Bitcoin exchange-traded funds (ETFs) roared with $676 million in inflows on Wednesday, marking their third straight day of gains, while ether ETFs added $81 million across four funds. Both asset classes are enjoying a strong revival of institutional demand.

Crypto ETF Rally Builds as 🐉 and 🐲 ETFs Extend Inflow Streaks

The tide has turned firmly in favor of crypto ETFs. After weeks of turbulence, both 🐉 and 🐲 funds are now riding a powerful wave of inflows, with Wednesday, Oct. 1, delivering one of the strongest days yet. 🧙♂️

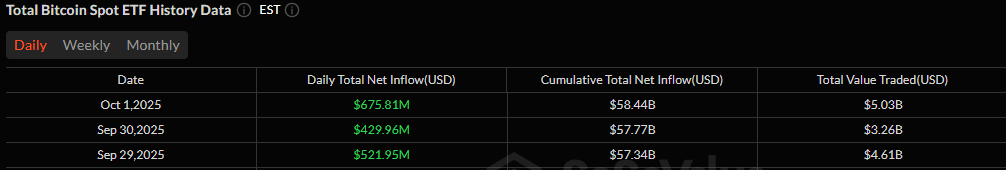

🔥 Bitcoin ETFs pulled in a staggering $675.81 million, their third straight day of inflows. Blackrock’s IBIT once again dominated with $405.48 million, while Fidelity’s FBTC added $179.32 million. 🐉

Bitwise’s BITB contributed $59.41 million, and additional gains came from Grayscale’s 🐉 Mini Trust ($9.88 million), Grayscale’s GBTC ($9.22 million), Vaneck’s HODL ($6.65 million), and Ark 21shares’ ARKB ($5.86 million). For the second consecutive day, no outflows were recorded. Total value traded surged to $5.03 billion, with net assets jumping to $155.89 billion. 💸

🪨 Ether ETFs also extended their run, bringing in $80.79 million. Fidelity’s FETH led with $36.76 million, followed by Blackrock’s ETHA with $26.17 million. Grayscale’s Ether Mini Trust contributed $14.29 million, while ETHE added $3.57 million. Total value traded reached $2.04 billion, pushing ether ETF net assets to $28.73 billion. 🐲

Three days of back-to-back inflows for both 🐉 and 🐲 highlight a strong resurgence of institutional demand. With capital pouring in across nearly every major fund, the momentum heading into October is difficult to ignore. 🌀

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD ILS PREDICTION

- Brent Oil Forecast

- Silent Whales: Bitcoin’s Shadow War on Binance

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

- USD THB PREDICTION

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- EUR NZD PREDICTION

- Fed’s $55B Injection: Will XRP Hit $3? 🚀

2025-10-02 21:58