Ah, the delightful waltz of numbers and fortunes! Bitcoin ETFs pirouetted with a staggering $757 million inflow on that fateful Wednesday, a feat orchestrated by the grand maestros of finance-Fidelity, Blackrock, and Ark 21Shares-while ether ETFs, not to be outdone, flitted in with a suave $172 million, as if saying, “Look at us too!”

Crypto ETFs Soar: Bitcoin Sees One of Its Largest Inflows as Ether Joins the Rally

What a blockbuster carnival it was on Wednesday, September the 10th-oh, do mark your calendars! Investors engaged in a veritable tug-of-war for both bitcoin and ether funds, resulting in an inflow day that might have even made Poseidon himself envious.

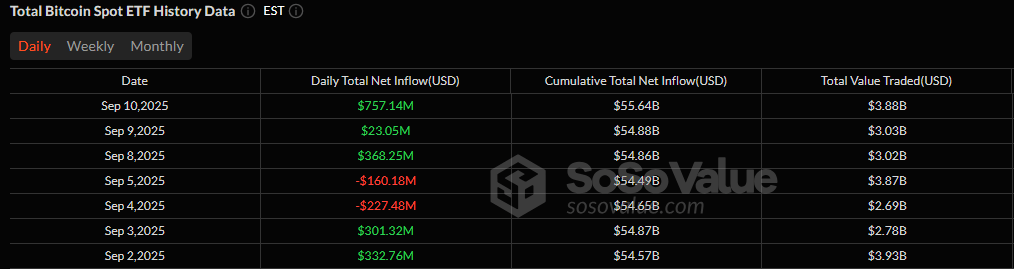

Behold! Bitcoin ETFs leapt skyward with an outrageous $757.14 million in inflows, a magnificent testament to the burgeoning confidence of institutions who seemed to have found their new favorite playpen. Leading the charge was Fidelity’s FBTC, bathing luxuriously in a $298.98 million inflow, followed closely by the ever-elusive Blackrock’s IBIT at $211.16 million, and none other than Ark 21Shares’ ARKB, rolling in with a tasteful $145.07 million.

But wait-there’s more! Strength of a different flavor came from the likes of Bitwise’s BITB grazing at $44.40 million, Grayscale’s Bitcoin Mini Trust at a modest $17.61 million, Valkyrie’s BRRR at $15.70 million, and Vaneck’s HODL at $12.03 million. Let’s not forget the petite contributions of Grayscale’s GBTC at $8.92 million and Franklin’s EZBC with a shy $3.28 million. Trading was more than just animated-$3.88 billion danced through the ticker, bringing bitcoin ETF net assets to an impressive crescendo of $147.83 billion.

And what’s this? Ether ETFs also decided to don their dancing shoes, prancing in with an eye-catching $171.54 million in inflows, almost every fund seemingly saying, “Hey, don’t forget about us!” Blackrock’s ETHA led with a magnificent $74.50 million, with Fidelity’s FETH adding a neat $49.55 million. The supporting cast included Vaneck’s ETHV with $11.07 million, Grayscale’s ETHE at $8.91 million, Bitwise’s ETHW dancing in at $8.36 million, Grayscale’s Ether Mini Trust twirling gracefully at $7.73 million, 21Shares’ TETH with $7.12 million, and Invesco’s QETH at $4.31 million. Trading amassed to a dazzling $2.28 billion, with ether ETF net assets gliding to $27.73 billion.

When both bitcoin and ether ETFs flaunt their verdant shades of profitability, Wednesday stands as testament-a roaring resurgence of institutional interest, igniting a spark of optimism for a more exuberant market future. Ah, the sweet scent of potential profits wafting in the air! 😊💸

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD MXN PREDICTION

- CRO PREDICTION. CRO cryptocurrency

- Why Is Everyone Obsessing Over These Cryptos? 🤔

- USD JPY PREDICTION

- EUR THB PREDICTION

- AVAX Poised for a Jump: Why the Next $80 Might Just Be a Matter of Time

- BNB Hits ATH, But Bearish Whispers Grow 🚀💸

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

2025-09-11 22:43