In the ever-changing realm of finance, where fortunes fluctuate as capriciously as the weather in Bath, one might suppose Ethereum’s latest suitor, the Nasdaq-listed Bitmine Immersion Technologies, to be the most ardent of admirers. With a sum of 446,255 ETH (valued at a rather impressive £201 million, if we may convert for the uninitiated), Bitmine has secured its place as the most distinguished corporate devotee of this digital coin. A most bold declaration of affection, indeed! 💸

Such fervent declarations have not gone unnoticed. The ETH token, once modest in its valuation, now dances above £4,410, a 3% increase in a single day. One might say it is flattered by the attention, though whether it is love or mere speculation remains to be seen. 😏

Bitmine’s Treasury: A Most Generous Gesture

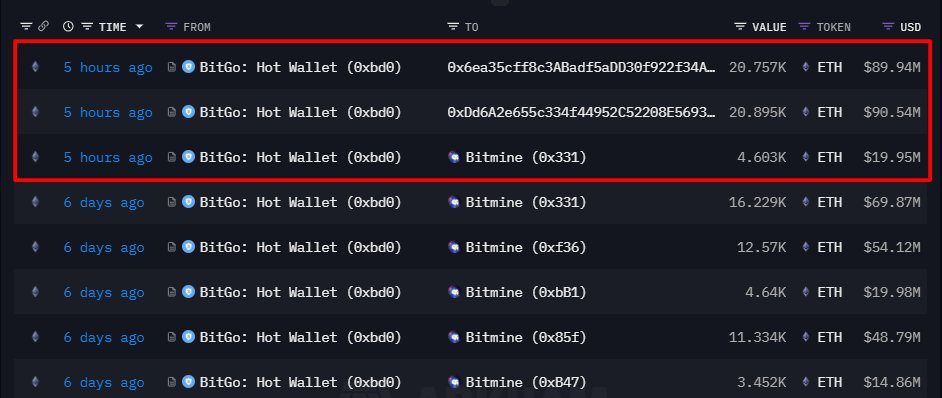

According to the esteemed Onchain Lens, Bitmine’s acquisition of 446,255 ETH was executed with the precision of a well-choreographed quadrille, facilitated by custodian BitGo on the 10th of September. The company now holds the title of “largest corporate holder of Ethereum globally,” a distinction that would make even the most jaded investor blush. 🏆

This was no impulsive purchase, but a calculated maneuver orchestrated by Chairman Thomas Lee, whose vision for Bitmine is as grand as a baronet’s estate. To own Ethereum, it seems, is to own the future-or at least a substantial portion of it. 🚀

One might argue that Bitmine’s approach is less a tentative waltz and more a cannonball into the pool of opportunity. A most vigorous commitment! 🏊♂️

A Quest for 5% of Ethereum’s Supply

With this latest acquisition, Bitmine now commands 2,126,018 ETH, worth nearly £9.3 billion. To own 5% of Ethereum’s total supply is no small ambition-it is the equivalent of a country estate in the Lake District, but with more zeroes. Such audacity echoes the strategies of MicroStrategy in the Bitcoin realm, though one suspects Ethereum may prove a more agreeable partner. 💼

This voracious accumulation, however, may have unforeseen consequences. By sequestering such vast quantities of Ethereum, Bitmine reduces the circulating supply, much like a hostess limiting the number of guests at a ball. Less liquidity may inflate prices, but it also risks leaving the market in a state of awkward scarcity. 🎩

Ethereum’s Price: A Dance of Hope and Despair

Ethereum’s recent trajectory has been as thrilling as a summer romance. The token now trades near £4,412, a 90% increase over the past year. It recently broke through a “descending triangle” (a term as dramatic as a heroine’s heartbreak) and flirted with £4,480 before retreating. Should it maintain its current momentum, it may yet reach £4,800. But beware! A stumble below the 50-day SMA or the £4,000-£4,200 support zone could send it tumbling toward £3,800. A most precarious waltz! 🕺

Read More

- Gold Rate Forecast

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- USD HKD PREDICTION

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- Binance Bewildered: 900 Million Dogecoins Crash the Party-Is the Moon Cancelled?

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

2025-09-11 09:41