In the grand circus of crypto, where tokens pop up like mushrooms after rain, Worldcoin has decided to throw on its dancing shoes. This surge isn’t just a fluke or some trader’s caffeine-induced hallucination-it’s actually backed by the sort of busy trading and open interest that makes you think: “Hmm, maybe this isn’t just wishful thinking.” Sitting comfortably in the top 80 of the crypto popularity contest, this little digital critter is shaking up the usual suspects with price, volume, and some technical mumbo jumbo all doing a chaotic conga.

One-Hour Chart Shows Strong Short-Term Price Movement

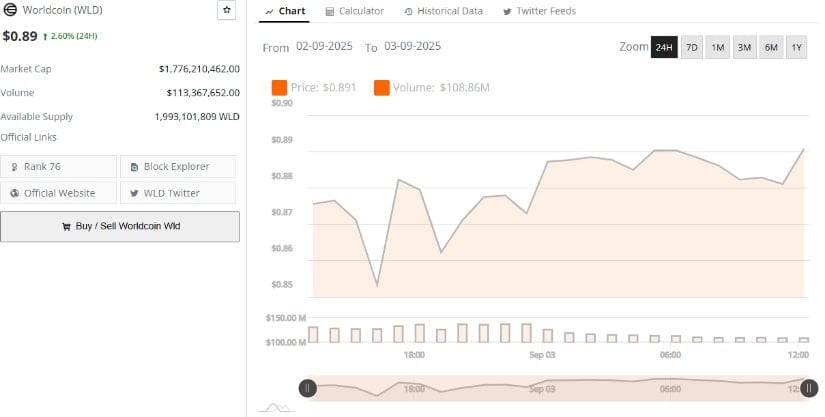

Now, if you squint at the one-hour chart (because staring at charts for hours is how grown-ups relax these days), you’ll notice a steady, if not slightly smug, climb. Price is casually shimmying between $0.88 and $0.91, like it’s waiting for a green light or maybe just the barista. It’s punched through short-term resistance like it’s bursting into a party uninvited, while the open interest-think of it as crypto’s version of enthusiastic party-crashers-keeps swelling.

When open interest and price rise like star-crossed lovers, it usually means traders are opening new positions with the kind of confidence one reserves for binge-watching a box set or deciding not to check your bank balance. This isn’t your average short squeeze shenanigans-nope, this rally has a bit of the old-fashioned “real market conviction” to it, suggesting momentum just might stick around for tea and biscuits.

Data Reflects Price Climb with Volume Growth

Meanwhile, the noble folks at Brave New Coin report that WLD’s price has moseyed up from about $0.85 to nearly $0.90 in recent days. And that’s matched by a sprightly 25% leap in daily trading volume, hitting a hefty $125 million-enough to make any crypto fan blink twice or thrice.

The circulating supply lingers around 2 billion tokens, giving Worldcoin a respectable market cap of about $1.76 billion-not bad for a digital blob of ones and zeros. Yet, lurking in the shadows is the total supply, a whopping 10 billion tokens, which means more coins keep trickling in like party guests who refuse to leave, threatening to pressure prices down despite the current upbeat mood.

Technical Indicators Signal Market Sentiment and Potential Next Moves

Peering at TradingView’s crystal ball as we speak, the coin trades near the $0.90 mark. The Bollinger Bands on the daily chart hint at strong momentum-they’re pushing price towards the top band like it’s trying to sneak out the window after curfew. But beware! That often spells increased volatility or the classic “overbought” signal, which is geek-speak for “hold your horses.”

As for the MACD, it’s sulking below zero but starting to perk up like it’s considering a weekend at the races, while the Chaikin Money Flow hovers near zero, playing referee between buyers and sellers-no clear winner yet, but certainly some drama in the ring.

So, what does it all mean? Well, crypto fans might be optimistic, but the market’s like a soap opera: it needs confirmation and a good plot twist (read: volume support and momentum shifts) to keep the drama rolling. Until then, keep your satchels close and your memes closer. 🚀🧐

Read More

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- ARB PREDICTION. ARB cryptocurrency

- Bitcoin’s Wild Ride: $135K by August? 🤑💸

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Crypto Market: Cooling Demand and a Niche Party, Not a Full-Blown Alt-Season 🚨

- Crypto Chaos: Shiba Inu Flirts with Another Zero, Ethereum on the Brink, Bitcoin’s $100K Nightmare!

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

2025-09-03 20:26