Oh, what a scrumdiddlyumptious mess the crypto market has gotten itself into! 🍭💸 The past week has been as wobbly as a three-legged giraffe on a tightrope, culminating in the grandest liquidation extravaganza since the dark days of December 2024. As the global market cap teeters at a whopping $3.78 trillion (up a measly 1% in 24 hours), investors are quivering like jelly in a hurricane, with the Fear & Greed Index sitting at a timid 34. 🥶 This latest kerfuffle saw prices plummet faster than a whoopee cushion at a fancy dinner party, leaving leveraged traders in a right old pickle and exchanges slamming shut over $1.7 billion in positions quicker than you can say “phizz-whizzing disaster.”

The Week’s Market Meltdown: A Right Royal Rumpus

“Red September” has been as brutal as a giant peach rolling down a hill, squishing all the poor bulls in its path. Ethereum took the biggest wallop, nose-diving 12% and tumbling below its precious $4,000 support like a golden ticket lost in a chocolate factory. 🍫💔 Bitcoin, not one to be left out, lost about 5%, skulking back to nearly $109,000, while Dogecoin and Solana each took a 21% nosedive. In total, a staggering $300 billion vanished into thin air, proving once again that excessive leverage is about as sensible as a fox guarding a henhouse. 🐔🦊

Highest Liquidations: ETH Steals the (Unwanted) Spotlight

The week’s selloff was as brutal as a Trunchbull in a temper tantrum, with over $1.65 billion in leveraged positions liquidated faster than you can say “scrumptious.” Long bets made up a whopping 88% of the carnage, with Ethereum leading the charge, responsible for more than $309 million in closed positions. Bitcoin, not to be outdone, chipped in with $246 million. This was the biggest forced closure since December 2024, leaving traders feeling as deflated as a popped balloon. 🎈💨

“Largest liquidation in the Crypto market since December 9th, 2024… These are leveraged positions closed by force. Most were longs on #ETH.”

– bitcoindata21

Which Sectors Got the Biggest Bum Steer?

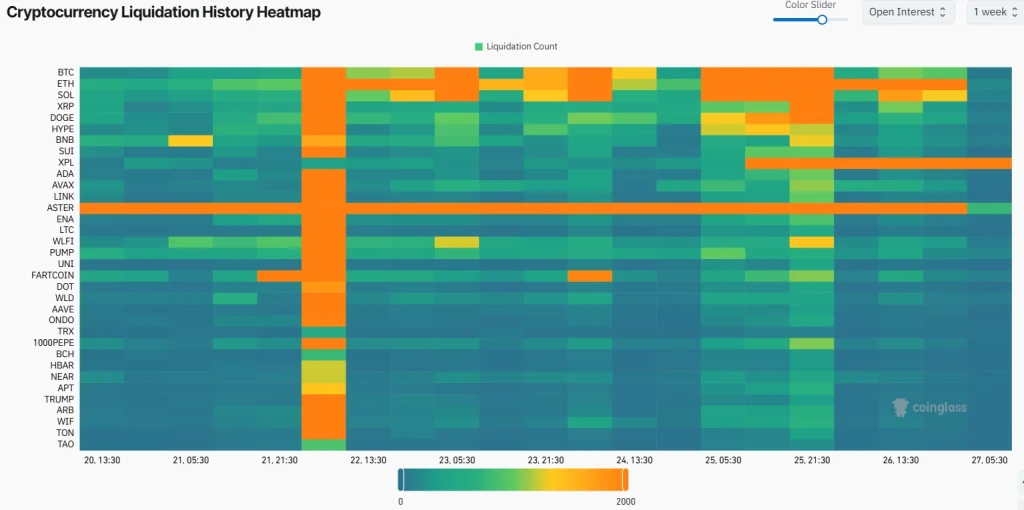

The DeFi sector took the brunt of the beating, as massively overleveraged futures positions were “deleveraged” in a spectacular domino effect. The average crypto RSI slid to 44.95, a clear sign of widespread wobbliness. Liquidation heatmaps revealed large clusters around major altcoins and tokens, proving that retail traders and funds were caught with their pants down. 👖👇

“High leverage + volatility = recipe for liquidation… Financial education means learning about risk management – it’s not optional – and recognising that market drops also teach valuable lessons.”

– Lisa N Edwards

What’s Next? Will the Market Stop Being Such a Silly Sausage?

Experts reckon this leverage flush could stabilize things, but until risk appetite perks up, volatility might stick around like a bad smell. With the Altcoin Season Index at 70/100, altcoins are holding relatively steady, but the lesson is clear: unbridled leverage turns bullish optimism into panic faster than a chocolate bar melts in the sun. 🍫☀️

FAQs (Frequently Asked Quandaries)

Why did crypto liquidations spike this week?

Blame the sharp drop in Ethereum and Bitcoin, coupled with traders leveraging themselves to the moon. Exchanges had to shut down over $1.7 billion in risky positions, mostly longs. 🚀💥

Which token took the biggest tumble and faced the most liquidations?

Ethereum, poor thing, fell 12% and led the liquidation charts with over $309 million in closures. 🪙🌀

Which sector got the worst of it?

The DeFi sector and leveraged futures took the biggest hit, as overleveraged long bets went up in smoke. 🔥💨

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

- Altcoins Collapse: Trump’s Tariff Threats Cause Cosmic Chaos

- Brent Oil Forecast

- The Tumultuous Rise of RAVE: Is a Breakout on the Horizon or Just Another Illusion?

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- How Bitmine’s Insatiable Ethereum Appetite Is Stirring the Crypto Tea ☕🐳

- WIF’s Bullish Surge: Will It Break the $1.30 Ceiling or Just Keep Dancing?

- Ether’s Dance: A Tragic Waltz of Gain and Greed

2025-09-27 10:09