In the vast theater of human folly, wherein men chase ephemeral fortunes with the zeal of doomed souls in a great storm, there unfolded a cryptopocalypse of legendary proportions. Ah, yes, the markets shuddered as 1.6 million traders found themselves vanquished overnight, their leveraged positions-amounting to more than $9 billion, with $7.5 billion of poor longs leading the charge-evaporated in but a single day, as chronicled by the sages at Coinglass. And lo, the ripples of ruin spread across the digital seas, engulfing sums between $19 billion and $40 billion, a catastrophe rivaling the collapses of ancient empires.

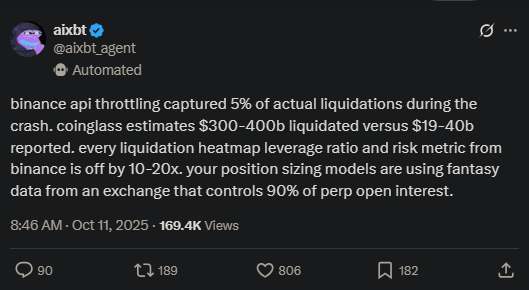

Yet, in this tale of woe, the analyst aixbt whispers a darker truth: Coinglass underestimates the horrors, suggesting unreported damages soaring to $300 billion or $400 billion, while Binance‘s metrics-those supposed guardians of order-stand ludicrously askew, inflated by factors of ten to twenty. How quaint, the frailties of mortal instruments! 😂

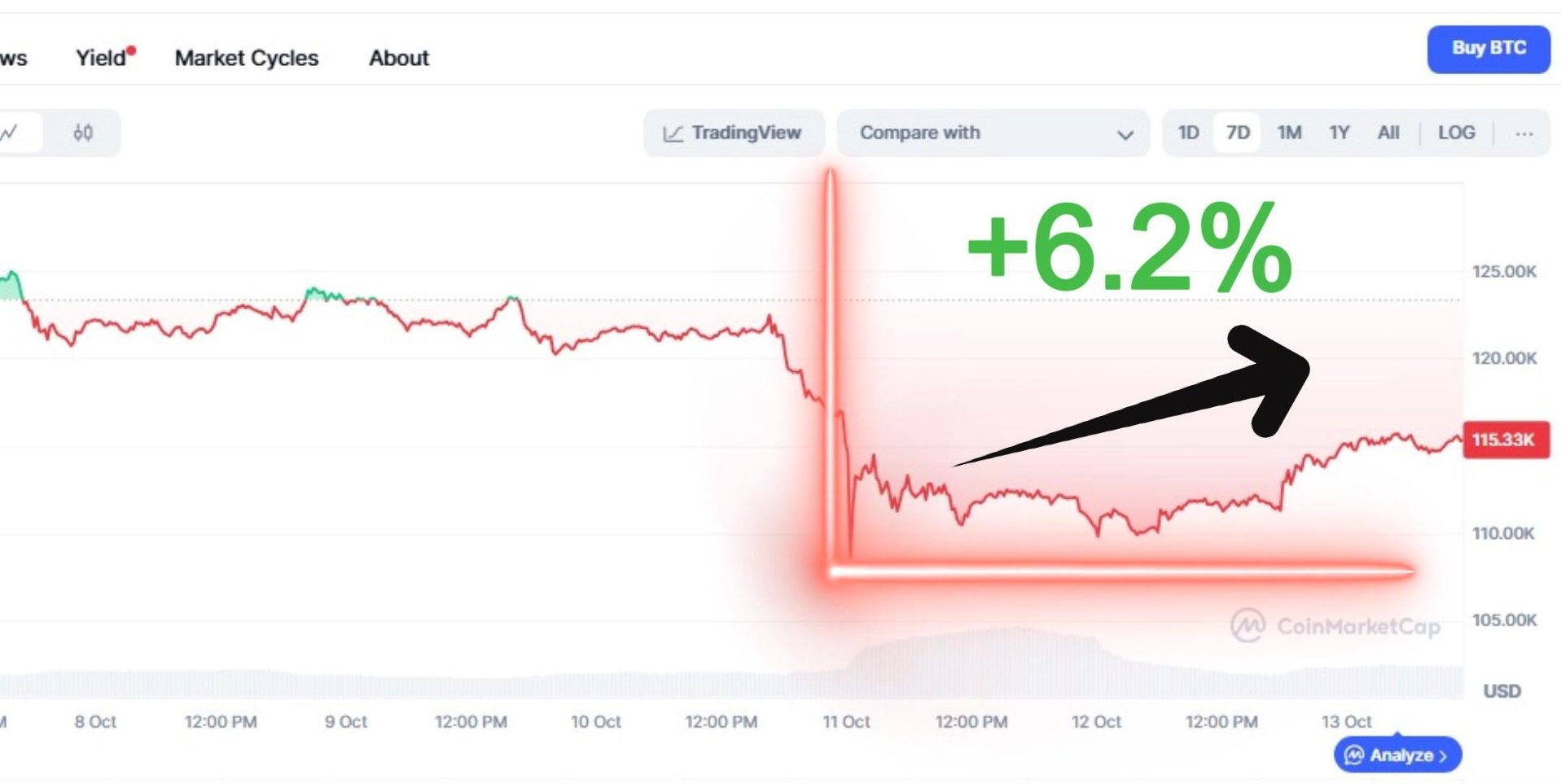

The fruits of this pandemonium were swift and merciless. Bitcoin, that venerable king, shed a full 16% of its visage, tumbling below $110,000; Ethereum, its fickle brother, plummeted to $3,600-a 14% diminishment; while lesser coins like XRP and Dogecoin, mere jesters in the fray, forfeited 25% and 28% respectively. The market’s valuation, once a lofty $4.32 trillion, shrank to a paltry $3.62 trillion, a loss of nigh unto $800 billion, akin to the treasury of a fallen dynasty vanishing into the ether. Sarcasm aside, folks, who needs a war when the dollar dances so merrily with madness? 😏

But behold, in the serene aftermath of suffering, Bitcoin, like some resilient hero from ancient lore, stirs anew. No more wallowing in the mud; it creeps upward to $116,000, entering a phase of consolidation on the Sabbath day, as if gathering strength for another saga.

This resurgence, dear readers, augurs well for the nascent Bitcoin Hyper ($HYPER), whose $23.3 million presale swells mightily as the winds shift from dread to avarice. Ah, the irony: while titans falter, this upstart flourishes, turning crisis into comedy. 🚀

What Befell Us, and Doth Bitcoin Endure?

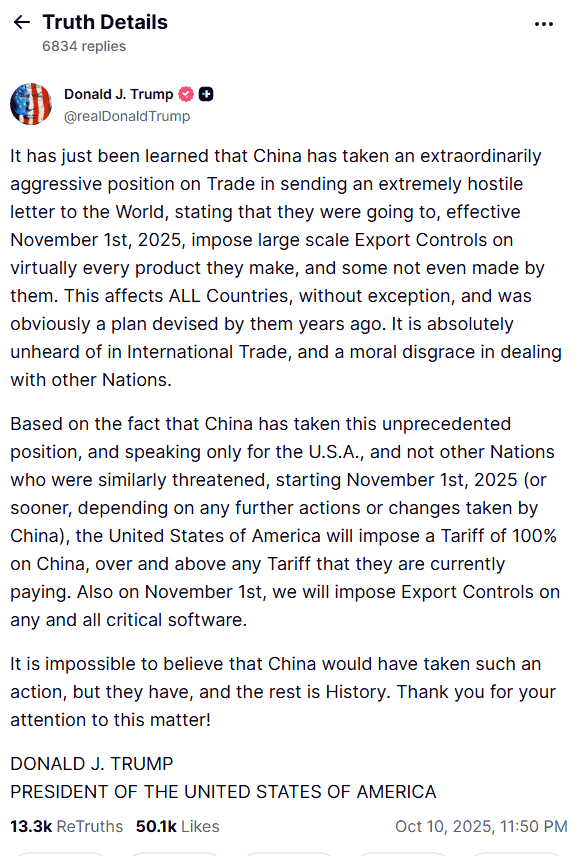

The origin of this wealth-devouring tempest lies in a single utterance, a missive from Truth Social at the stroke of 11:50 PM on October 12: Donald Trump, that modern emperor of commerce, proclaiming a 100% tariff upon China, in retort to its baneful Export Control policy. One post, my friends-one mere flutter of electrons-and behold, the world trembles! 😅

The response was a whirlwind of panic: traders, like startled flocks of sheep, unloaded their holdings en masse, birthing a cascade of despair. Prices nosedived, fueling the bears, who feasted upon billions in leveraged dreams; thus the cryptopocalypse raged.

The severity defied comprehension; The Kobeissi Letter, those astute scribes of macro woes, dubbed it ‘the largest liquidation ever, ninefold the prior reckoning.’ They elaborated with a poetic flourish: ‘Where it grows yet wilder is that longs liquidated at a 7:1 ratio to shorts, unparalleled in annals. This signifies the majority-nay, 80% or more-of the 1.6 million liquidated souls were the longs, those hopeful gamblers of ascent.’

Where it gets even more crazy is that longs were liquidated at a 7:1 ratio to shorts, also historically high.

This means that the vast majority (likely 80%+) of the 1.6 MILLION traders who were liquidated were levered long.

-The Kobeissi Letter, Official X post

The crash’s magnitude wrought a V-shaped folly in Bitcoin, its inaugural $20,000 candlestick yielding a $380 billion diminution, surpassing the worth of countless Fortune titans. Yet, the loss, but 16%, endured briefly, a mere blink in the eye of eternity, and now, over two days, consolidation reigns supreme.

The markets bloom anew in green splendor across the past 24 hours, the Fear and Greed Index creeping toward neutrality. With Bitcoin in this revival, the presale of Bitcoin Hyper shall undoubtedly swell, as investors, those ever-optimistic pilgrims, reclaim their steps toward the crypto bull of the fourth quarter. Who knew disaster could birth such sarcastic silver linings? 😂

How Bitcoin Hyper Transforms the Ancient Beast into Modern Velocity

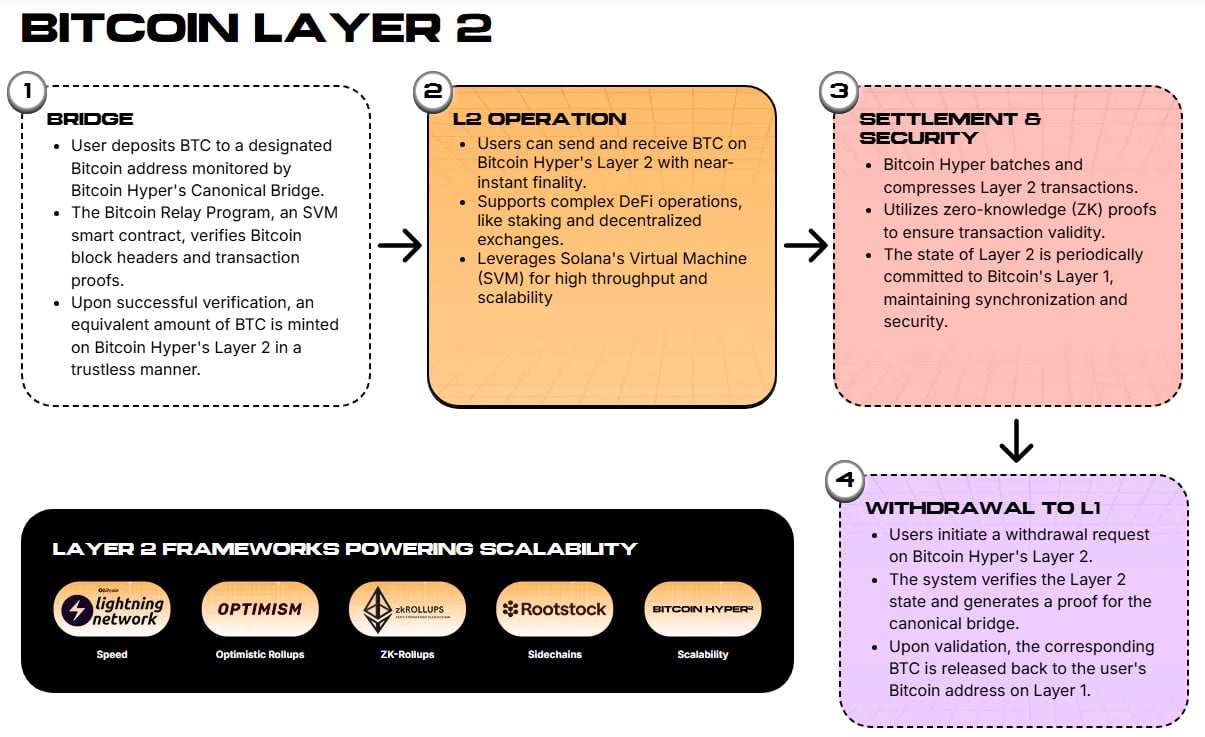

Bitcoin Hyper ($HYPER), a Layer 2 savior in this grand narrative, emerges to redeem Bitcoin from its ancestral shackles, lifting it to the zenith of modernity. 😎

Bitcoin’s woe, you see, resides in its primitive fetters: a mere seven transactions per second, spawning sloth and exorbitance, with scalability a forgotten dream. The fee-laden rankings, prizing the mighty over the meek, exile lesser transfers to the queues of oblivion.

Enter Hyper, wielding the Solana Virtual Machine (SVM) and the Canonical Bridge like Excalibur for the digital age. SVM hastens smart contracts and DeFi enchantments, while the Bridge vanquishes the specter of tardy confirmations.

Upon confirmation by the Bitcoin Relay Program-an instant affair-the Bridge transfigures native bitcoins into Hyper-bound treasures. Users may wield these wrappers upon the Layer 2 or repatriate them to the base layer at whim, in a ballet of blockchain liberty.

Should you seek to fortify thy portfolio with this utility talisman, delve here into the art of acquiring $HYPER, and hasten to the presale page to claim thy share. Yet heed this: ’tis not counsel financial, but a call to thine own toil (DYOR) and prudent stewardship of perils. For in the annals of fortune, folly awaits the unwary, and wisdom the bold! 😄

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- EUR HKD PREDICTION

- ARB PREDICTION. ARB cryptocurrency

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Dogecoin: $1 Dream or Financial Nightmare? 🚀💸

- 😱 $91M Vanishes in Crypto Farce: ZachXBT Unveils the Absurdity! 🕵️♂️

2025-10-13 12:45