So, the crypto ETFs had a bit of a wobble earlier in the week, like a drunk astronaut trying to walk on the Moon. But fear not, dear reader, for they’ve bounced back with the resilience of a rubber chicken on a trampoline, pulling in a cool $339 million. And who’s leading the charge? Fidelity, of course, because apparently they’ve got more faith in crypto than a cat has in a laser pointer. 🐱✨

Fidelity to the Rescue: Bitcoin and Ether Inflows Save the Day 🦸♂️💸

After Monday’s dramatic sell-off-which was about as unexpected as a plot twist in a soap opera-the crypto exchange-traded fund (ETF) market decided it wasn’t done with its 15 minutes of fame just yet. Investors, ever the optimists, came rushing back like seagulls to a chip shop, with both bitcoin and ether ETFs swinging back into the green. $339 million in inflows? That’s more confidence than a game show host with a glittery jacket. 🌟

Bitcoin ETFs, not wanting to be left out of the party, recorded $102.58 million in net inflows. Fidelity’s FBTC was the life of the party, raking in $132.67 million-because who doesn’t love a good comeback story? Bitwise’s BITB and Ark 21Shares’ ARKB also joined in, adding $7.99 million and $6.76 million, respectively. It’s like they all got the memo: “Crypto is so back.” 📈

Of course, not everyone was feeling the love. Blackrock’s IBIT and Valkyrie’s BRRR saw outflows of $30.79 million and $14.05 million, respectively. But let’s be honest, they’re probably just taking a nap. Inflows still outweighed exits, so the party’s still going strong. Trading volume? A whopping $6.92 billion. Total net assets? Steady at $153.55 billion. Crypto’s not just surviving-it’s thriving. 💪

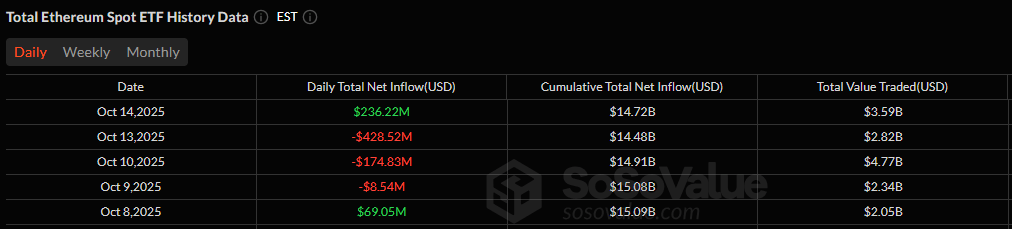

Ether ETFs, not to be outdone, bounced back with $236.22 million in inflows across six funds. Fidelity’s FETH, clearly the MVP of the day, added $154.62 million. Grayscale’s Ether Mini Trust and ETHE followed with $34.78 million and $15.19 million, respectively. Bitwise’s ETHW, Vaneck’s ETHV, and Franklin’s EZET also joined the party, adding $13.27 million, $10.55 million, and $7.81 million, respectively. Total value traded? $3.59 billion. Net assets? $28.02 billion. Ether’s not just rebounding-it’s moonwalking. 🌕

So, what’s the takeaway from all this? After Monday’s retreat, Tuesday’s recovery was like a “Hold my beer” moment for crypto ETF investors. They’re not backing down-they’re just catching their breath before the next rollercoaster ride. Strap in, folks, because this is going to be a wild one. 🎢

FAQ (Frequently Asked Questions, or as I like to call it, “Stuff People Keep Asking”)

-

How much did crypto ETFs recover after the sell-off?

A cool $339 million, because apparently crypto investors love a good bargain. 🛍️ -

Which ETF led the Bitcoin rebound?

Fidelity’s FBTC, with $132.67 million. They’re like the superhero of ETFs, cape and all. 🦸♂️ -

How did Ether ETFs perform during the recovery?

$236 million in inflows, led by Fidelity’s FETH with $154.62 million. Ether’s not just bouncing back-it’s doing a backflip. 🤸♂️ -

What does this rebound indicate for crypto ETF sentiment?

Investors are more optimistic than a puppy with a new toy. 🐶

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- AAVE: Oh, the Drama!📉

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

2025-10-15 14:59