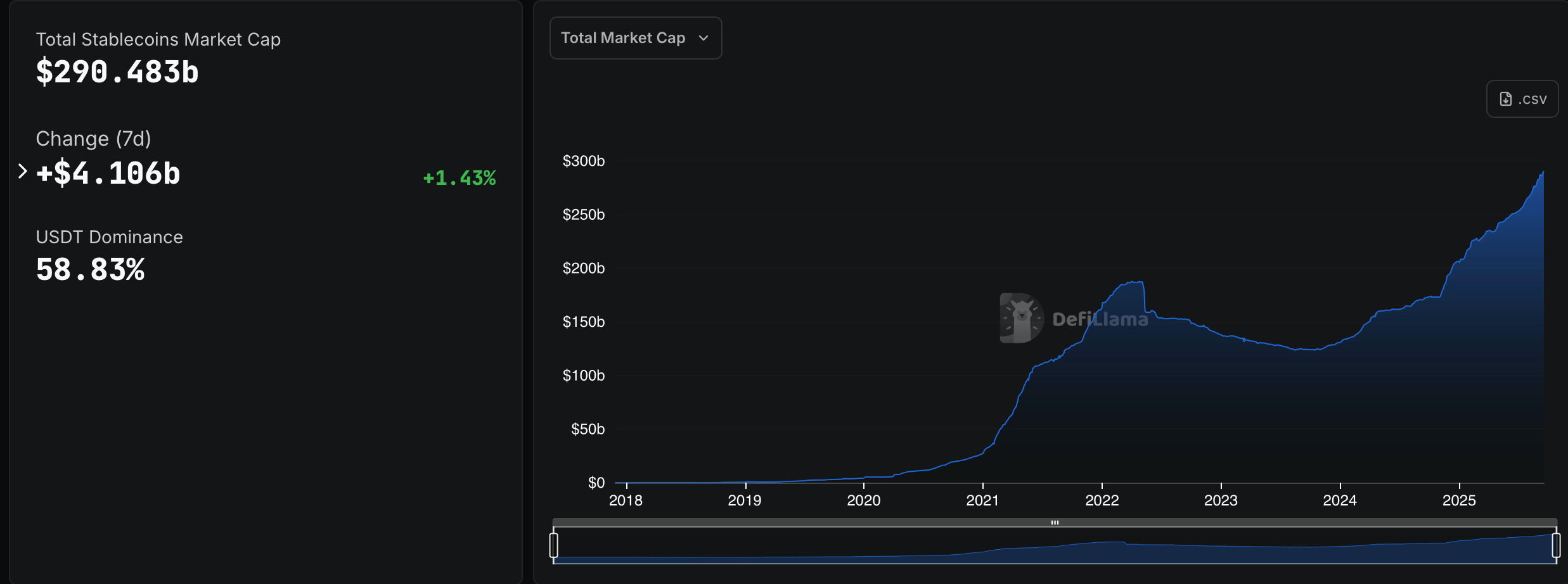

On a Wednesday that shall forever be etched in the annals of financial folly, the stablecoin market-that bastard child of greed and innovation-shattered the $290 billion barrier. Ah, humanity! Ever chasing the mirage of stability in a world of chaos, padding its coffers with $4 billion in fresh capital, as if numbers could ever quell the soul’s torment.

From USDT to RLUSD: A Carnival of Fiat-Pegged Folly 🎪

Stablecoins, those digital sirens, have seized the spotlight once more, with all their highs and existential hiccups. Leading this tragicomic cast is Tether (USDT), strutting like a peacock with a $170.9 billion market cap and a 2.33% monthly bump, according to the oracles at defillama.com. With the stablecoin market now at $290.483 billion, Tether reigns supreme, clutching 58.83% of the pie-a pie baked in the fires of hubris and hope.

Circle’s USDC, ever the ambitious understudy, boasts a 7.74% monthly gain and $73.1 billion in clout. The second-largest stablecoin by market cap has bulked up, adding $879 million in a mere seven days-a testament to the insatiable hunger for digital “stability.” Ethena’s USDe, the nouveau riche of this circus, leapt 20.46% to $13.6 billion, swelling by $2.31 billion in a month. Ah, the sweet scent of inflated coffers!

Meanwhile, Sky’s DAI notched an 8.65% lift, while Sky’s USDS performed a flashy 2.48% pop in a single day, though it still limps with a -6.24% monthly slide. World Liberty Finance’s USD1, the stealthy climber, posted a 20.54% monthly lift without so much as a whisper. DAI’s market cap now exceeds $5 billion, USDS holds at $4.65 billion, and USD1 clocks in at $2.66 billion. Blackrock BUIDL, once the darling of Wall Street, sank nearly 10% this month-proof that even the gloss of prestige cannot shield one from the blockchain’s merciless whims. BUIDL now holds a mere $2.146 billion in valuation.

Ethena’s USDTb continues to flex, boasting a 24.92% gain to $1.817 billion. Falcon’s USDf, not to be outdone, pulled off a 41.48% monthly climb, swinging well past its $1.75 billion weight class. Paypal’s PYUSD delivered a respectable 7.87% gain, while First Digital’s FDUSD tripped hard with a -13.02% faceplant. Ripple’s RLUSD, now the 12th largest stablecoin, capped things off with a neat 9.46% lift, securing its spot in this digital danse macabre.

In the end, Tether still wears the crown, Ethena and Falcon are the wild cards, Blackrock slipped a notch, and the rest are merely hustling to keep their groove on the dance floor. $290 billion is no trifle, and with just $10 billion to go, the $300 billion milestone is but a stone’s throw away. Ah, humanity! Ever chasing the mirage of stability, even as the abyss stares back. 🕳️💰

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD CNY PREDICTION

- Silver Rate Forecast

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Brent Oil Forecast

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

2025-09-17 20:57