAX/BTC revisiting a long-term demand zone that served as a strong base back in 2021. Right now, the pair is pressing into this green support area, where accumulation might start if buyers stick around. The MACD, that clever indicator, hints at a possible shift in momentum, showing early signs of stability after a long period of selling pressure. 📈

This zone between 0.000200 to 0.000190 is crucial. Holding here could signal the start of a broader accumulation phase for AVAX relative to Bitcoin. If buyers can keep this support, the pair might start climbing higher, marking the beginning of a reversal pattern.

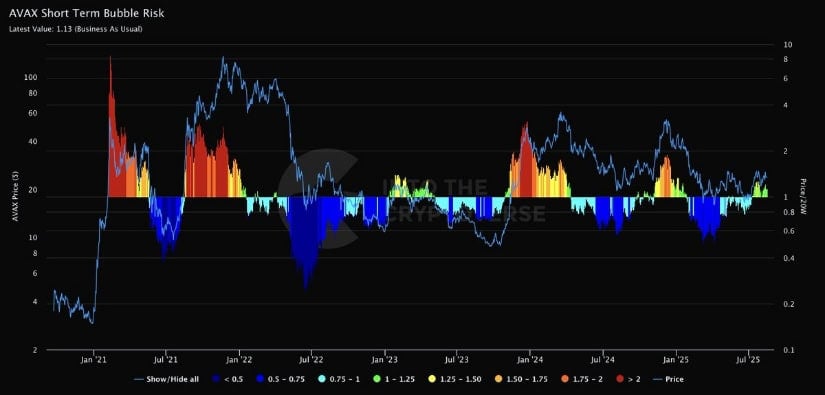

Bubble Risk Remains Contained

Into The Cryptoverse points out that AVAX isn’t in overheated territory just yet, with its short-term bubble risk reading staying neutral. Historically, when AVAX hit the higher ranges of this metric-marked in red and orange-it often signaled sharp local tops. But right now, the reading is closer to the usual zones, leaving the door open for further upside. 🌡️

From a market structure standpoint, this setup means AVAX has the technical room to rally higher without the immediate pressure of overheating. It’s like a horse ready to bolt, but the reins are still loose.

AVAX Mirrors LINK’s Earlier Rally Path

A recent fractal comparison between Chainlink and Avalanche shows a clear difference in performance. While LINK has surged over 150%, AVAX has only managed a modest 3.5%. However, AVAX’s chart is showing a consolidation pattern that mirrors the basing structure of LINK. 🔄

This sideways range could be setting the stage for a stronger trend if buying pressure starts to pick up. As babax memes noted, AVAX’s structure mirrors the kind of compression LINK experienced before its explosive rally. If AVAX can defend its current support range and push through resistance with higher lows, it might follow a similar recovery path, potentially positioning itself for a stronger breakout phase.

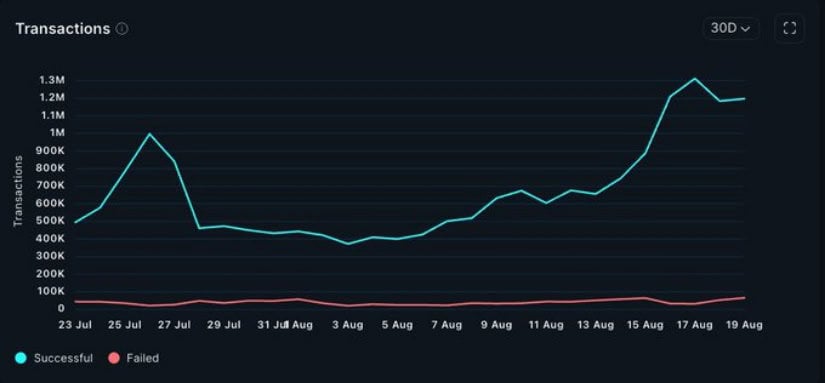

On-Chain Activity Signals Strong Demand

Avalanche’s latest on-chain data is painting a rosy picture, with transactions surging past 1.3 million in just 24 hours-three times higher than what was recorded earlier in August. This isn’t just noise; it reflects growing utility across the network, from DeFi participation to token transfers. A steady rise in successful transactions, paired with a relatively flat failure rate, shows that throughput is scaling effectively without bottlenecks. 🚀

AVAX records over 1.3M transactions in 24 hours.

Such a spike in on-chain engagement often precedes stronger price momentum, as fundamentals begin to align with technical setups. This acceleration in daily usage suggests AVAX is gaining traction even while the price consolidates, hinting at underlying strength. If the network continues to post these kinds of numbers, it could act as a catalyst for price action to eventually catch up, supporting the broader bullish narrative building around Avalanche.

Avalanche Technical Analysis

The AVAX/USD chart is looking promising as the price holds above the $22 to $23 demand zone, where buyers have been consistent over recent weeks. The green support band has acted as a launchpad, and the latest bounce coincides with a golden cross between the 50-day and 200-day moving averages, indicating that momentum is shifting back in favor of the bulls. Structurally, this sets the stage for an attempt at reclaiming mid-range resistance near $26.80, with $32 to $34 highlighted as the next major supply zone. 🌟

Kelvin’s chart points to this scenario with a clean breakout projection, suggesting that if AVAX can defend its current base, the path toward $34 opens up with little overhead resistance. Volume patterns also indicate steady accumulation rather than aggressive selling, adding conviction to the bullish bias.

Final Thoughts: AVAX Price Prediction

Avalanche is quietly building a solid foundation. With the price holding steady at support and network activity hitting record levels, the signals are pointing toward a market that’s preparing for its next phase. Strengthening charts add further weight, showing momentum is shifting back toward the bulls. If this base continues to hold, AVAX could be gearing up for a move that finally breaks it out of its prolonged sideways grind. 🚀

Key resistances still need to be cleared, but AVAX looks far from overheated, giving it room to grow without immediate bubble risk. If demand keeps flowing on-chain and buyers hold the $22 to $23 zone, a push towards $34 seems realistic. So, buckle up, folks, it might be a bumpy ride, but the destination looks promising! 🎉

Read More

- Gold Rate Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Silver Rate Forecast

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Bitcoin’s Wild Ride: Will It Hit $120K? 🚀

- USD CNY PREDICTION

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

2025-08-22 01:04