It appears the Avalanche Foundation has embarked upon a most ambitious endeavour-negotiations of considerable consequence concerning the establishment of not one, but two cryptocurrency-treasury vehicles within the United States, the objective being the procurement of some $1,000,000,000 in capital to acquire AVAX, the native token of their network, according to the most recent dispatch from the Financial Times.

The Financial Times Reveals Avalanche’s Capitalistic Aspirations: A Grand $1 Billion AVAX Scheme

The benevolent society behind Avalanche finds itself in rather advanced conversations with magnanimous investors, intent upon founding one digital-asset treasury enterprise and transforming another into a kindred establishment, as so diligently noted by the FT report. It is expected these negotiations might reach their culmination in the forthcoming weeks. Pray, both endeavours are aimed at none other than the esteemed American institutional investors. Astonishingly, the Avalanche Foundation has elected to maintain a silence on the matter, as the FT scribes were quick to add.

One such venture seeks a princely sum approaching half a billion dollars, effected by a private investment spearheaded by the reputed Hivemind Capital into a company that graces the Nasdaq listings, with none other than Mr. Anthony Scaramucci providing counsel. Hivemind has graciously confirmed its involvement, though Mr. Scaramucci was, alas, silent as the grave. Further gossip from FT mentions a second stratagem, championed by Dragonfly Capital, which proposes to amass a similar sum via a special-purpose acquisition vehicle, with a hoped-for closure in the merry month of October.

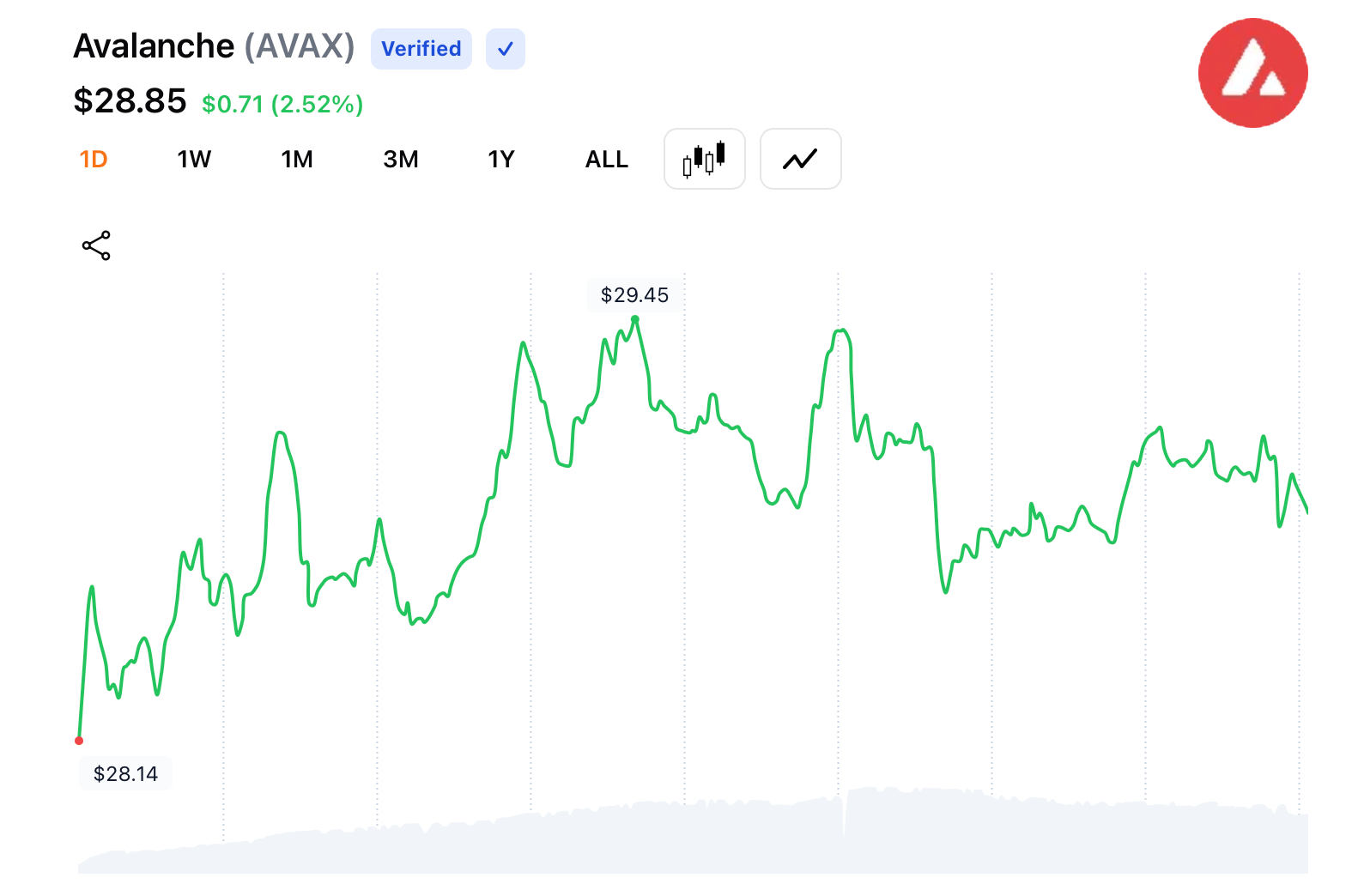

The fruits of these enterprises shall purchase millions of AVAX tokens, procured at a discount from the foundation itself, as informed by the sagacious FT sources. The Avalanche token boasts a maximum supply fixed at 720 million, of which approximately 422 million currently dance in circulation. Upon hearing this startling intelligence, AVAX token prices modestly ascended by 2.5% on Thursday, and indeed, showed a weekly gain of 17%. Yet, lest one be too optimistic, the token remains humbled, languishing some 80% below the dizzying heights of $144, witnessed in the year of our Lord 2021, trading presently at a mere $28.85. 😏

This grand undertaking arrives at a most curious moment: whilst shares of other crypto-treasury enterprises have rather declined, the tokens tethered to bitcoin (BTC), ethereum (ETH), and solana (SOL) have soared during recent months, rather like a well-meaning but somewhat misguided suitor aiming at a family ball. Avalanche, despite courting the attentions of Wall Street luminaries such as Blackrock, Apollo, and Wellington Asset Management for tokenized fund experiments, continues to lag behind its rivals amid this broad market festivity. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

- USD HKD PREDICTION

- CRO PREDICTION. CRO cryptocurrency

- USD MXN PREDICTION

2025-09-11 19:08