In the vast, unforgiving tundra of the cryptocurrency markets, the once-mighty Bitcoin (BTC) treasury companies now find themselves shackled to the icy winds of fate. Their market premium, that golden halo of investor confidence, is crumbling like a stale bread crust in the hands of a starving peasant. Volatility, the lifeblood of their existence, has fled like a coward, leaving them to grapple with a 97% crash in monthly BTC purchases since November 2024. Ah, the cruel whims of the market gods! 😢🪨

Volatility’s Vanishing Act: A Tragedy in Three Acts

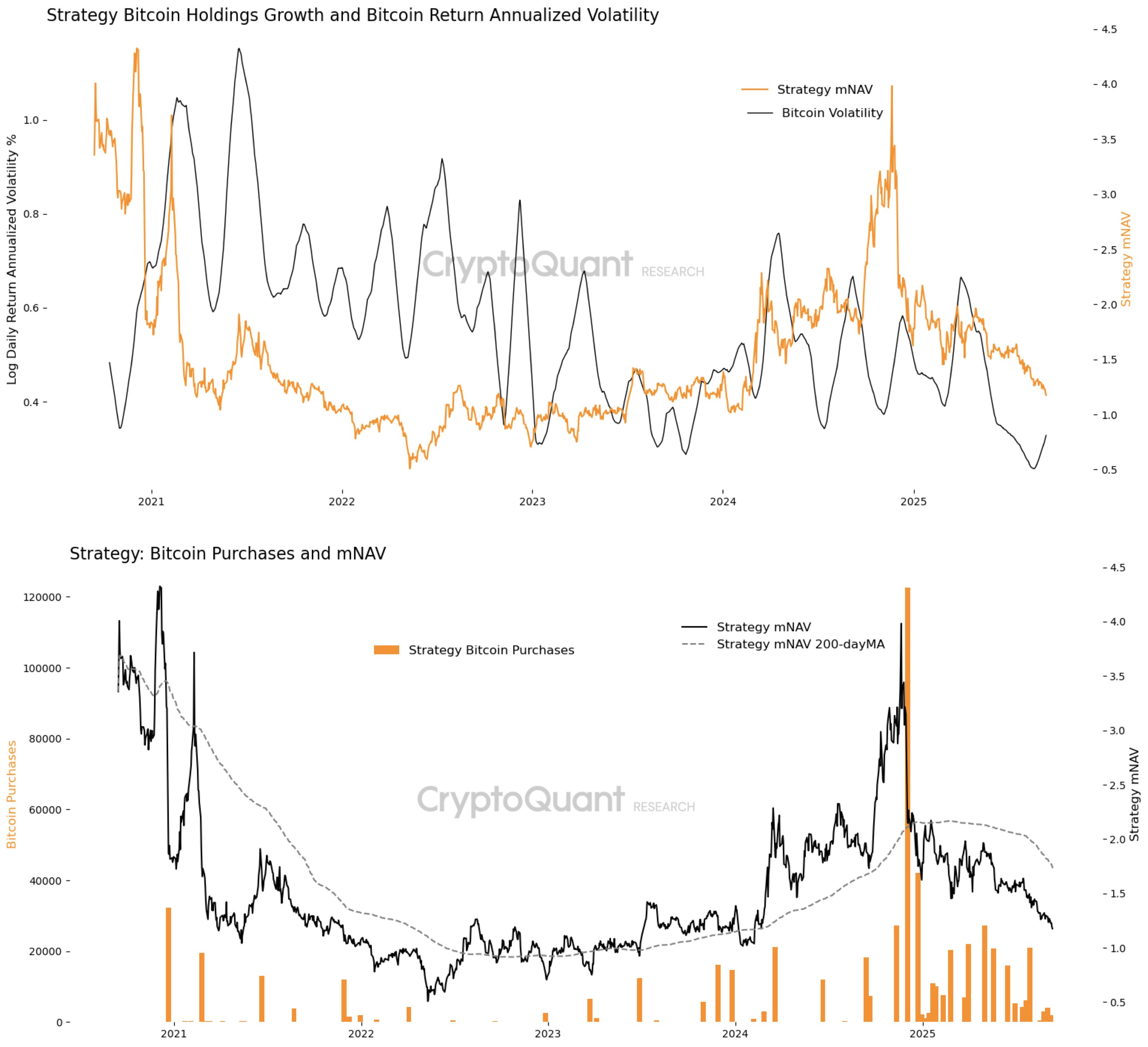

Once upon a time, Bitcoin treasuries basked in the glow of investor adoration, their market value soaring above the mere worth of their BTC holdings. Why? Because the masses believed-nay, *worshipped*-their ability to grow, to monetize chaos, to be the safe harbor in the storm of cryptocurrency. Their market net asset value (mNAV), a sacred number always greater than 1, was the testament to their divine right to rule. But alas, CryptoQuant’s Julio Moreno, a modern-day Cassandra, warns that annualized Bitcoin volatility has plummeted to multi-year lows. The party’s over, comrades. 🎈✨

Consider Strategy, the Goliath of corporate BTC holders. In the halcyon days of early 2021 and mid-2024, volatility spikes sent their mNAV soaring above 2.0, like a phoenix rising from the ashes. They feasted on price swings, raising equity and debt with the arrogance of a tsar, only to plow it back into BTC. But now? Volatility has shriveled to a pathetic 0.4 log daily return annualized, its lowest since 2020. The mNAV, once a proud 2.0, now limps along at 1.25. Investors, once enamored, now eye these treasuries with the disdain of a peasant gazing at a failed harvest. 🌾❌

Demand Dries Up: The Treasury’s Thirst Unquenched

Without volatility’s fiery breath, Bitcoin treasury firms are but shadows of their former selves, struggling to expand their holdings in a way that justifies their premium. Buying activity, once a torrent, has dwindled to a trickle. Strategy’s mNAV, once a beacon of hope, has been in freefall since 2025, even as BTC itself trades at lofty heights. The cycle of premium issuance and BTC accumulation, once a well-oiled machine, now sputters like a dying tractor in a Siberian winter. 🚜❄️

Moreno, ever the bearer of bad news, declares that for the mNAV premium to survive, volatility must rebound, and demand must roar back with large-scale purchases. Until then, treasury companies face the grim prospect of justifying valuations above their Bitcoin net asset value. Investors, once loyal subjects, may soon abandon ship, opting for direct exposure to Bitcoin instead. After all, why pay a premium for a fading star? 🌟💔

As of this writing, Bitcoin trades at $115,810, a 4.72% gain in the past week. But who cares? The real drama is in the treasuries, where the once-mighty are now mere mortals, their premiums slipping through their fingers like sand. Will they rise again, or are they doomed to wander the crypto wasteland, forever cursed by the gods of volatility? Only time will tell. ⏳🤡

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Altcoins Collapse: Trump’s Tariff Threats Cause Cosmic Chaos

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- The Tumultuous Rise of RAVE: Is a Breakout on the Horizon or Just Another Illusion?

- XRP: A Most Lamentable Fall! 📉

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

- How Bitmine’s Insatiable Ethereum Appetite Is Stirring the Crypto Tea ☕🐳

- Ether’s Dance: A Tragic Waltz of Gain and Greed

2025-09-13 15:23