Bitcoin exchange-traded funds (ETFs) suffered a gut-wrenching $418 million outflow, while ether ETFs experienced their fifth consecutive day of gloomy redemptions, totaling $248 million.

ETF Exodus Deepens: Bitcoin Funds Shed $418 Million, Ether Sees $248 Million Outflow

Ah, a week that ETF investors would love to erase from their minds. Bitcoin and ether funds closed the week of September 26, 2025, staring into the abyss of financial despair. Bitcoin ETFs bled out a monstrous $418.25 million – a loss so large it could fund a small country’s desire for luxury yachts.

It was Fidelity’s FBTC that really took one for the team, bleeding out $300.41 million – ouch. Blackrock’s IBIT and Bitwise’s BITB weren’t far behind, parting with $37.25 million and $23.79 million respectively, as if that wasn’t already painful enough. Ark 21shares’ ARKB joined the mourners with a $17.81 million loss. And Grayscale’s GBTC and Bitcoin Mini Trust didn’t want to be left out, each withdrawing $17.14 million and $12.57 million, just for good measure.

Vaneck’s HODL made the obligatory contribution with a measly $9.28 million, making it a perfectly red symphony. No fund saw a single inflow – this was a session as crimson as a 17th-century vampire’s outfit. Trading volumes were strong at $3.92 billion, but net assets took a nosedive, closing at a bleak $143.56 billion.

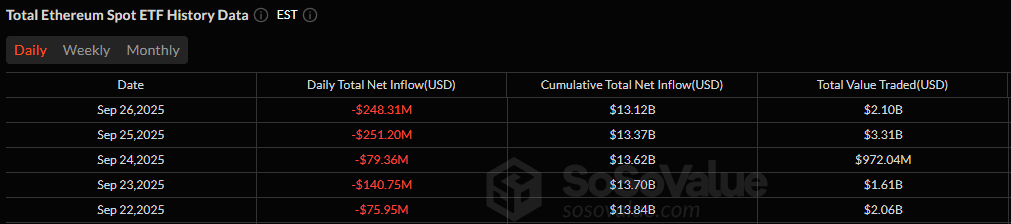

As for ether, the ETF exodus continued its relentless march, with an additional $248.31 million in outflows. Blackrock’s ETHA led the charge, suffering a brutal $199.87 million exit, while Fidelity’s FETH wasn’t far behind, shedding $74.39 million in sorrowful dismay.

But all was not lost, dear reader, for there were small pockets of resistance. Grayscale’s ETHE managed to attract a modest $17.91 million in inflows – like a lone lifeboat in a sea of financial chaos. 21Shares’ TETH saw $8.05 million in additions, but these meager inflows were like trying to stop a tidal wave with a spoon. By the end of the week, ether ETFs faced their fifth straight day of outflows, capping a rather unremarkable week of stagnation. Total value traded reached $2.10 billion, while net assets were left gasping for air at $26.01 billion.

And so, the curtain falls on a week of crypto ETF losses, with investors pulling out capital like they’ve just discovered their funds have been living in a house of cards. What will next week bring? A glimmer of hope, or just more redemptions? Stay tuned, folks, and don’t forget to pack your emotional support llama. 😉

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Silver Rate Forecast

- XRP: A Most Lamentable Fall! 📉

- Bitcoin’s Big Breakout: Fed Cuts, Crypto Cash, and a Million BTC Heist 🚀

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

- Bitcoin’s Christmas Miracle? Analysts Bet Big Bucks Amid Crypto Chaos 🎅💰

- WIF’s Bullish Surge: Will It Break the $1.30 Ceiling or Just Keep Dancing?

- Ether’s Dance: A Tragic Waltz of Gain and Greed

2025-09-28 08:03