\n

It has been observed with much curiosity that Bitcoin\’s current fortitude in the short-term market appears to wane, yet her long-term grace remains steadfast, as per the latest exposition from the sagacious Cryptoquant. This suggests that the present cycle of prosperity is yet in its genteel progression of accumulation rather than approaching an untidy conclusion.

\n\n

Bitcoin\’s Maturation: A Subtle Affair

\n

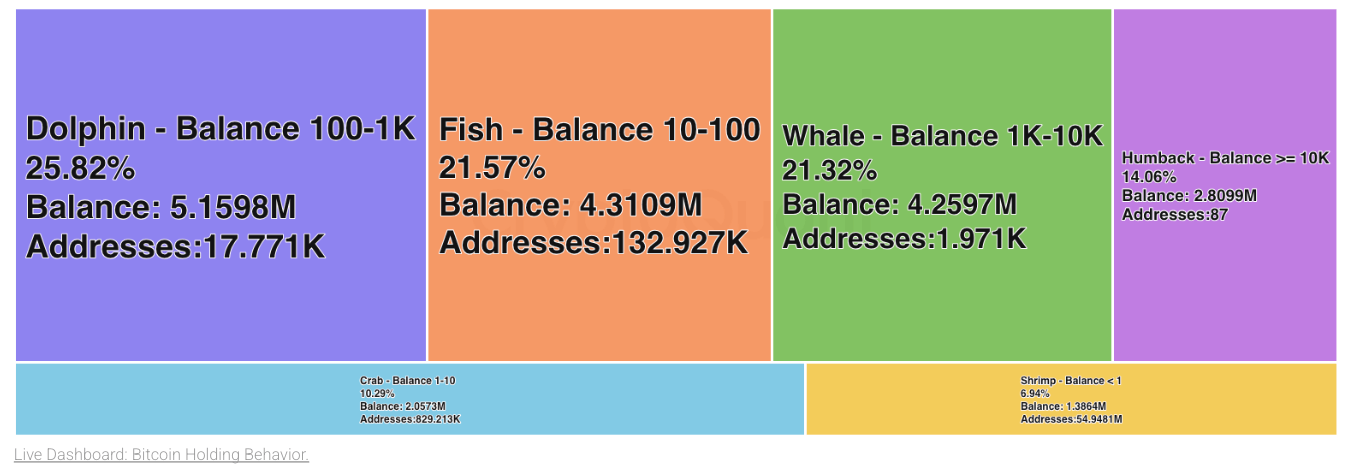

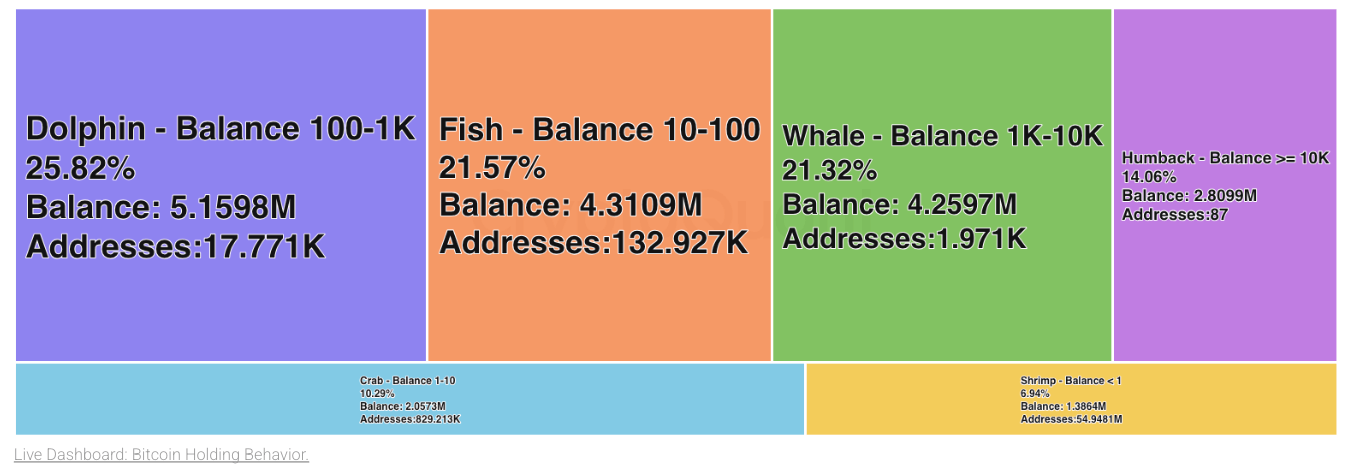

The insightful report from the estimable Cryptoquant indicates that mid-to-large denizens of the Bitcoin realm-henceforth dubbed the “Dolphin cohort,” ensconced with holdings ranging from one hundred to one thousand of these digital coins-are now at the forefront of market prowess, commanding the share of nearly one-fourth of the circulating supply, thus accumulating some 5.16 million Bitcoin in their stead.

\n\n

The prominent actors within this cohort, who include traded funds of the public exchange, spirited corporate treasuries, and institutional connoisseurs of investment, have showcased their acumen by thus far adding more than 681,000 coins to their collections this very year, while the smaller participants have opted for modest withdrawal. It appears, with a dash of irony, that the youthful exuberance of retail interest is cooling as the matured institutions last their wallets open.

\n\n

\n

\n\n\n

This divergence between youthful retreat and seasoned entrenchment casts a clear light on how the zealous institutional demand anchors Bitcoin\’s structure, even against the gusts of fading public participation. As noted by the perspicacious Cryptoquant, a pause in Dolphin gathering often presages a time for reflection and possible redistribution but renewed inflows heralds ascent towards hitherto uncharted summits.

\n\n

Despite the evident weakness in recent breaths of momentum, the foundations remain vigorous. The Dolphin cohort, with annualized growth scaling heights of 907,000 coins-surpassing the average of 730,000 coins in the preceding annum-gives evidence that the prevailing winds of fortune have not yet relinquished their hold.

\n\n

Where, in history\’s recent annals of commerce, a waning in the accumulation by these noble holders foretold a vacating of zest among institutions, our present reports of accumulation are stout and flourishing, making for a structure that bodes well both for the maturity and continuance of bullish endeavors.

\n\n

However, the near-term tableau presents a softer spark than we might desire. The growth of balances within the Dolphin assembly is presently teetering beneath its monthly average, marking reticence in immediate demand. Bitcoin\’s valor is thus tested near the gate of $115,000, whereas her comforts lie at $100,000. Should the lower door be opened, a descent toward $75,000 may well be necessitated.

\n\n

The apt Cryptoquant analysts thus surmise that a revival in the spirited gathering, especially as engaged by exchange-traded funds and those large holders with a penchant for hoarding, shall be the keys to vaulting above the pinnacle of $126,000. Absent such vigor, one could envisage Bitcoin resting in a calm, contemplative phase suited to her late-cycle comportment.

\n\n

FAQ ⏰

\n

- \n

- Pray, what insights does Cryptoquant\’s report disclose about Bitcoin\’s cycle?\n

It claims with reassurance that Bitcoin\’s cycle is maturing in decorum but not yet fulminated, with her long-lasting demand intact and firm.

\n

- Who may this “Dolphin cohort” be, pray tell?\n

They are the participants whose coffers range in occupancy from a hundred to a thousand Bitcoin, including the esteemed ETFs, corporate houses, and grand proprietors of large volumes.

\n

- How much of this Bitcoin have the Dolphins engaged with in the annum of 2025?\n

Oh, they have quite admirably added over 681,000 Bitcoin to their reserves, collectively holding some 5.16 million Bitcoin as a mark of no small achievement.

\n

- At what figures do the markets regard resistance and support for Bitcoin\’s immediate fate?\n

Resistance is marked near the stately $115,000, whilst support finds refuge at $100,000, with a further nudge toward $75,000 should prudence dictate a descent.

\n

\n

\n

\n

\n

\n

It has been observed with much curiosity that Bitcoin’s current fortitude in the short-term market appears to wane, yet her long-term grace remains steadfast, as per the latest exposition from the sagacious Cryptoquant. This suggests that the present cycle of prosperity is yet in its genteel progression of accumulation rather than approaching an untidy conclusion.

Bitcoin’s Maturation: A Subtle Affair

The insightful report from the estimable Cryptoquant indicates that mid-to-large denizens of the Bitcoin realm-henceforth dubbed the “Dolphin cohort,” ensconced with holdings ranging from one hundred to one thousand of these digital coins-are now at the forefront of market prowess, commanding the share of nearly one-fourth of the circulating supply, thus accumulating some 5.16 million Bitcoin in their stead.

The prominent actors within this cohort, who include traded funds of the public exchange, spirited corporate treasuries, and institutional connoisseurs of investment, have showcased their acumen by thus far adding more than 681,000 coins to their collections this very year, while the smaller participants have opted for modest withdrawal. It appears, with a dash of irony, that the youthful exuberance of retail interest is cooling as the matured institutions last their wallets open.

This divergence between youthful retreat and seasoned entrenchment casts a clear light on how the zealous institutional demand anchors Bitcoin’s structure, even against the gusts of fading public participation. As noted by the perspicacious Cryptoquant, a pause in Dolphin gathering often presages a time for reflection and possible redistribution but renewed inflows heralds ascent towards hitherto uncharted summits.

Despite the evident weakness in recent breaths of momentum, the foundations remain vigorous. The Dolphin cohort, with annualized growth scaling heights of 907,000 coins-surpassing the average of 730,000 coins in the preceding annum-gives evidence that the prevailing winds of fortune have not yet relinquished their hold.

Where, in history’s recent annals of commerce, a waning in the accumulation by these noble holders foretold a vacating of zest among institutions, our present reports of accumulation are stout and flourishing, making for a structure that bodes well both for the maturity and continuance of bullish endeavors.

However, the near-term tableau presents a softer spark than we might desire. The growth of balances within the Dolphin assembly is presently teetering beneath its monthly average, marking reticence in immediate demand. Bitcoin’s valor is thus tested near the gate of $115,000, whereas her comforts lie at $100,000. Should the lower door be opened, a descent toward $75,000 may well be necessitated.

The apt Cryptoquant analysts thus surmise that a revival in the spirited gathering, especially as engaged by exchange-traded funds and those large holders with a penchant for hoarding, shall be the keys to vaulting above the pinnacle of $126,000. Absent such vigor, one could envisage Bitcoin resting in a calm, contemplative phase suited to her late-cycle comportment.

FAQ ⏰

- Pray, what insights does Cryptoquant’s report disclose about Bitcoin’s cycle?

It claims with reassurance that Bitcoin’s cycle is maturing in decorum but not yet fulminated, with her long-lasting demand intact and firm.

- Who may this “Dolphin cohort” be, pray tell?

They are the participants whose coffers range in occupancy from a hundred to a thousand Bitcoin, including the esteemed ETFs, corporate houses, and grand proprietors of large volumes.

- How much of this Bitcoin have the Dolphins engaged with in the annum of 2025?

Oh, they have quite admirably added over 681,000 Bitcoin to their reserves, collectively holding some 5.16 million Bitcoin as a mark of no small achievement.

- At what figures do the markets regard resistance and support for Bitcoin’s immediate fate?

Resistance is marked near the stately $115,000, whilst support finds refuge at $100,000, with a further nudge toward $75,000 should prudence dictate a descent.

Read More

- Gold Rate Forecast

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Brazil Ditches Cash?! 💸

- Dogecoin’s Crypto Comedy: A Meme Coin’s Misadventures

2025-10-26 19:00