XRP, that restless creature of the market, spent the week darting through the high-$2 zone, retreating from a $3.13 tease, but holding tight above its sturdy $2.75-$2.80 base like a ship anchored in a storm.

XRP Stands Guard at $2.75-$2.80 While the $3 Wall Looms Larger

The price opened near $2.90 per XRP, making repeated attempts to scale the $3 summit, only to be swiftly thwarted by sellers, those ever-watchful market sentinels. The action cooled into a confined space between $2.83 and $2.87, as if the market itself were too weary for another dance. The daily relative strength index (RSI) oscillator lingered in the low-40s-perhaps the sellers were losing their edge, but the bulls were not yet being handed the reins.

Nothing too dramatic from the technicals: resistance stacked like fortifications at $2.95-$3.00, then at $3.10-$3.20. On the dip side, bids appeared around the upper-$2.70s, ready to support, like a crowd waiting for the next act. Yet, the momentum indicators were a bit more cryptic-MACD showing a bearish crossover on higher timeframes, but the pattern seemed like a falling wedge. Could the market surprise us all and flip the script? A volume surge might just be the catalyst needed.

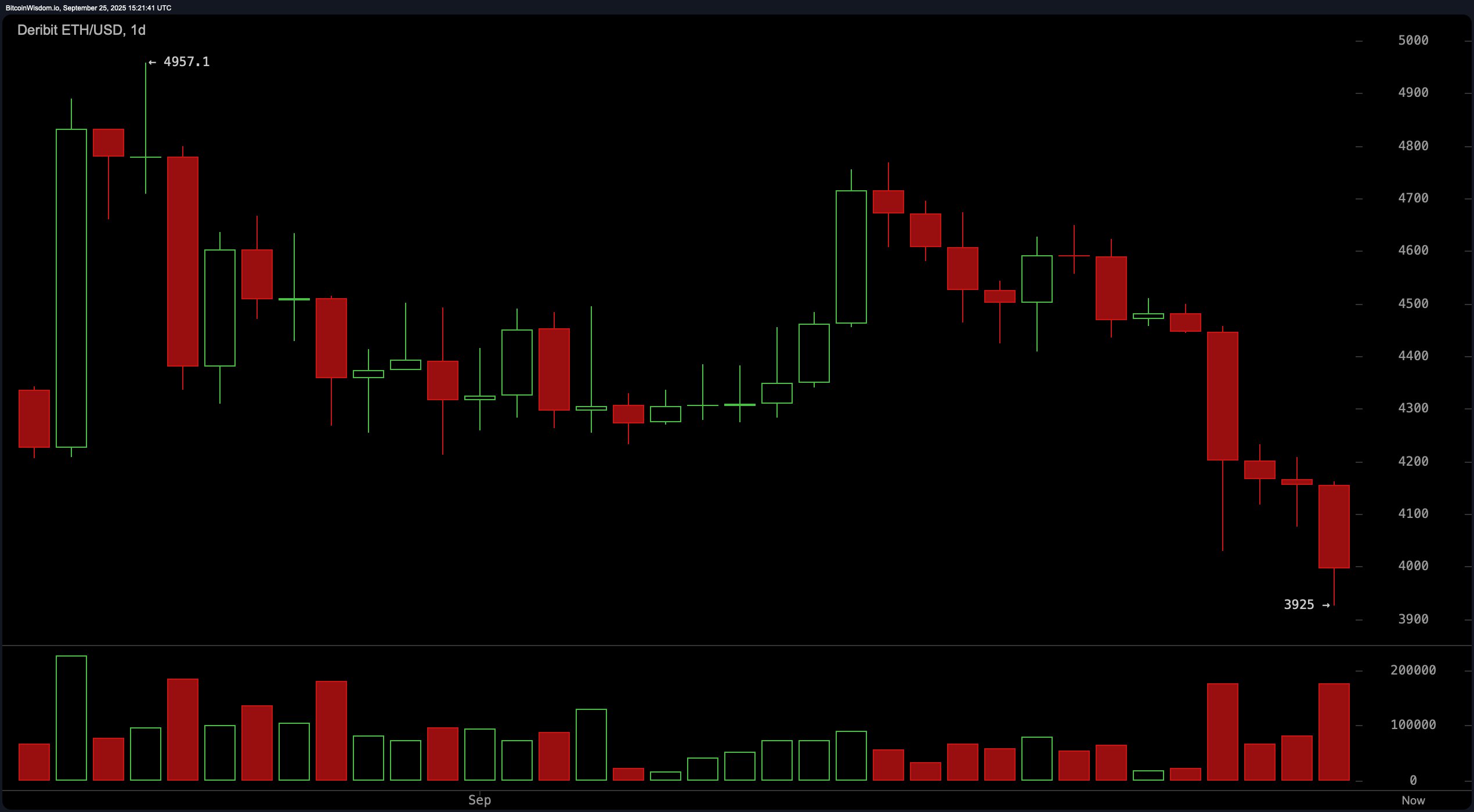

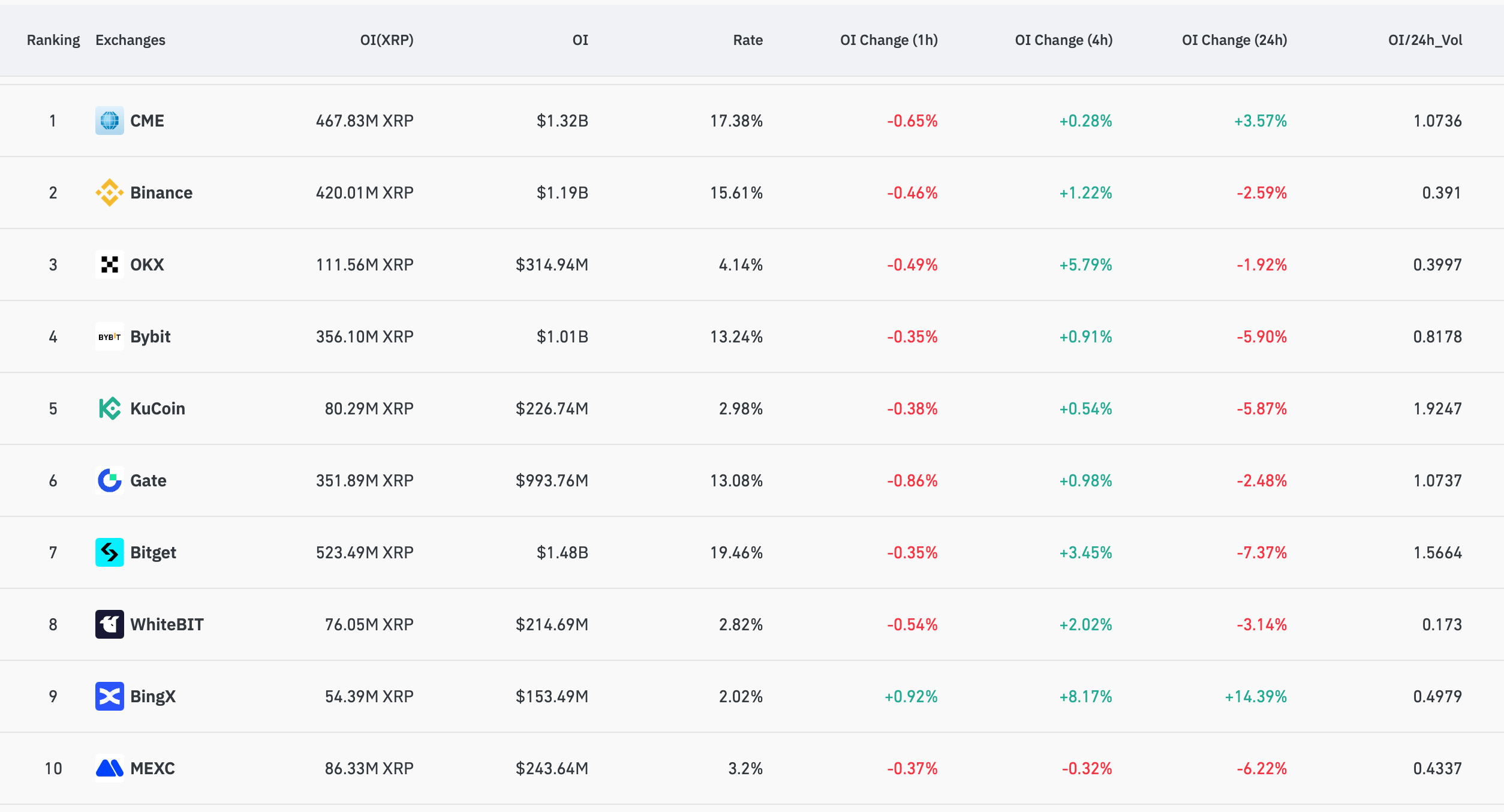

Derivatives were writing a louder subplot. Open interest (OI) nudged higher by the week’s end, suggesting traders were preparing for a more substantial move. And now options traders have a date to circle: CME Group plans to launch options on XRP futures on October 13, assuming all goes well. Could this stir things up, make the hedging and skewing of positions feel like a weekend at the amusement park?

Meanwhile, macro forces still have a firm grip on the wheel. Inflation readings and the drifting path of bitcoin (BTC) remain the fast tracks for sentiment shifts. A clean break above $3.00 likely needs a friendlier backdrop, while a fall below $2.75 might lead to a hasty retreat to the $2.60s. A perfect tug-of-war. Who’s winning? No one knows yet.

Behind the scenes, liquidity looks deeper than a few months ago, thanks to steady exchange volumes and clearer order books. But buyers are playing hard to get, and whale movements are more significant than the usual social media chatter. If the net longs get too cozy near resistance, expect the spring-loaded outcome we all know and dread.

For now, the bias feels neutral to cautious. A daily close above $3.08 with rising volume could suggest a rally toward $3.20-$3.30. Miss that, though, and the market probably stays coiled tighter than a spring, with $2.70-$2.75 playing the role of the vigilant gatekeeper until either the bulls or bears finally take a misstep.

Zooming out, the big headlines about XRPL and its ecosystem from stablecoin rails to tokenized cash vehicles continue to hover in the background. They’re not igniting the flames on their own, but they could nudge flows when things get stuck. For now, the mission is clear: defend the shelf, reclaim $3 with authority, and make those shorts scramble into the low-$3s.

Bottom line: XRP is in a hurry to go nowhere, until volume makes its voice heard. If it breaks above $3, expect things to get spicy. Below $2.75, it’s time for some serious damage control. Trade the levels, not the noise. No, really. Do it.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Altcoins Collapse: Trump’s Tariff Threats Cause Cosmic Chaos

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

- How Bitmine’s Insatiable Ethereum Appetite Is Stirring the Crypto Tea ☕🐳

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- XRP: A Most Lamentable Fall! 📉

2025-09-25 21:05