Ah, Bitcoin-a subject that brings out the fervor of conspiracy theorists and the sharp-witted alike. After a brief but dramatic dip that felt like watching a soap opera unfold, Bitcoin’s price has decided to snuggle up to some critical support levels. It’s like it’s playing hide-and-seek just below the $107K mark, while the market can’t help but eavesdrop on whale activity, the 50-day simple moving average (SMA), and those RSI signals that hint toward a possible breakout at $123K. No pressure, right? 😏

Whales Quietly Accumulate as Bitcoin Consolidates Around $107K

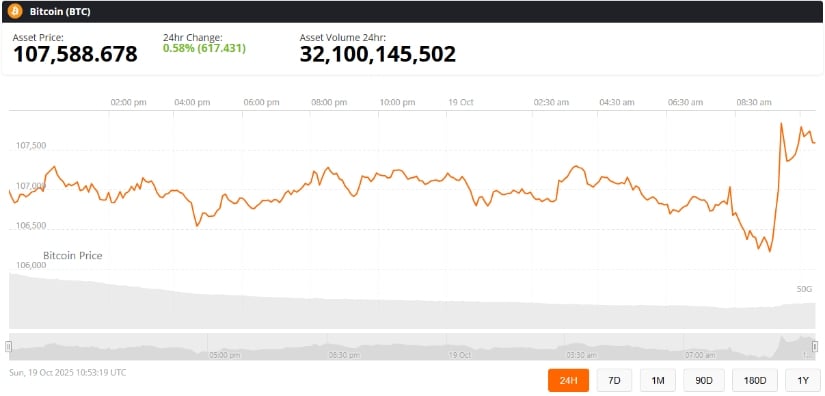

So here we are, with Bitcoin (BTC) trading in a straitjacket of consolidation at approximately $107,588-because what’s more exciting than hovering just shy of a solid number? According to data from BraveNewCoin (because who needs a social life when you can obsessively track crypto?), it appears the whales, those mysterious creatures of the sea… I mean crypto ocean, have been guzzling up Bitcoin like it’s a limited-edition vintage wine during a garage sale.

Market analysts-those prophets of our digital age-whisper that this gathering of Bitcoin whales might indicate growing institutional confidence. One trader on X-pseudo or real, who can tell anymore?-Crypto King intoned, “Zoom out and the story stays the same. $BTC is still moving strongly.” It’s like watching your cat do the same trick for the fifth time, yet still acting shocked every time. 🐱

According to all-knowing data from Glassnode and Bitget, these whales collectively hoarded over 16,000 BTC during the tumultuous recent dip. It’s as if they were preparing for a rainy day, while the rest of us are left wondering if we can afford avocado toast.

Critical Technical Supports Hold the Line

Bitcoin’s 50-week SMA is sitting pretty at around $101,700, like that neighbor who refuses to take down their Christmas lights in March. The Relative Strength Index (RSI), which currently rests at a groggy 45, are both crucial indicators that it seems we can’t escape, much like the cheery sound of holiday bells no matter the season. Coin enthusiast @Crypflow pragmatically noted that past articles suggest whenever BTC dipped a candle below the 50-SMA, it was bear market time. Isn’t that just dandy?

As of right now, BTC is still graciously floating above these support levels. Let’s take a moment to appreciate the resilience of Bitcoin! Meanwhile, those technical traders are eyeing a multi-year ascending trend channel, stretching back to 2023 like a yoga class for financial markets, predicting resistance somewhere around $120K-$125K by mid-2026. If only preparing for a storm was this well organized.

Rally Targets Point Toward $123K and Beyond

Everyone’s got their hopes up again, and Mike Investing, the technical wizard of the trading world, is making bold predictions that we could see a “parabolic squeeze” pushing Bitcoin to $135,000+ by year-end. It’s like believing your 8-year-old can be the next Michael Jordan because they can make a basket on a good day. 🙌

While this claim has yet to be “verified” (are we living in a world where nothing can be taken at face value?), it does highlight a broader belief that Bitcoin might just be preparing for a grand rally. However, like all good things, some analysts suggest that if it slips below the 50-SMA, we may be looking at a deeper dive, plunging toward the swift depths of $95K before any chance of a genuine rebound. How delightful! 🔮

But for today, the structure seems to lean favorably toward the bulls. If Bitcoin can keep its head above the 50-SMA and accumulate more whale wallets like it’s going out of style, a $123K push might not just be wishful thinking!

What to Watch Next

-

Exchange Outflows: Look out for BTC withdrawals from exchanges because declining supply pressure signals bullish potential. And who doesn’t love a good bullish signal?

-

ETF Inflows: Institutional products like the BlackRock BTC ETF and Fidelity Bitcoin ETF are key players in this drama. Sustained inflows are like caffeine for the market; they keep everything buzzing!

-

Macro Factors: Global market liquidity, interest rate policies, and crypto ETF performance are controlling Bitcoin’s wild price ride. It’s like watching a circus where the clown could either trip or do a perfect jump-all while performing on a tightrope!

Final Thoughts

As Bitcoin steadies itself above $107K, the overarching tale remains one of quiet accumulation and robust support-much like that one friend who insists they’re fine even as they’ve dropped half their drink on their shirt. With whale purchases, sturdy technical foundations, and a rise in institutional commitment, the outlook toward Q4 2025 looks bright-then again, who knows? 😂

If Bitcoin can keep chugging along its long-term trend channel, that breakout toward $123K (and possibly beyond) may arrive sooner than anyone could imagine. Just keep your eyes peeled and try not to gasp-history shows us that even the strongest uptrends know how to throw a hissy fit before heading back up. Buckle up, folks!

Read More

- Gold Rate Forecast

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

2025-10-19 16:27