In a recent OECD soiree in Paris, SEC Chair Paul Atkins, that most earnest of regulators, assured the assembled masses that “most crypto tokens are not securities,” a statement as enlightening as a moth describing the sun. The agency, he claimed, toils diligently on market guidelines, though one suspects their quills are dipped in bureaucratic honey.

Atkins, with the fervor of a man who has finally mastered the crossword clue “digital assets,” emphasized his focus on reshaping regulations for on-chain capital. He promised clarity for investors and legal certainty for entrepreneurs, all while urging the SEC to abandon its penchant for selective enforcement-a practice as charming as a raccoon raiding a bakery.

Atkins also hinted at a “Super app” and a blockchain vision that could validate all-in-one crypto projects, a concept as revolutionary as suggesting one might wear socks and sandals in unison.

His speech, a masterclass in regulatory optimism, coincided with Bitcoin’s ascent to $114,233, a figure that makes one wonder if the coin has been secretly funded by a time-traveling Warren Buffett. Trading volume surged 18%, and investors flocked to Bitcoin Hyper ($HYPER), which raised $15M in a presale so enthusiastic it could make a venture capitalist weep into their kale smoothie.

Paul Atkins Unveils Game-Changing Crypto Regulatory Vision

Atkins, that most visionary of bureaucrats, emphasized the need for clarity and legal certainty in on-chain capital raising. The SEC, he insisted, must ensure transparency and consistency in rules, a task as delicate as threading a needle while blindfolded.

Project Crypto, a framework designed to modernize regulation, was the star of the show. It enables platforms to offer trading, lending, and staking under a single license-a bureaucratic miracle akin to finding a four-leaf clover in a parking lot.

This framework, Atkins claimed, could birth crypto “super-apps,” consolidating services under one interface. A bold vision, though one might argue it’s less about innovation and more about giving users another reason to stare at their phones.

Atkins also praised Europe’s MiCA framework, a regulatory move as transformative as the invention of the wheel. He waxed poetic about AI and blockchain integration, a next-gen solution that could lower costs and expand access to trading tools. A utopian ideal, perhaps, but one that makes as much sense as a vegan steakhouse.

The new policy, a shift from aggressive enforcement to a more flexible approach, positions the U.S. as a crypto leader. A title once held by the moon, now passed to the SEC in a bureaucratic relay race.

Atkins’ Crypto Shake-Up-Here’s How Investors Stand to Win

With Atkins’ policies, investors and users are said to benefit. Clarity and legal certainty, he argued, are catalysts for token growth and financial apps. A claim as bold as suggesting that coffee is essential to productivity.

The Clarity Act and SEC-CFTC cooperation agreement are steps in the right direction, a phrase as hollow as a man’s promises after a night of drinking.

Atkins’ policy shift, he claimed, would make crypto markets more accessible, transparent, and safe for retail investors. A promise as reliable as a weather forecast in Texas.

And best of all, we could get new crypto ETFs and hybrid portfolios (Bitcoin/gold), which let you diversify without navigating unregulated platforms. A solution as elegant as a toaster oven that also brews tea.

Regulatory clarity, Atkins argued, will encourage whales and retail investors to move capital into Layer-2 projects like Bitcoin Hyper. A claim as audacious as suggesting that a goldfish could win a Nobel Prize.

SEC’s Atkins Sparks Market Optimism-Is Bitcoin Hyper the Next Big Thing In Crypto?

Built on a Bitcoin Layer 2 via the Solana Virtual Machine (SVM) and the Canonical Bridge, Bitcoin Hyper ($HYPER) enables ultra-fast, low-cost contract execution without compromising Bitcoin’s security. A feat as impressive as a magician pulling a rabbit from a hat made of blockchain.

The industry will finally have dApps, smart contracts, and DeFi features on Bitcoin’s ageing chain! A statement as optimistic as a snowball in July.

The token supports lending, borrowing, and liquidity farming on partner platforms, with optional token burns that boost scarcity and value. A strategy as subtle as a megaphone whisper.

The presale has raised over $15M, a figure that makes one wonder if the SEC is now in the business of funding moonshots. Participation is still open, though the window is as narrow as a camel through the eye of a needle.

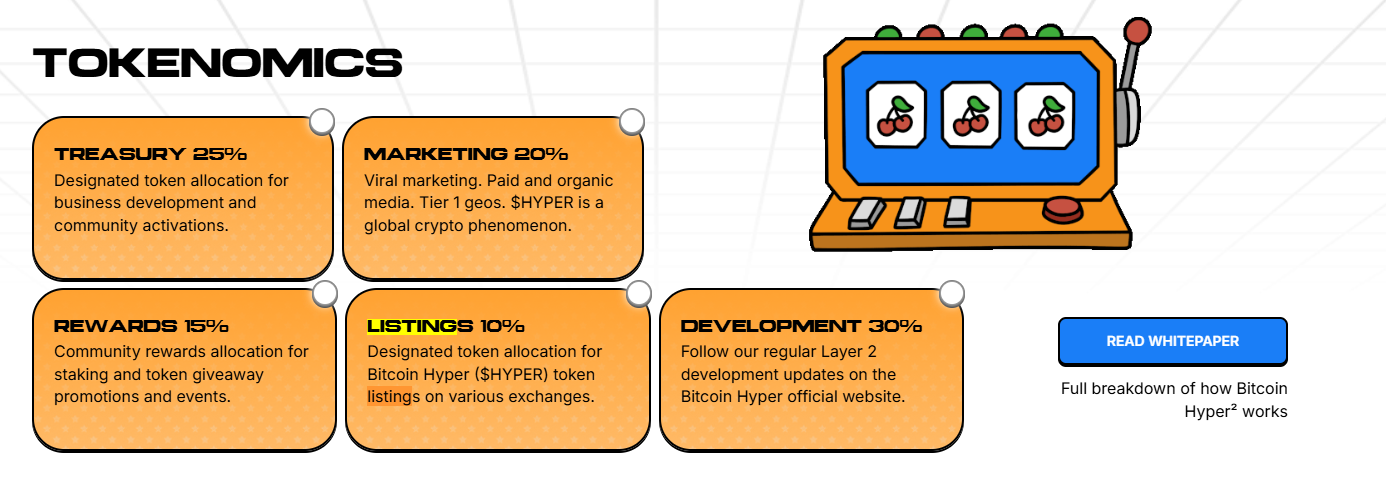

With a fixed supply of 21B tokens, $HYPER reserves 15% for rewards, including staking incentives. The staking program offers a 74% APY, a number so high it could make a venture capitalist faint.

Additionally, 30% of tokens are allocated to Layer 2 development, a commitment as strong as a man’s loyalty after a divorce.

Recent whale buys of $161.3K and $100.6K show big-money confidence. A confidence as misplaced as a man betting his house on a coin flip.

Analysts predict $HYPER could reach $0.02595 by 2025 and $0.253 by 2030. A forecast as reliable as a psychic predicting the lottery numbers.

Read more about the Bitcoin Hyper price prediction 2025 – 2030 here.

Takeaway: Clear Rules and Market Optimism Make Bitcoin Hyper a Token to Watch

Paul Atkins’ push for clarity has reinstated confidence in Bitcoin-based projects like Bitcoin Hyper. The new framework aims to protect investors while opening doors to innovation. A balance as delicate as a tightrope walker on a trampoline.

Atkins’ policies have elevated $HYPER’s potential to “exponential growth.” With strategic developments and adoption, the $15M raise sets the stage for a crypto coup. A coup as dramatic as a man trying to eat a whole pizza in one bite.

Bitcoin Hyper ($HYPER)

Cryptocurrency tokens are highly speculative and volatile. Always do your own research (DYOR) before investing. A reminder as useful as a weather forecast for a desert.

Read More

- Gold Rate Forecast

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- USD HKD PREDICTION

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

2025-09-11 11:30