Well, here we go again. Another Bitcoin crash, another excuse to lose sleep over your digital fortune. But hold onto your hats, folks, because Glassnode, the on-chain analytics firm that’s smarter than your average bear, claims this latest tumble isn’t your run-of-the-mill disaster like the LUNA and FTX fiascos of 2022. 🧐

Bitcoin’s Profit Trend: Dodging the Usual Pitfalls 🎢

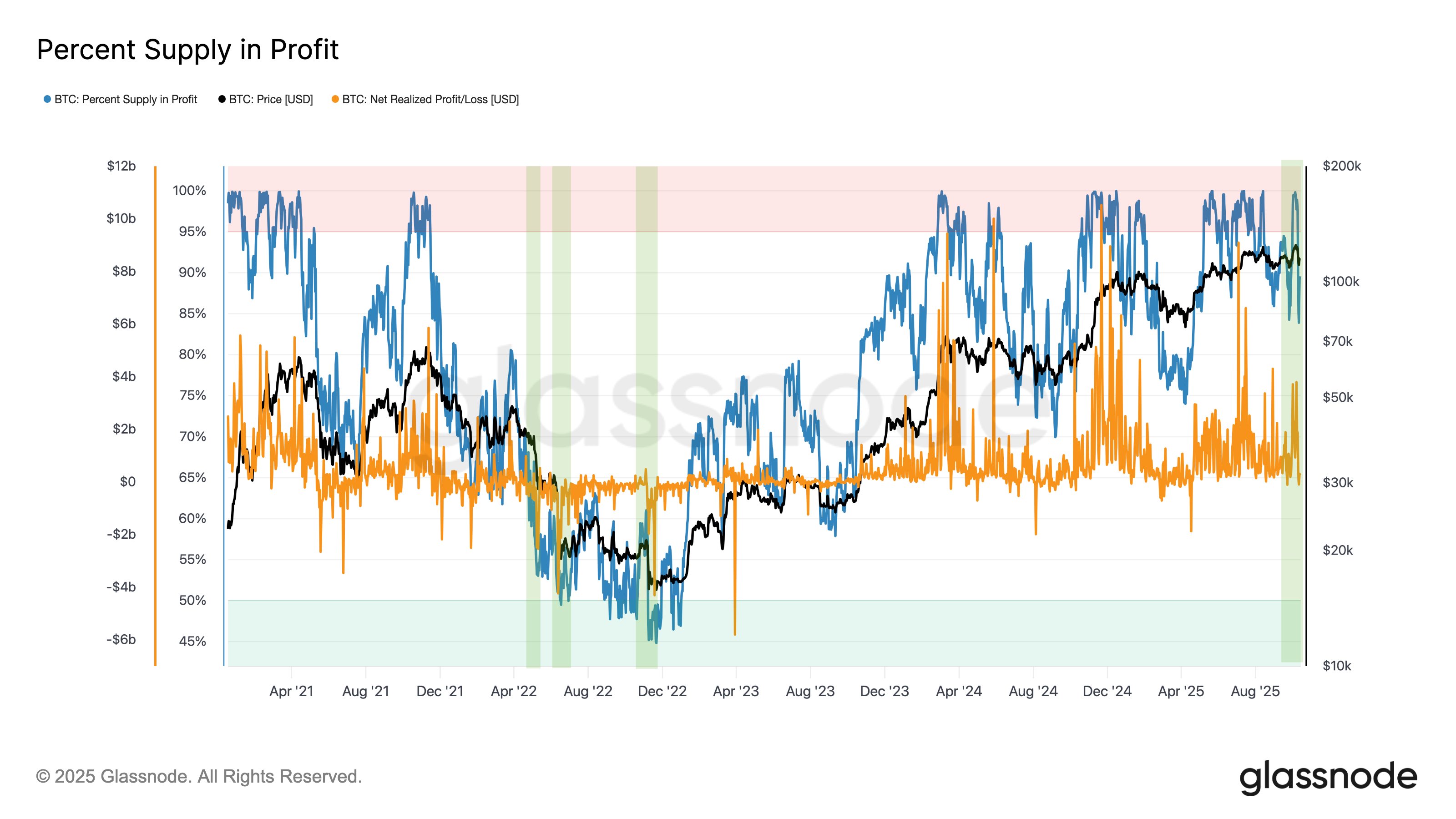

In a tweet that probably didn’t go viral because crypto enthusiasts are too busy crying, Glassnode broke down how this Bitcoin selloff is playing by its own rules. They whipped out the Percent Supply in Profit metric, which sounds fancy but basically tells you how many Bitcoin holders are still grinning ear to ear.📈

This metric works by digging through the transaction history of every Bitcoin in existence. If your coin was last sold for less than its current price, congratulations-you’re in the green. If not, well, maybe consider knitting as a hobby. 🧶

Now, here’s the kicker: Glassnode plotted this metric over the last few years, and here’s what they found:

As you can see, Bitcoin’s Percent Supply in Profit was chilling at 100% earlier this month, right before the price decided to take a nosedive. Even after the crash, it was still above 90%, meaning most investors were still raking in profits. 🤑 Compare that to the LUNA and FTX disasters, where the metric was scraping the bottom at under 65%. Ouch.

Glassnode also threw in something called the Net Realized Profit/Loss, which sounds like a tax form but actually measures whether folks are cashing in their chips or cutting their losses. Spoiler: the LUNA and FTX crashes were total bloodbaths.💀

So, what’s the verdict? Glassnode says this crash was “a structurally different, leverage-driven event.” Translation: it’s not the same old story, but it’s still a mess.

Bitcoin’s Price: Down But Not Out (Yet) 📉

As of now, Bitcoin is hovering around $110,400, down more than 11% over the last week. So, if you’re holding onto your BTC for dear life, maybe take a deep breath and remember: the only thing more volatile than Bitcoin is your Aunt Karen’s opinions at Thanksgiving dinner. 🦃

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

2025-10-15 08:50