In a development both mystifying and monumentally lucrative, a hoard of Bitcoin-long dormant since the halcyon days of 2022-has suddenly re-entered circulation, sending ripples of existential dread through the crypto-verse. One might think these coins had merely paused for a coffee break, but no, they’ve returned to the fray with the subtlety of a drunk uncle at a family reunion.

The Great Bitcoin Nap: A Three-Year Slumber Interrupted by a Snore Heard ‘Round the Cryptoverse

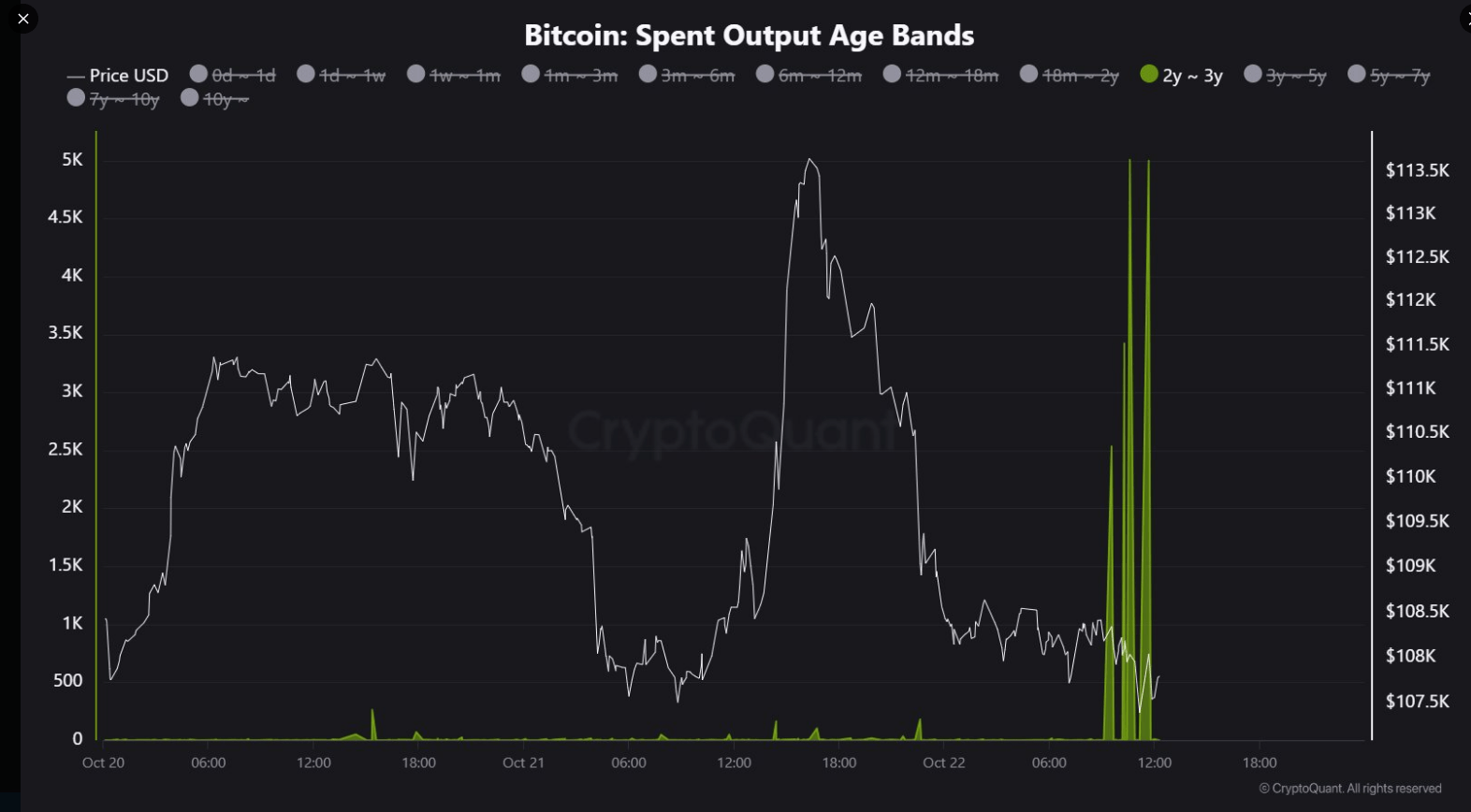

According to the esteemed CryptoQuant oracle, JA Maartun, a precise 15,965 BTC-sleeping beauties since the twilight of 2022-were jolted back into action. This coincided with Bitcoin’s recent retreat from its lofty peaks, now trading at a modest $108,000 per coin. The total value? A paltry $1.724 billion. One wonders if the coins’ custodians were simply tidying up or preparing for a grand auction of their digital assets.

CryptoQuant’s records, which are about as reliable as a weather forecast in the Sahara, reveal these addresses had been as active as a stone since late 2022. The funds, now on the move, have vanished into shadowy destinations, leaving behind a trail of speculation and a few too many conspiracy theories involving black helicopters and rogue algorithms.

Market observers, armed with spreadsheets and existential dread, have noted the timing. Is this a harbinger of profit-taking, or merely a bureaucratic reshuffle between offshore accounts and tax havens? The answer, like so much in crypto, is likely “all of the above” or “none of the above”-depending on your level of caffeine intake.

15,965 BTC, aged like a fine wine but with worse customer service, just moved on-chain.

This cohort had been dormant since the days of the Great FTX Collapse-until now.

– Maartunn (@JA_Maartun) October 22, 2025

New Whales Underwater: A Tale of Hubris and Hype

Meanwhile, newer whale enthusiasts-those who bought near the recent highs-find themselves in a precarious position. Their average cost of $113,000 per BTC leaves them floundering in the depths, with unrealized losses nearing $7 billion. One might say they’ve bitten off more than they can chew, though in this case, it’s more like they’ve swallowed the entire menu.

Yet, amid this chaos, accumulation persists. Some deep-pocketed entities have quietly added 26,500 BTC to their stashes, suggesting either remarkable foresight or a desperate attempt to outbid their rivals in a game of digital musical chairs.

The resulting tug-of-war between buyers and sellers has left the market teetering on a knife’s edge. Traders now watch the $107,000-$108,000 support level like vultures eyeing a feast. Should this bastion hold, a bounce might be possible; should it falter, the descent toward $100,000 could resemble a particularly dramatic episode of House of Cards.

Price Targets Spark Debate (Because Nothing Unites People Like Financial Uncertainty)

The recent volatility has ignited a cacophony of opinions. Galaxy Digital’s CEO, speaking with the confidence of someone who clearly hasn’t checked their bank balance, insists reaching $250,000 by year-end would require “a heck of a lot of crazy stuff.” One wonders if he’s referring to the market or his own LinkedIn posts.

Others, like Fundstrat’s Tom Lee and BitMEX’s Arthur Hayes, remain bullish, citing policy moves and inflows as potential catalysts. Perhaps they’re betting on a miracle-or a regulatory breakthrough that somehow ignores the entire history of human greed.

Growing institutional involvement, as evidenced by Galaxy’s record quarter ($29 billion in revenue), has bolstered some investors’ optimism. Whether this is due to genuine growth or a collective delusion remains to be seen.

Glassnode reports open interest has dropped by 30%, reducing speculative pressure to a simmer. Lower open interest, they claim, makes price trends easier to read-until the next scandal, hack, or Elon Musk tweet derails everything. For now, the market breathes a sigh of relief, though it’s the kind of sigh one hears before a thunderstorm.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- EUR KRW PREDICTION

- EUR ZAR PREDICTION

- Bitcoin Ghosts, Rogue Bankers & The Not-So-Smart Crypto Circus: This Week’s Recap Will Make You Regret Not HODLing

- Dogecoin’s Bull Run? Don’t Bet Against This Chart, Says Analyst 🐕💸

- Binance’s Futures Freeze: Oopsie or Oops-We’re-Fucked? 🧊💸

- 🐶 Dogecoin’s Grand Adventure: From Meme to Market Marvel! 🚀

2025-10-23 16:59