Ah, the sweet scent of financial despair! Bitcoin ETFs, those darling darlings of the crypto set, have suffered a second day of outflows, hemorrhaging $104 million, while their gauche cousin, Ether, lost a staggering $141 million. Fidelity, that bastion of fiscal prudence, led the charge, leaving net assets in a state of genteel collapse, despite the plebeian trading volumes remaining steadfastly robust. 🤑💨

Crypto ETFs in Freefall as Bitcoin and Ether Wallow in Misery

The air was thick with the odor of caution on Tuesday, Sept. 23, as the crypto markets continued their lamentable descent. Both bitcoin and ether ETFs extended their losing streaks, with investors fleeing like debutantes from a scandal. Despite the bustling trading volumes, the appetite for inflows was as absent as good taste at a nouveau riche soiree. 🎭🚫

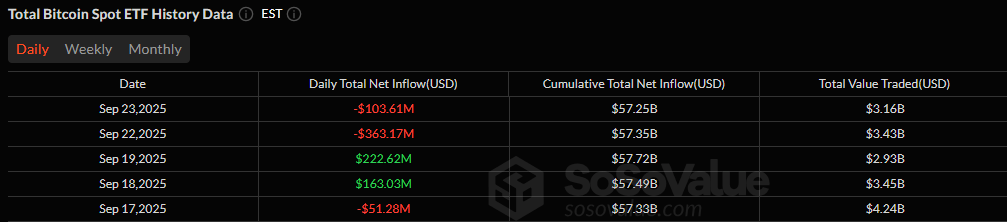

Bitcoin ETFs, those once-lauded vehicles of speculative excess, posted $103.61 million in outflows, marking the second consecutive day of withdrawals. Fidelity’s FBTC, ever the trendsetter, led the exodus with $75.56 million, while Ark 21Shares’ ARKB and Bitwise’s BITB trailed behind with losses of $27.85 million and $12.76 million, respectively. Invesco’s BTCO and Blackrock’s IBIT attempted to stem the tide with paltry inflows of $10.02 million and $2.54 million, but their efforts were as effective as a band-aid on a bullet wound. Total value traded stood at $3.16 billion, with net assets slipping to $147.17 billion, a sum that would scarcely cover the annual champagne budget of a minor aristocrat. 🥂📉

Ether ETFs, never ones to be outdone in the realm of financial calamity, fared even worse, with a collective outflow of $140.75 million. Fidelity’s FETH, ever the leader in this tragic ballet, lost $63.40 million, while Grayscale’s Ether Mini Trust and Bitwise’s ETHW followed with redemptions of $36.37 million and $23.88 million, respectively. Grayscale’s ETHE brought up the rear with a loss of $17.10 million. Total value traded reached $1.61 billion, leaving net assets at a mere $27.48 billion, a sum that would barely cover the upkeep of a modest country estate. 🏰💸

After Monday’s broad selloff, Tuesday’s crimson figures confirm a decidedly bearish tilt in ETF flows. With both bitcoin and ether ETFs posting back-to-back outflows, the coming days will be as critical as a society matron’s verdict on a new hat. Whether this is a temporary pullback or the beginning of a deeper shift in sentiment remains to be seen, but one thing is certain: the crypto world is in for a spot of bother. 🕶️🌀

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Altcoins Collapse: Trump’s Tariff Threats Cause Cosmic Chaos

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

- How Bitmine’s Insatiable Ethereum Appetite Is Stirring the Crypto Tea ☕🐳

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- XRP: A Most Lamentable Fall! 📉

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

2025-09-24 14:02