Oh, the crypto market. It stirs, it shimmies, it pretends to ascend. For a fleeting moment, Bitcoin and its lesser, often quite absurd, altcoin brethren have deigned to flirt with a height not witnessed in over a week. A week, mind you, in the perpetually accelerating, slightly nauseating chronology of digital speculation. 🙄

Bitcoin (BTC), that digital chimera, currently rests at $112,866-an increase of 5.3% over a week’s worth of fervent keyboard clicking. The total market capitalization, that rather grand and ultimately illusory figure, puffed itself up a respectable 14% to $3.73 trillion, having briefly deigned to peek its head above this month’s somber low of $3.24 trillion.

- Bitcoin and its motley crew held relatively still this weekend – as still as a hyperactive hummingbird, that is.

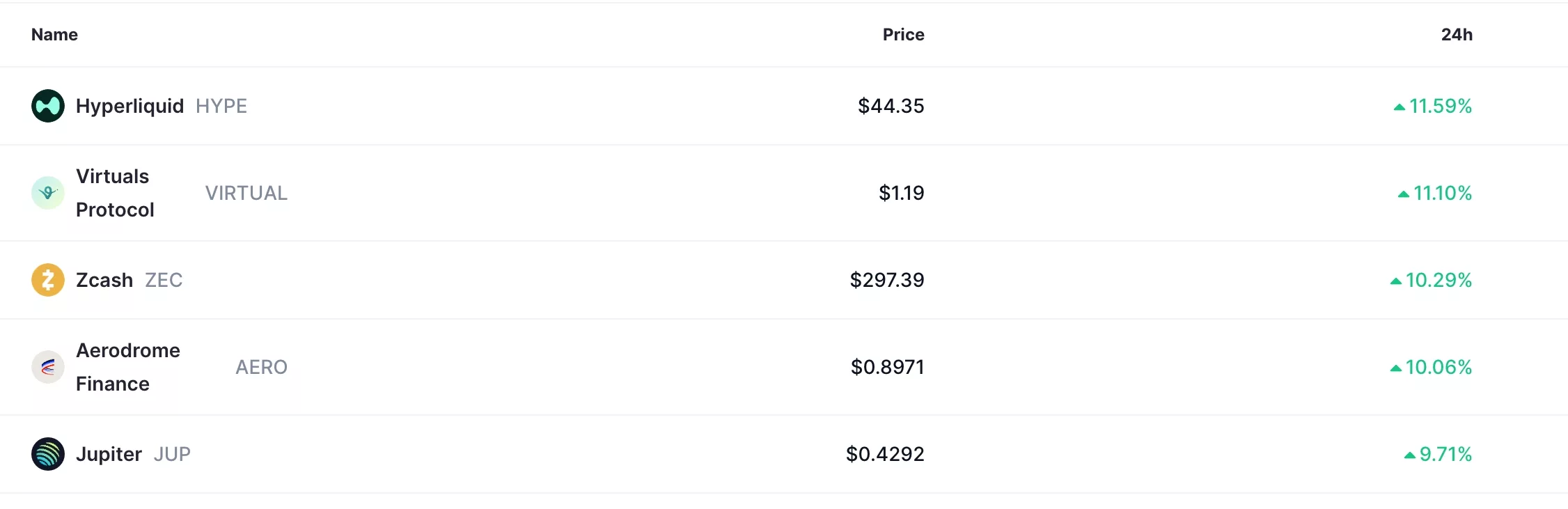

- The usual suspects – VIRTUAL, HYPE, and Zcash – demonstrated a rather vulgar eagerness to climb. Honestly, the names alone…

- The momentary surge coincided with a slightly less alarming report regarding US inflation. Almost as if the markets are susceptible to facts! A curious notion.

Most altcoins, those digital butterflies, experienced an unseemly eagerness to rise, with Hyperliquid (HYPE), Virtuals Protocol (VIRTUAL), Zcash (ZEC), and Aerodrome Finance (AERO) leading the charge-leaping a good 10% in the last twenty-four hours. One wonders if they’ve been taking performance-enhancing algorithms. 🤨

A Tepid Boost, Perhaps?

The alleged reason for this upswing? Why, the Bureau of Labor Statistics, bless their statistical hearts, published an “encouraging” inflation report on Friday. Encouraging, in the sense that things aren’t quite as catastrophically bad as they could be. The headline Consumer Price Index managed a modest creep from 2.9% to 3.0% in August-September. Core inflation, that selectively pruned figure designed to soothe the anxieties of the financially literate, retreated from 3.1% to 3.0%.

Such numbers have, naturally, inflated the hopes that the Federal Reserve will bestow upon us a rate cut this week. ING Bank’s analysts, those oracles of the financial world, even suggest further cuts in December, and the cessation of quantitative tightening-a process sounding suspiciously like removing life support. 😴

These burgeoning hopes for an “easy-money policy” (a delightful euphemism, isn’t it?) may explain the stock market’s soaring antics, with the Dow Jones, S&P 500, and Nasdaq 100 indices reaching hitherto unimagined altitudes. One almost expects them to require oxygen masks.

Trump and Xi: A Diplomatic Dance

Adding a layer of geopolitical spice to this already frothy brew, President Donald Trump has embarked upon a three-country excursion in Asia. The naive hope, naturally, is that a reduction in trade tensions with China is forthcoming, pending a meeting with President Xi Jinping.

On Sunday, Trump landed in Malaysia, merely a hop, skip, and a rather extravagant jet flight from the APEC Summit in South Korea, where his impending encounter with President Xi awaits. The potential for trade negotiations is viewed favorably by the crypto market, presumably reversing the minor distress experienced earlier this month when Trump threatened a tariff of 132% on Chinese goods. A rather baroque gesture, even by his standards. 🙄

A Dead Cat’s Brief Respite?

However, let us not succumb to unbridled optimism. The lurking specter of the “dead cat bounce” haunts this rally. A DCB, for the uninitiated, is that pathetic twitch of a falling asset-a temporary illusion of recovery before the inevitable downward spiral resumes. One truly pities the cat. 🐈

This bounce, should it prove to be precisely that, could unfold over days, weeks, or even months. A worrying sign is the Bitcoin price encountering significant resistance at the 100-day moving average, suggesting the bullish momentum is beginning to wane. A rather deflating thought, isn’t it?

Looking ahead, beyond the machinations of the Federal Reserve and the diplomatic posturing of world leaders, the crypto market awaits the earnings reports of the US big-tech behemoths-Apple, Microsoft, and Meta Platforms. Their pronouncements, like judgments from digital deities, will inevitably send ripples through the market. Such is the capriciousness of our modern financial world.

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Brazil Ditches Cash?! 💸

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Solana’s $200 Gambit: Will This Blockchain Darling Finally Deliver? 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

2025-10-26 15:06