Ah, the tale of Bunni DEX-a story that starts with innovation and ends with a hacker’s piggy bank overflowing. 🐷 The platform’s Liquidity Distribution Function (LDF), a clever contraption meant to outsmart standard Uniswap protocols, became the unwitting star of a heist movie. Within hours of the breach, Bunni’s team hit the panic button, freezing smart contract operations across multiple blockchains like a conductor abruptly halting an orchestra mid-symphony. 🎻🎶

The Plot Thickens: A Hacker’s Masterstroke 🎭

Picture this: a hacker, armed not with brute force but with mathematical precision, exploited Bunni’s custom LDF system. This mechanism, designed to shower liquidity providers with returns, was tricked into miscalculating ownership stakes. Victor Tran, co-founder of KyberNetwork, spilled the beans on social media: the attacker executed trades with amounts so specific they could make a mathematician blush. 😳 Repeating this process like a magician pulling endless rabbits from a hat, the hacker siphoned off tokens worth $2.4 million from Ethereum and $6 million from Unichain. And just like that, poof! The funds vanished into Ethereum via the Across Protocol. 🪄💰

Security sleuths at Hacken traced the stolen loot to specific wallets, revealing $1.33 million in USDC and $1.04 million in USDT stablecoins. Blockchain detectives, ever the diligent bunch, left no stone unturned. 🔍

Bunni’s Desperate Dance: Recovery Mode 🕺

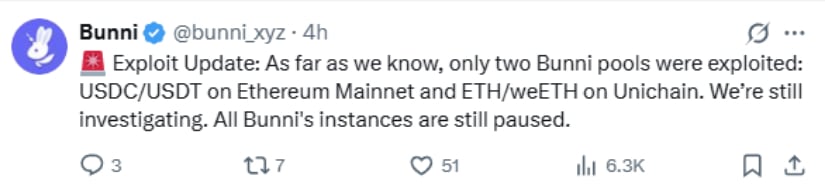

In the aftermath, Bunni’s team scrambled faster than a rabbit evading a fox. They paused all smart contract functions across Ethereum, Base, Arbitrum, and BNB Smart Chain. Core contributor @Psaul26ix took to social media, urging users to yank their funds pronto: “If you’ve got money on Bunni, get it out NOW!” 🚀

And then came the pièce de résistance: Bunni offered the hacker a 10% bounty to return the stolen goods. Imagine sending an on-chain message akin to leaving a note on a thief’s doorstep: “Call us, let’s negotiate!” 🤝💬 Partner protocols, meanwhile, scrambled to reassure users. Michael Bentley of Euler Finance confirmed his platform remained unscathed, while other DeFi players watched nervously from the sidelines.

The Rise, the Fall, and the Irony 🌟🍂

Before its downfall, Bunni was the darling of the Uniswap v4 ecosystem. Dominating HookRank and processing nearly 59% of trading volume, it was the belle of the DeFi ball. Its re-hypothecation hook-a mouthful, yes-allowed tokens to earn from both trading fees and lending. 💃🕺 The ETH-USDC 1.1 pool on Base blockchain? A cash cow, generating over $80 million in trading volume with an eye-watering 2,690% annual percentage yield. 📈

But alas, innovation has its price. Bunni’s Liquidity Density Functions, which kept gas costs steady, were groundbreaking. Yet, these very innovations became the chink in its armor. The DeFi world, rife with risk, lost over $300 million to hacks in two months alone. Bunni’s fate serves as a cautionary tale: the cutting edge can sometimes cut back. ⚔️

The Bigger Picture: DeFi’s Double-Edged Sword 🗡️

This incident underscores the eternal tug-of-war between innovation and security. Despite audits by Trail of Bits and Cyfrin, Bunni’s vulnerabilities slipped through the cracks. Attackers are evolving, targeting complex mechanisms like Bunni’s LDF. The Uniswap v4 ecosystem, still in its infancy, remains a playground for experimentation-and exploitation. 🎢

Will this slow adoption? Perhaps. But the show must go on. The Uniswap Foundation has pledged over $144 million to incentivize hook development. For users, the lesson is clear: high rewards come with high risks. Proceed with caution, dear reader, lest your bunnies turn into booby traps. 🐇💣

The Curtain Falls: Lessons Learned 🎭

And so, the Bunni saga concludes-a blend of brilliance and blunder, ambition and irony. It reminds us that in the world of decentralized finance, every innovation is a double-edged sword. As we look to the future, one thing is certain: the bunnies will hop again, but perhaps with a tad more caution. 🐰✨

Read More

- Gold Rate Forecast

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- USD HKD PREDICTION

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

- Silver Rate Forecast

2025-09-03 00:37