Behold! A $303M Bitcoin (BTC) exchange move, a spectacle of institutional investment, fueling Bitcoin market momentum like a drunken squirrel on a trampoline. 🐿️💥

US-China Trade Deal Boosts Bitcoin Market

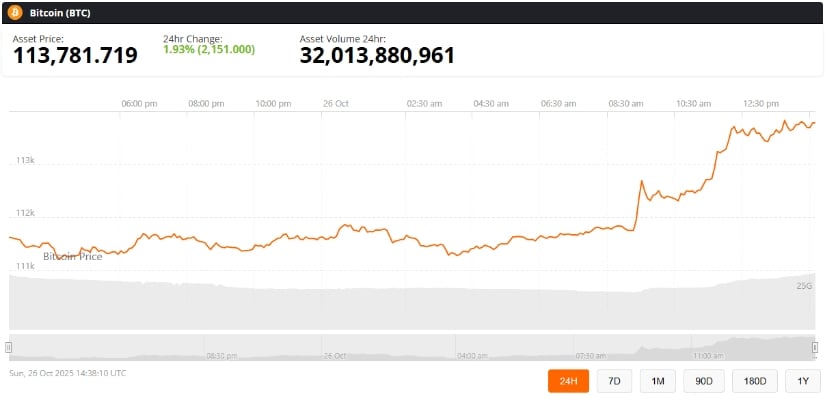

The latest surge in Bitcoin prices comes after reports that China and the United States reached a trade deal during talks in Malaysia, easing tariffs on selected goods and loosening export controls on rare earths. While full implementation will require a follow-up summit between former President Donald Trump and President Xi Jinping, the announcement triggered a sharp uptick in risk-on assets, including Bitcoin. 🤯✨

Crypto analyst 0xNobler highlighted the move, stating: “GIGA BULLISH NEWS! $BTC JUST FLEW PARABOLIC! 🚀” Binance charts showed BTC climbing from around $111,000 to $112,979 within hours, marking a 1-2% intraday spike. A 2% rise? How daring of it! 💸

Historically, diplomatic breakthroughs like this correlate with Bitcoin price rallies, echoing similar trends seen during the 2019 Phase One trade deal. Ah, yes, because nothing says “peace” like a cryptocurrency surge. 🕊️📈

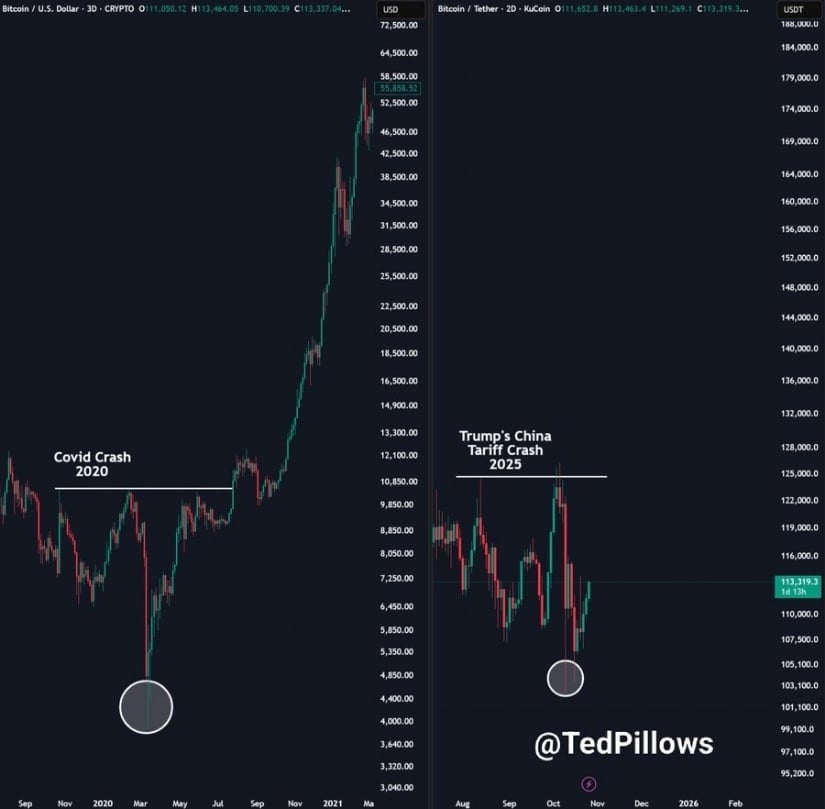

Technical Recovery Mirrors March 2020 Patterns

Analysts are noting that Bitcoin’s rebound after October’s tariff-induced sell-off mirrors patterns from the March 2020 Covid crash recovery. BTC had briefly dropped to approximately $104,782, prompting $19 billion in liquidations across crypto markets. Liquidations? More like liquid dreams. 💸💤

Technical commentator TedPillows observed: “$BTC reversal from the tariff’s crash is mimicking the March 2020 timeline… the 4-year cycle might be over now.” Over? Or just napping? 🛌

Current on-chain data suggests Bitcoin is trading around $112,000-$113,500 USD, with a market capitalization exceeding $2.26 trillion. These indicators point to growing institutional accumulation and a market that is 30% below its Nasdaq-implied fair value, according to Coingecko reports. Fair value? More like “we’ll pretend this makes sense.” 🤡

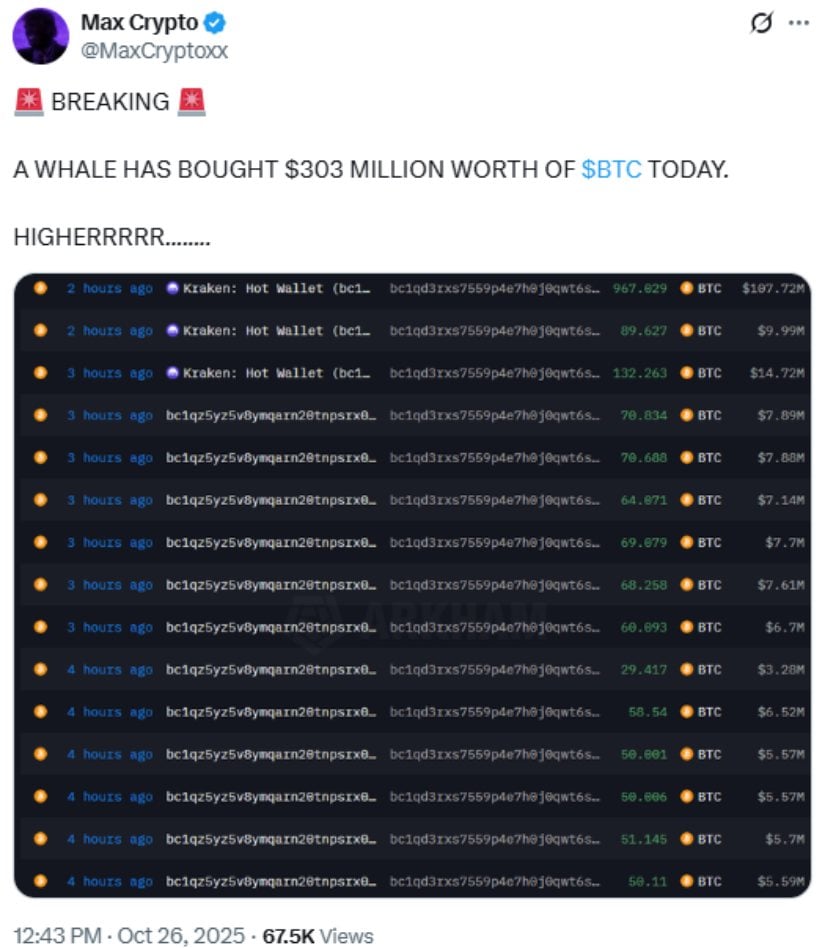

Whale Activity Highlights Exchange Movements

Market watchers were also tracking a substantial Bitcoin inflow to exchange wallets. Reports indicate that a whale transferred approximately 1,884 BTC-valued at $212 million-to a Kraken hot wallet, with some sources suggesting a total figure of $303 million. A whale? Or just a very large and wealthy fish? 🐟💸

While such movements often suggest potential selling pressure, no immediate market impact was observed. Arkham Intelligence screenshots circulated on social media, though confirmation of an exact $303M purchase remains unverified. Unverified? Like a conspiracy theory, but with more numbers. 🧐

Max Crypto noted: “HIGHERRRRR… a whale has bought $303 million worth of $BTC today,” highlighting the ongoing institutional interest in Bitcoin. Institutional interest? More like “institutional desperation.” 💸😵

Market Outlook and Community Debate

The broader Bitcoin community remains divided on the implications of these events. Some analysts argue that traditional 4-year halving cycles are now secondary to monetary policy, ETF inflows, and macro liquidity trends. Others caution that while mid-cycle bottoms may support near-term gains, external risks such as trade tensions, economic slowdowns, and employment pressures could temper future rallies. Risks? What risks? We’re all just here for the ride. 🎢

Influencers such as Kyle Chasse and Nicrypto have suggested that Bitcoin has evolved into a macro asset, influenced by traditional finance, stablecoins, and reduced volatility strategies, potentially shifting peak cycles into 2026 without the typical altcoin surges. Peak cycles? More like “peak confusion.” 🤯

Read More

- Gold Rate Forecast

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- USD HKD PREDICTION

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Chainlink & Polymarket: A Match Made in Crypto Heaven? 🤝📈

- 🤑 Bitcoin, Bills, and Bold Moves: Lummis’s Crypto Revolution! 🌟

2025-10-27 02:31