In the grand theatre of financial speculation, one act stands out: the protracted consolidation of SEI within a descending triangle, a spectacle watched with bated breath by traders and investors alike. Volume trends and momentum indicators whisper of a potential breakout, a dramatic turn that could either launch our hero into the stratosphere or send it plummeting back to earth.

The token, much like a character in a Dickensian novel, teeters on the brink of fate, with the critical $0.37 resistance acting as the final hurdle before a grand rally or a renewed wave of selling pressure. The suspense is almost too much to bear! 🤯

Long-Term Descending Triangle Pressures Toward Critical Resistance

According to the illustrious Ali (@ali_charts on X), SEI has been ensnared in a descending triangle pattern for what feels like an eternity, pressing against a resistance trendline that stretches back to its early days of glory. The breakout point, set at the modest sum of $0.37, is the key to unlocking a potential surge after months of dwindling volume and consolidation near the triangle’s apex. One can almost hear the collective breath-holding of the market. 🎭

Fibonacci retracement levels, those mystical guides of the financial world, hint at the first major upside target around $0.50, a figure that corresponds to the 0.236 retracement level. Should the bulls muster their strength and push through, further gains towards the lofty heights of $0.76-$0.90 are not out of the question, aligning with previous consolidation zones and higher Fibonacci extensions. But alas, should the token falter and fail to break above $0.37, it may find itself retracing its steps to lower supports, continuing its accumulation phase until a more decisive trend emerges. 🌟

Short-Term Market Snapshot Shows Sideways Trading and Base Formation

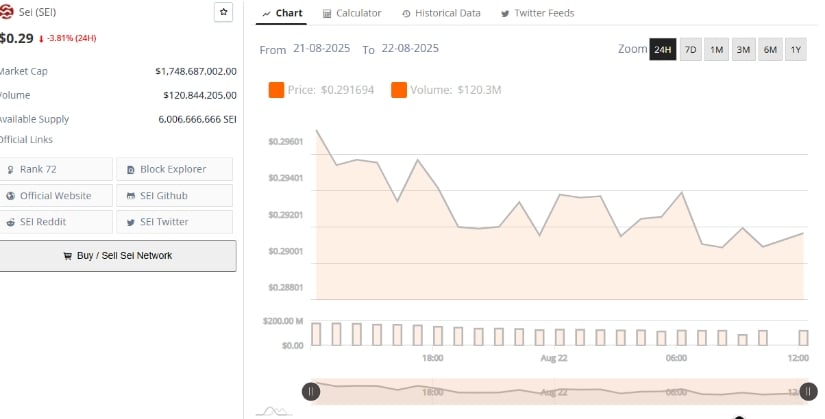

The short-term data, courtesy of BraveNewCoin, paints a picture of SEI trading near $0.29, a slight 3.8% dip over the past 24 hours. Yet, despite this minor setback, trading volume remains robust at $120 million, a testament to the coin’s enduring appeal. Price action, much like a well-rehearsed play, has been confined within a narrow range between $0.288 and $0.296, a clear indication of market indecision. 🤔

This consolidation near $0.29 suggests the formation of a near-term base, with repetitive dips and rebounds hinting at attempts to stabilize. Momentum, however, remains as elusive as a unicorn in a coal mine, and a break below this base could quickly test the $0.28 support. The cryptocurrency’s market rank at #72, a position that whispers of mid-cap status, underscores the importance of holding solid support for bulls aiming to build upward momentum. A surge in volume, the lifeblood of any successful breakout, would be the clarion call needed to challenge higher resistances effectively. 📊

Daily Technical Indicators Reflect Potential Momentum Shift

TradingView’s daily chart, a veritable treasure trove of technical wisdom, integrates Bollinger Bands and MACD to provide insights into the coin’s momentum. SEI price, a creature of habit, hovers slightly below the Bollinger middle band at $0.3129, currently resting at about $0.2926. The lower band at $0.2751 acts as immediate support, a safety net for the weary trader, while the upper band at approximately $0.3508 aligns closely with the $0.37 resistance, a level of critical importance.

The MACD, that enigmatic indicator of trends, remains in a mildly bearish stance, with the MACD line just below the signal line and a negative histogram at -0.0039, a sign of subdued bullish momentum. However, the proximity of the MACD and signal lines suggests a possible bullish crossover if buying activity picks up. Maintaining price above the $0.29 support and separator line could build the momentum needed to propel the token toward the $0.35-$0.37 resistance range, while a failure to hold may result in a pullback to $0.27, where stronger support lies in wait. 🌐

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Silver Rate Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Bitcoin’s Wild Ride: Will It Hit $120K? 🚀

2025-08-22 23:15