Ah, dear reader, behold the curious spectacle of Bitcoin trading at the modest sum of $111,569 on the third day of September! A price so bold, teetering near its noble resistance like a bashful nobleman at a grand ball. The market cap, a gargantuan 2.22 trillion! And the 24-hour volume? A dizzying $46.41 billion, with the price pirouetting somewhere between $108,538 and $111,653 – as if the coin were performing a delicate minuet, one step forward, two steps back.

Bitcoin

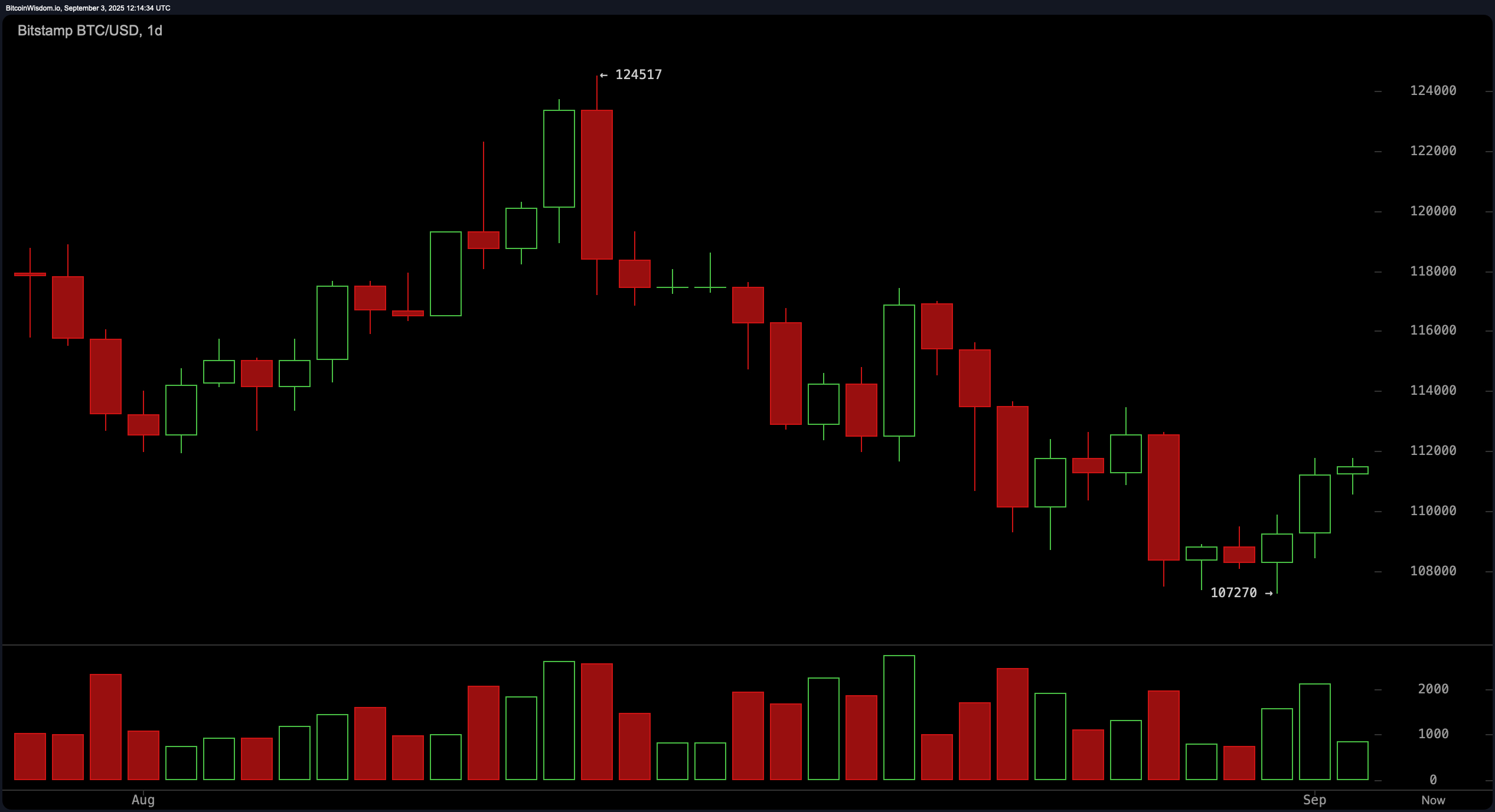

On the daily bitcoin chart, our merry protagonist took a plunge worthy of a peasant’s falling hat-from a lofty $124,000 down to a humble $107,000. Yet like the cunning Cossack rising from the dust, it staged a cheeky rebound, hinting at a temporary truce in this volatile waltz. The floor, firm as a village tavern’s wooden plank, sits near $107,270, while resistance lurks in the $112,000-$114,000 range-a fortress tested often, like a bored landlord looking for rent. The volume sings a strange tune: sellers storm in with raucous vigour while buyers tap in timidly, as if tiptoeing through a field of landmines. Swing traders, those daring folk, eye this scene with hopeful eyes, awaiting a chance to buy low between $107,000 and $108,000-only to exit with pockets jingling near $114,000 to $116,000.

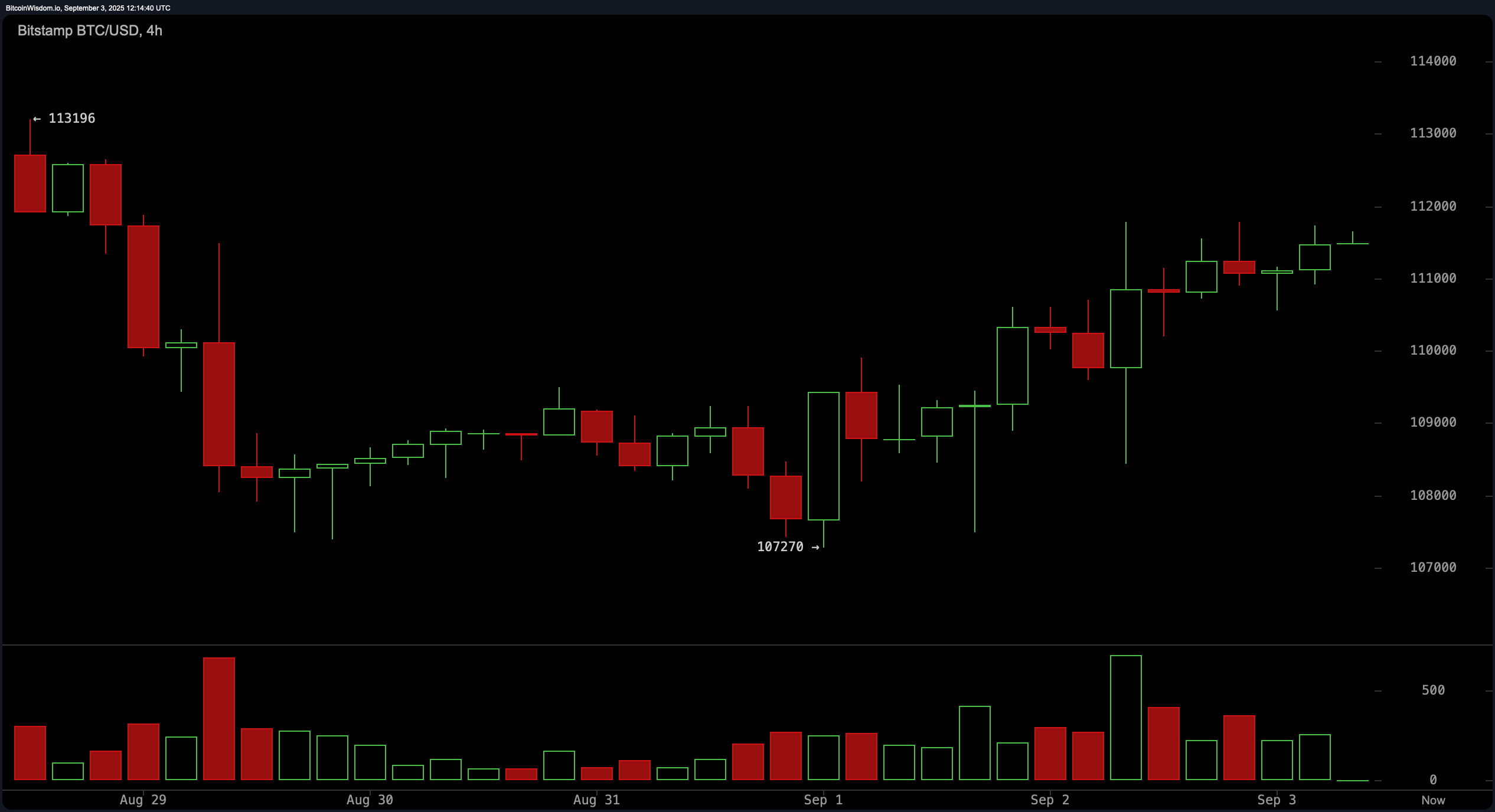

Gaze then upon the 4-hour chart: here our silly bitcoin shuffles up from the $107,000 low with all the determination of a drunk peasant climbing a hill, making higher lows without too much fanfare. Alas, the much-needed cheering crowd (volume) failed to show up! Above, a sinister resistance zone between $112,000 and $113,000 waits like a grumpy customs officer denying entry to a hard-working merchant. The script suggests that should our hero break through this blockade with gusto and volume in tow, a swift pilgrimage towards $114,000 might ensue, with wise profit-takers retreating near $114,000-$115,000 unless the gods of momentum laugh upon the scene.

Ah, the 1-hour chart! A thrilling soap opera unfolds as bitcoin dips to $108,426 before pirouetting back above $111,000, as if testing the patience of its admirers. It saunters in a slow ascending channel, charmingly indecisive. The green candles-those fleeting symbols of hope-appear here and there, suggesting some buyers press intraday with the enthusiasm of a lover chasing a will-o’-the-wisp. The plan? If $111,000 stands firm like a stubborn mule, and a breakout near $111,500-$112,000 flees the shadows with volume, then dear traders might enter this dance, risking below $110,000 and dreaming of the blissful heights of $113,000-$114,000.

Oscillators seem as indecisive as a bureaucrat on payday: the Relative Strength Index tiptoes at 46-too polite to call it bullish or bearish; Stochastic at 33, politely neutral; CCI mumbles around −41; ADX ambles at 20; and the Awesome Oscillator grumbles at −5,079. However, amidst this parade of neutrality leap two warriors-momentum (MOM) throws a bullish wink at −1,936, while the MACD grumbles a bearish growl at −1,670. Such is the eternal tug of war at our dear resistance territory!

Moving averages (MAs) parade in a mixed fashion worthy of a village feast. The short-term troopers-the EMA (10) at $110,982 and SMA (10) at $110,324-nod approvingly, bullish as a horse at the starting gates. But watch! The next brigade-EMA (20) at $112,387, SMA (20) at $112,863, EMA (30) at $113,205, SMA (30) at $114,566-march back, defensive and bearish as if nursing hangovers from the previous day’s revelry. Midcurve remains similarly cautious, while the longer-range elders bring hope: EMA (100) and EMA (200) blink bullishly, with SMA (100) grumbling a sell and SMA (200) chuckling bullishly from afar. Confusing? Like a village council meeting with too many babushkas, yes!

In summation, our beloved file speaks of a market pressing against a well-guarded supply zone, with breadth so hesitant it might as well be shy at the ball. The great resistance stands like an old bear at $112,000-$114,000, demanding proof of volume-backed valor to push forth. Intraday, disciplined longs might dare, eyes on the $113,000-$114,000 prize. But woe! Should the price drop below $110,000 to $108,000, all eyes turn to the $107,000 floor-a slip there might introduce a sorrowful deeper correction leg, like a poor soul slipping on the frozen mud.

Bull Verdict:

If bitcoin keeps its toes above $111,000 and forces its way through the $112,000-$114,000 gates with pomp and circumstance (i.e., volume), our bullish comrades might gallop forth to $116,000 and perhaps even dream of $120,000. Short-term moving averages and select momentum oscillators stand ready like trusty steeds, eager to carry the party onward.

Bear Verdict:

But should poor bitcoin stumble and fail to guard $110,000, slipping below the gracious $108,000 line, expect the bears to roar with delight, dragging price toward the critical $107,000 floor-or worse. The chorus of sell signals from intermediate moving averages and the lackluster volume convince these bearish bards that the resistance wall shall hold, turning away hopeful suitors with a dismissive wave.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Silver Rate Forecast

- USD HKD PREDICTION

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Tokenization: The New “Mutual Fund 3.0” You Didn’t Know You Needed

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

2025-09-03 16:34