Ah, Ethereum, that most enigmatic of cryptocurrencies, has once again shown its penchant for dramatics. After a brief flirtation with the stars, it’s now back to earth, or at least the vicinity of $4,200, where it’s currently engaged in a heated debate with its own shadow. 🌌💸

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ETH failed to hold above $4,400, breaking below the small ascending channel formed recently. This breakdown has shifted momentum, with price now hovering around $4,200. The RSI is also sitting around 40, reflecting a loss of bullish strength but not yet an extreme oversold condition. 🤷♂️📊

The first major support is found near $4,000, followed by the $3,800 area, which lines up with the 100-day moving average and the lower boundary of the larger channel. If buyers defend this level, ETH could form a higher low structure, keeping the broader uptrend intact. Or it could just be a temporary pause before the inevitable plunge. 🧠💣

For now, ETH’s mid-term trend remains bullish as long as $3,700 holds, but the momentum shift suggests more downside probing before strength returns. Because nothing says “bullish” like a game of chicken with a bear. 🐻🪂

The 4-Hour Chart

The 4H chart paints a clearer picture of recent weakness. ETH broke down from its $4,400-$4,800 consolidation range and quickly dropped toward $4,100. Momentum is now heavily tilted to the downside, with RSI near 30, showing short-term oversold conditions. While this could spark a relief bounce, the breakdown has shifted the local trend bearish until $4,400 is reclaimed. 📉📉

The next strong liquidity cluster sits around $3,800, which aligns with both horizontal demand and the ascending trendline. This zone is likely where buyers will attempt to step in aggressively. If ETH can hold and rebound from this area, the first upside target would be $4,200, followed by a retest of the key $4,400 level. On the other hand, failing to hold above $3,800 could accelerate selling pressure, dragging the market into an overall bearish phase. 🐺⚡

Onchain Analysis

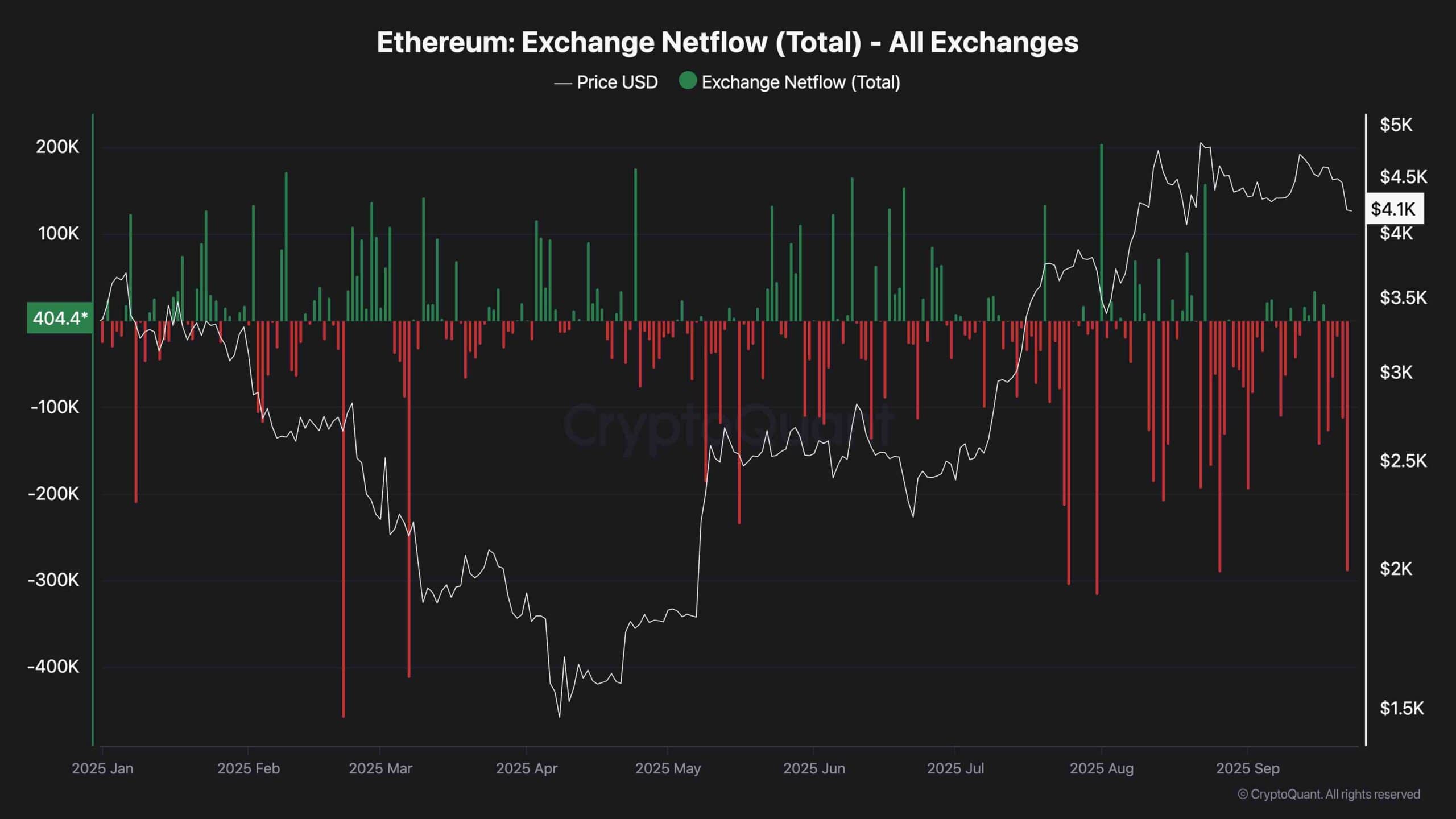

Exchange Netflows

Exchange netflows continue to show large negative spikes, indicating consistent ETH outflows from exchanges. This suggests investors are moving coins into self-custody or staking, which reduces sell-side supply and is generally bullish over the medium to long term. Or, as one analyst put it, “They’re hiding their coins in the fridge, hoping the market will forget they exist.” 🧊📈

However, in the short term, the market is more influenced by technical weakness and profit-taking at recent highs. If accumulation continues during this dip, it could set the stage for a strong recovery later, but for now, market sentiment leans toward testing lower support levels before a new bullish leg begins. Because nothing says “optimism” like a bear market. 🐻💤

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP: A Most Lamentable Fall! 📉

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin ETF Dreams Shattered: TradFi Ditches Crypto like It’s 2018!

- Kanye West’s YZY Token: A Wild Ride of 6800% Surge and Market Mayhem! 🎢💰

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Altcoins Collapse: Trump’s Tariff Threats Cause Cosmic Chaos

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

2025-09-23 16:02