So, here’s the thing: XRP is doing that dance again, the one where it teases us with the possibility of soaring to the dizzying heights of $10. 🤑 Why? Well, it seems the whales-those enigmatic, deep-pocketed creatures of the crypto sea-have decided to hoard XRP like it’s the last towel at a galactic beach resort. 🏖️ Combine that with some bullish macroeconomic signals (because the Federal Reserve sneezed and the crypto world caught a cold) and Ripple’s latest partnerships, and you’ve got traders frothing at the mouth like a hyperintelligent shade of the color blue.

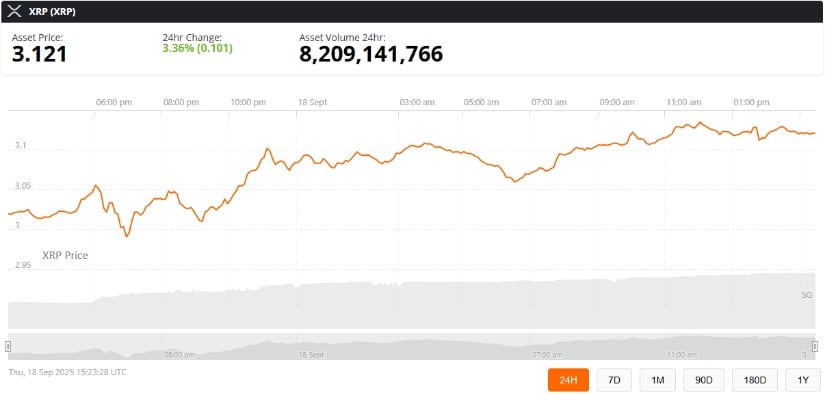

Market analysts-those folks who spend their days staring at charts and muttering about “historical patterns”-are pointing out that this sudden drop in exchange reserves usually means one thing: a price surge. 🌋 Fewer tokens on exchanges? Upward pressure. It’s basic economics, or as basic as anything can be in a world where money is just numbers on a screen and everyone’s a rocket scientist. 🚀

XRP Whale Accumulation and the Great Exchange Supply Vanish

On-chain data-the crypto equivalent of reading tea leaves-shows that Coinbase’s XRP reserves have plummeted from 970 million to a mere 199.47 million in the past three months. That’s a 90% drop, folks. 😱 Whales and institutional players are yanking their tokens off exchanges faster than a Vogon can recite poetry. Why? Probably because they’re planning to hold onto them longer than a Babel fish can survive without a host. This, of course, leads to what analysts call a “supply shock,” which is just a fancy way of saying, “Uh-oh, prices might go up.” 📈

History, that relentless narrator of crypto’s greatest hits, tells us this isn’t the first time whales have gone on a shopping spree. Back in August 2025, BeInCrypto reported that whales gobbled up $3.8 billion worth of XRP, sending the price soaring near its all-time high of $3.66. Analysts are now whispering (or shouting, depending on their coffee intake) that we might be in for a repeat performance. 🎭

Ripple Partnerships: Because Who Doesn’t Love a Good Tokenized Money Market Fund?

But wait, there’s more! Ripple hasn’t been sitting on its hands. They’ve teamed up with DBS Bank and Franklin Templeton to launch tokenized money market funds, backed by their RLUSD stablecoin. 🏦 Because nothing says “utility” like turning traditional finance into a blockchain-based game of Monopoly. This could boost XRP’s real-world adoption, making it more than just a speculative asset-though let’s be honest, speculation is half the fun. 🎢

Brad Garlinghouse, Ripple’s CEO, has been touting XRP as the solution to the “global payments problem,” calling it a “multi-trillion-dollar opportunity.” 🌍 Bold words, Brad. Bold words. Let’s just hope XRP doesn’t end up being the Answer to the Ultimate Question of Life, the Universe, and Everything-especially since we already know that’s 42.

XRP Price Outlook: To $10 and Beyond?

So, where does this leave us? With whales hoarding XRP, Ripple expanding its ecosystem, and the Fed playing nice with liquidity, it looks like XRP is gearing up for its next big move. 🚀 Traders are eyeing a breakout above $3.66, which could pave the way for a rally toward the elusive $10 mark. Will it happen? Who knows. But one thing’s for sure: the crypto world is never short on drama. 🎬

Volatility? Check. Macro tailwinds? Check. Institutional interest? Double-check. If the stars align (or the whales decide to stop hoarding and start selling), that $5-$10 price prediction for 2025 might just become reality. 🌟 Until then, grab your towel, don’t panic, and remember: in space, no one can hear you HODL. 🌌

Read More

- Gold Rate Forecast

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- USD HKD PREDICTION

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- XRP’s 2026 Forecast Collapses-Banks Wave Goodbye to Crypto Dreams!

2025-09-18 23:53