Bitcoin, that elusive specter of digital gold, has once more haunted the vicinity of a pivotal technical threshold-a 50-week Simple Moving Average, a relic of bullish lore, now a siren song for traders. Since early 2023, this line has served as a lifeline, a phantom limb of optimism, as if the market itself were a moth drawn to the flame of hope.

As the clock struck the appointed hour, Bitcoin lingered near the elusive figure of $111,200, a modest gain etched in the annals of the day, yet a lamentable descent over the week. A paradox, this price: a whisper of triumph, a sigh of defeat.

Bitcoin Retests Long-Term Support

The chart, a mosaic of data, reveals that each retest of the 50-week SMA since 2023 has heralded new peaks. The moving average, a sentinel of trend, has become a beacon for those who dare to decipher its whispers. In 2022, it was breached, a betrayal that ushered in a tempest of corrections. Now, it beckons again, a siren call to the brave or the foolish.

Merlijn The Trader, that enigmatic oracle of the markets, declared: “BITCOIN JUST RETESTED THE BULL MARKET BASELINE.” A proclamation as grand as a Shakespearean soliloquy, yet tinged with the bitter irony of a man who knows the difference between a trader and a tourist. “Smart money buys the retest. Retail buys the breakout.” A lesson in the art of survival, if one dares to learn.

Sentiment Still Unsettled After Liquidation

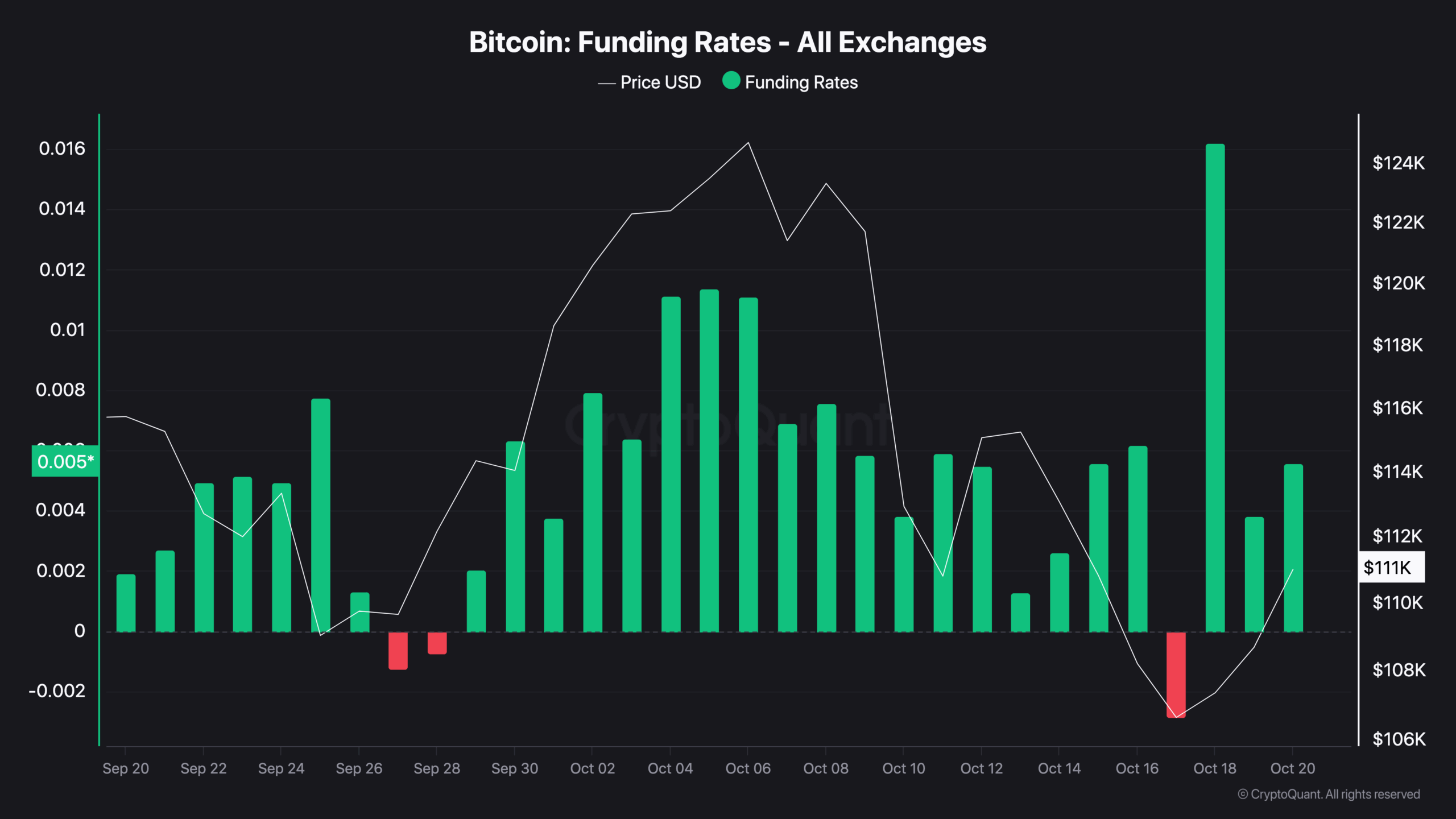

Market confidence, that fickle companion, lay prostrate after a tempest of liquidations on October 10. Funding rates, those barometers of trader sentiment, plunged into the abyss of negativity on October 17, as many bet on further decline. A world where even the most seasoned gamblers hedge their bets with the caution of a man avoiding a minefield.

Yet, like a phoenix, funding rates have risen from the ashes, now flirting with 0.005. A flicker of hope, but one that trembles in the shadows of past trauma. Traders, those wary voyagers, still clutch their compasses, uncertain if the horizon holds a sunrise or a storm.

Key Price Levels in Play

Bitcoin, that mercurial dancer, now pirouettes near the resistance at $111,440, a level that once heralded a descent into the depths of $108,600. Analyst Lennaert Snyder posits that a breach above this threshold could unlock the gates to $115,800. If that too is conquered, the price may revisit $120,800, where a swift selloff once left the market gasping.

Bitcoinsensus, that self-proclaimed seer, notes that the weekly candle closed above the $107,200 low, a flicker of defiance. The liquidity index, that quiet herald of capital, has begun to rise-a whisper of new money entering the fray, though one wonders if it’s a trickle or a flood.

Broader Trends and External Pressure

EGRAG CRYPTO, that prophet of market omens, suggests Bitcoin is treading a familiar path, a cyclical waltz. The analyst warns that the final act may be a sharp reversal, as retail participation swells, and the curtain falls on the current act. “Everyone will think we’re finally safe… but that’s where the real twist comes.” A warning wrapped in a riddle, as cryptic as a Nabokov novel.

The recent correction, a shadow cast by political maelstroms, was partly fueled by the words of a former president, Donald Trump, whose musings on tariffs ignited uncertainty across financial realms. A reminder that even the most digital of markets are tethered to the earthly whims of politicians.

CryptoPotato reports that the prediction platform Polymarket, in its whimsical wisdom, offers odds of 6% for alien confirmation and a mere 5% for Bitcoin scaling $200,000. A jest, yet it mirrors the cautious hearts of traders, their expectations tethered to the fraying threads of hope.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD MXN PREDICTION

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD JPY PREDICTION

- USD HKD PREDICTION

- Why Is Everyone Obsessing Over These Cryptos? 🤔

- Brazil Ditches Cash?! 💸

2025-10-21 06:43