What to know: 🤯

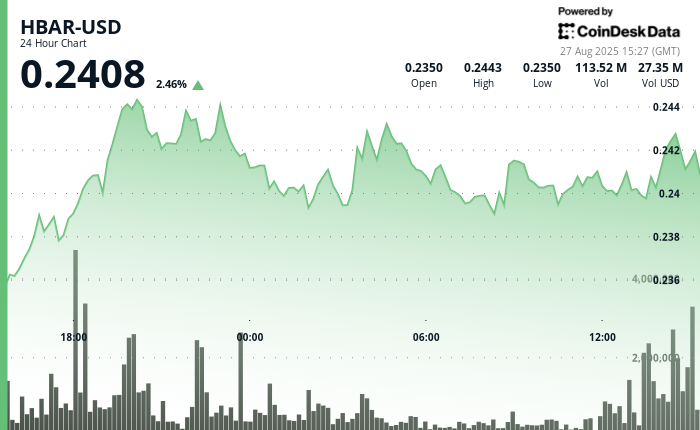

- HBAR traded in a tight $0.01 corridor ($0.24-$0.25) over a 23-hour period, with volume surging to 70.13 million units, well above session averages. 📈💸

- The token briefly peaked at $0.25 on Aug. 26 before consolidating near $0.24, where multiple support tests confirmed a strong technical base. 🧠💎

- Institutional interest is mounting, with SWIFT testing Hedera for tokenized settlement and Grayscale establishing a Delaware trust for HBAR. 🕵️♂️🏛️

Hedera’s HBAR token showed strong momentum in a 23-hour trading window between Aug. 26 at 15:00 and Aug. 27 at 14:00, oscillating within a narrow $0.01 range that reflected a 4% spread between its $0.25 high and $0.24 low. 🔄🔥

The token gained early traction on Aug. 26, surging from $0.24 to its peak at $0.25 by 19:00, supported by unusually heavy trading volume of 70.13 million units. Afterward, the market settled into consolidation, with repeated tests of support at $0.24 and resistance near the upper band, establishing a stable corridor for the remainder of the session. 🧱📉

HBAR saw renewed strength in the final hour of trading, advancing from $0.24 to close slightly higher, underscoring continued bullish pressure even within tight market conditions. 🦘📈

Analysts noted that the session’s elevated activity marked one of the more robust liquidity events for the token in recent weeks, highlighting growing interest among traders despite broader market caution. 🤔💸

The token’s technical resilience comes as institutional players step deeper into Hedera’s ecosystem. Payments network SWIFT has launched live blockchain tests using Hedera for tokenized settlement infrastructure, while asset manager Grayscale has established a Delaware trust for HBAR. 🏦⚡

Technical Indicators Breakdown 🧪

- Trading corridor of $0.01 indicating 4% differential between session high of $0.25 and low of $0.24. 📏📉

- Maximum bullish strength materialized around 19:00 on 26 August with advancement from $0.24 to $0.25. 🚀💰

- Substantial trading volume reached 70.13 million units surpassing typical session metrics. 📈💥

- Foundation level formed near $0.24 through multiple successful support confirmations. 🏗️🛡️

- Resistance materialized around $0.24 establishing well-defined trading channel. 🛑🌀

- Concluding 60-minute session demonstrated 1% appreciation from $0.24 to $0.24. 🤯%

- Trading volume surge of 7.08 million units materialized at 13:42 during dramatic price movement. 📉🌪️

- $0.24 level functioned as crucial pivot point transitioning from resistance to support. 🔄⚖️

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- USD HKD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- ATOM Soars to $2.65-Can It Reach $3.3? 🚀💸

- Fed’s $55B Injection: Will XRP Hit $3? 🚀

- The Bubble That Refuses to Burst: Are We in a Bull Market or Just Fooling Ourselves?

2025-08-27 20:39