What must one clutch in this fracas:

The Cast of Characters:

DOGEDOGE $0.2076 ◢3.94%

BTCBTC $108,783.53 ◢0.31%

WLDWLD $1.2321 ◢18.12%

By your humble servant, Omkar Godbole

Ah! Attend, good gentles, to the tale most curious-Friday’s dismal U.S. nonfarm tale caused brooding clouds of bearish gloom, yet lo! The morrow dawned and those fears were but smoke and shadows! Thus, coins such as Ethena’s ENA, worldcoin, hyperliquid (HYPE), and that merry fool Dogecoin, did pirouette and soar like jesters on a midsummer’s stage! 🎭

Meet Bitcoin, the ostentatious lord, who after falling beneath the sacred $112,000 barrier, now strives to don a bullish inverse head-and-shoulders wig-a fashion oft-a-harbinger of a grand rally! His miner subjects toil harder, and Master Saylor, of Strategy (MSTR), doth hint at hoarding more of this noble coin. 🏰

Yet beware, noble observers, the on-chain scrolls speak truths more tangled than a Parisian wig-maker’s secrets! Illiquid holders clutch their treasures tightly, but might the whales be selling faster than a courtesan’s purse at the masquerade? CryptoQuant whispers so, with a hint of mischief.

Meanwhile, on that scandalous stage called X, a lively quarrel erupts ’bout Ethereum’s health. One sage cries, “Ethereum is dying!” (Alas, August’s poor performance seemed to bolster this grievous jest). Yet, another wise fellow, Tom Dunleavy of Messari, retorts sharply-Ethereum and Solana thrive as lively as court jesters dancing at all hours, their metrics painting a far merrier scene than mere revenue figures imply. 📜

Speak we now of Ethena’s governance token, ENA, which did bubble and boil to three-week heights, buoyed by StablecoinX’s promised $530 million purse-aiming to serenade Nasdaq. Robust revenues and sweet hopes of Fed’s interest-rate lullabies set ENA in a role most tempting, as foretold by the enigmatic bard, Crypto Stream.

Pray, do not forget the plight of Hyperliquid, whose dream to birth its own USDH stablecoin sparked a tempest of governance battles-provoking the crowd to wield pitchforks against the ominous shadow of Stripe’s Bridge centralized grasp. ⚔️

On the grand global stage, the Yen stands firm against the dollar, shrugging off Prime Minister Ishiba’s exit with all the nonchalance of a cat ignoring a spilled goblet. Across the seas, France appears ever so close to political collapse-quel drame!

And the U.S.? The Bureau of Labor Statistics prepares to unveil annual revisions come Tuesday-so brace thyself! Reports whisper of lost hundreds of thousands, nay millions, of jobs vanished into the ether-a tragedy worthy of the finest Molière script!

An Assembly of Tokens and Affairs

- Governance votes & calls

- Lido DAO debates the grand migration of Nethermind’s 7,000 Ethereum serfs to Twinstake’s infrastructure realm. The vote ends Sept. 8, or else chaos reigns.

- Uniswap DAO doth decide whether to birth “DUNI,” a Wyomingen legal entity protecting their decentralized follies whilst keepeth coffers for tax and legal tomfoolery. Vote by Sept. 8.

- Uniswap DAO again! This time on the Unichain-USDS Growth Plan: “No result, no reward,” cryeth the contract! Vote ends Sept. 9.

- Hyperliquid wagers on which knave shall issue its USDH stablecoin: Paxos, Frax, or the Agora & MoonPay coalition? Sept. 14, the fateful date!

- Unlocks

- Sept. 9: Sonic (S) unveils 5.02% of treasure worth $46M; potential chaos inevitable.

- Sept. 11: Aptos unlocks 2.2% (~$48.86M), let the revelry commence.

- Sept. 15: Starknet (STRK) dares the world with near 6% unlock; Sei unfreezes 1.18%, market breathes.

- Sept. 16: Arbitrum doth unlock 2%, a modest yet knowing gesture.

- Token Launches

- Sept. 8: Openledger (OPEN) leaps onto Binance Alpha & co., grand debut!

- Sept. 8: OlaXBT (AIO) graces the stage of Binance Alpha and others.

The Theatres of Conferences

Hear ye! The CoinDesk Policy & Regulation Conference (once State of Crypto) unfolds Sept. 10 in Washington, a rendezvous for the legal sages and government wizards. Seats are rare! Invoke code CDB15 for 15% off thy entry-lest ye be left in the wings.

- Day 2 of 4: Future Proof Festival, Huntington Beach (California)-where dreams meet sunscreen.

- Sept. 9-10: Fintech Week, London 2025-pomp and circumstance abound.

- Sept. 9-10: WOW Summit, Hong Kong 2025-prepare your oohs and aahs!

- Sept. 9-13: Boston Blockchain Week-quaint Massachusetts meets blockchain chaos.

- Sept. 10: The grand CoinDesk Policy Conference in New York, among others.

Token Talk: A Comedy of Memecoins

By Oliver Knight

- Memecoins, those lovable jesters, rise anew! Despite earlier celebrity launches that fell flat like a soufflé, today’s tokens dance with glee.

- Bonk, that nimble Solana hound, led a merry charge with near 7% gain! Dogecoin, the old court jester, matched with a 7% leap-a true renaissance! 🐕🦺

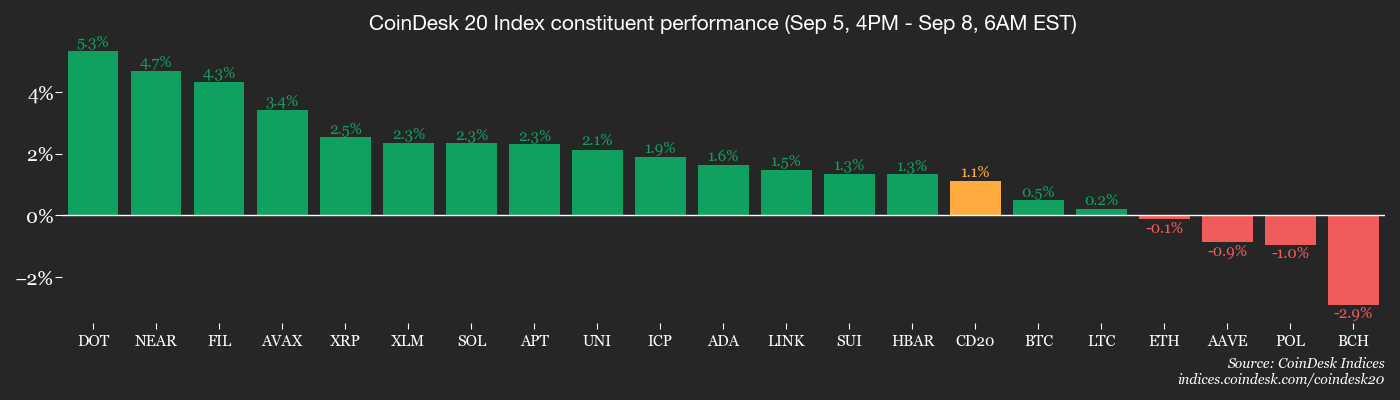

- The CoinDesk Meme Index (CDMEME) outstripped the broader market’s CoinDesk 20 Index-because why should seriousness have all the fun?

- Even ‘fartcoin’ (FARTCOIN) found lovers, a cheeky reminder that finance need not always be grave.

- MemeCore (M) the layer-1 blockchain, shot like a cannonball: +164% in seven days!

- Broad crypto markets tiptoe upwards as BTC and ETH dust off their wigs and prepare to dance once more.

The Derivatives Masquerade

By Omkar Godbole

- DOGE, SUI, and HYPE flaunt double-digit gains in futures, taunting other boring coins.

- Dogecoin’s open interest swelled to 16.88 billion DOGE; apparently, the merry mutt breaks free from the declining chains! 🎉

- BTC ambles between 270K-290K open interest, a volatile teasing of what’s next.

- On CME, BTC futures slumber near an April low, while ETH futures retreat from their peak, a financial siesta.

- Deribit whispers bullish plots for XRP and SOL calls, whilst BTC and ETH options murmur of lurking shadows.

The Grand Market Dance

- BTC up slightly, 0.39% since Friday, merely shaking out the cobwebs at $112,087.64.

- ETH inches forward by 0.26% at $4,328.09, modest as a pageboy.

- CoinDesk 20 ascends by 1.25%, the crowd surges with glee.

- Ether CESR Staking rate slips by 9 bps to 2.81%, a slight bow.

- BTC funding rate almost flat, a delicate balance on Binance’s ledger.

- DXY stands stone-faced at 97.73, no change to tell tales of.

- Gold futures unmoved at $3,651.60, the alchemist’s dream stagnates.

- Silver whispers up by 0.66%, a glimmer in the dusk at $41.83.

- Nikkei 225 closed with a proud 1.45% rise-a haiku in numbers.

- Markets across the globe pirouetted with modest gains and feints.

Bitcoin’s Ledger of Lore

- BTC Dominance reigns steady at 58.47%, the monarch of crypto.

- Ether-to-Bitcoin ratio dips modestly (-0.56%), a gentle tumble from the dais.

- The mighty hashrate pulses at 973 EH/s, miners swinging hammers heartily.

- Hashprice stands at $51.88, as hands count fees noble and vast: 3.23 BTC, or $358,958.

- CME Futures Open Interest balances at 134,065 BTC, a grand assembly.

- Price of BTC counted in golden ounces: 30.8, gleaming like a court necklace.

- BTC’s market cap versus gold: a humble 8.72%-still the talk of alchemists and bankers alike.

Technical Chorus

- DOGE’s recent two-day surge shatters the shadow of July 21’s decline-hooray for the clown prince!

- Price boldly crosses the Ichimoku cloud, a stroke of bullish fate awaited by soothsayers.

- Eyes now fixed on 25.58 cents, the august high of August 14, as if gazing at the rising sun.

Crypto Equities: The Players Upon the Stage

- Coinbase Global (COIN): Friday’s curtain fell at $299.07 (-2.52%), today it flirts at $301.50 (+0.81%).

- Circle (CRCL): closed $114.56 (-2.49%), gently up to $115.35 (+0.7%) after intermission.

- Galaxy Digital (GLXY): a plucky 2.53% rise to $23.49, but dips slightly after.

- Bullish (BLSH): in a jaunty mood at $52.35 (+6.81%), relaxing a smidge now.

- MARA Holdings (MARA), Riot Platforms (RIOT), and others pirouette with modest steps.

Crypto Treasury Companies:

- Strategy (MSTR): closed at $335.87 (+2.53%), cooling to $329.10 (-2.02%).

- Various players act their parts-with ups, downs, and dramatic flourishes!

ETF Flows: The River of Gold

Spot BTC ETFs

- Daily net flows waltzed backward by -$160.1 million.

- Cumulative net flows boast a stout $54.47 billion.

- The royal vault holds ~1.29 million BTC glinting.

Spot ETH ETFs

- Daily net flows sailed downstream by -$446.8 million.

- Cumulative net treasure: $12.74 billion.

- ETH holdings near 6.42 million shiny tokens.

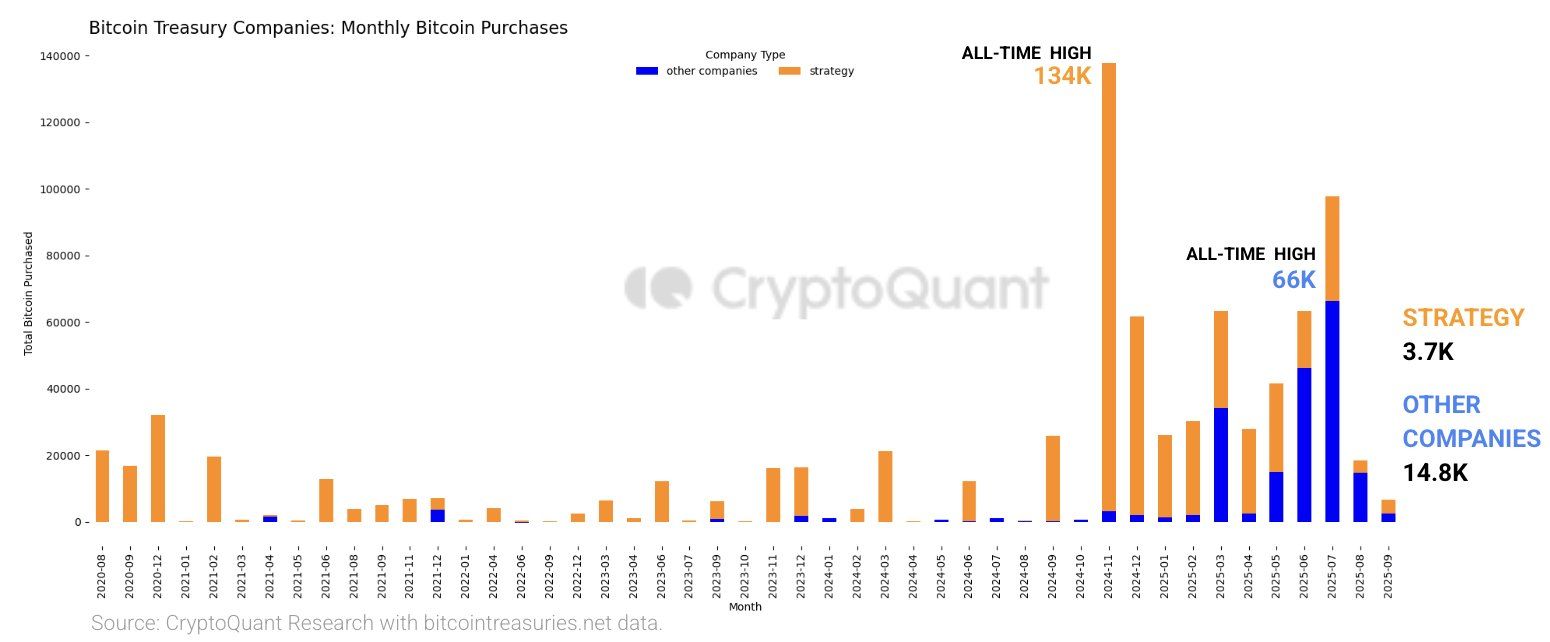

Chart of the Day: The Slow Waltz of Bitcoin Buyers

- Observe, noble lords, the companies have slowed their BTC purses’ opening-no longer rushing but partaking with caution.

- In August, just 3,700 BTC added, a stark retreat from November’s 134,000 BTC frenzy.

- Such slow buying surely explains why the price rally lingers, longing for the bard’s applause.

In the Ether: Visual Revels

Read More

- 🚀 XRP’s ETF Waltz: Less Exchange Drama, More Market Flair! 💃

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: The Great Reset – Who’s Buying, Who’s Selling, and Who’s Just Confused? 😱🚀

- USD CNY PREDICTION

- The Tumultuous Rise of RAVE: Is a Breakout on the Horizon or Just Another Illusion?

- Economist Reveals His Biggest Bitcoin Mistake – You Won’t Believe What It Is

- Sir Bitcoin’s Delicate Predicament: A Cautionary Dance of Bulls vs. Bears 🐘💔

- Brent Oil Forecast

- Will Polkadot Price Soar? Community Votes Amid JAM Upgrade Chaos 🚀

2025-09-08 15:25