Amidst the market’s ceaseless turmoil, one might be forgiven for mistaking the Sei price chart for a Soviet-era allegory of hope and despair. Yes, the coin stumbles, as if shackled by invisible chains, yet analysts whisper of a “constructive range”-a phrase that sounds less like financial jargon and more like a bureaucratic excuse for why the breadlines are still long. Buyers, it seems, cling to a “demand zone” like peasants to a dying fire, convinced it will warm them before the frost of bear markets returns. Or perhaps they’re just stubborn.

A Bullish Ballet of Buy Walls and Sell-Side Whispers

In a recent X post (because who needs a soapbox when you can tweet?), analyst Sjuul declared the bullish narrative “untarnished,” despite the coin’s recent retreat into what can only be described as a “consolidation purgatory.” The chart, he insists, reveals buyers hoovering up liquidity like gluttons at a state banquet, though one wonders if they’re celebrating or simply delaying the inevitable. The “major demand area” remains a fortress, albeit one guarded by traders armed with coffee and questionable life choices.

Sjuul’s “bullish structure break” is less a revolution and more a polite suggestion to the bulls: “Hey, maybe try pushing harder up there?” The resistance level he cites isn’t just a number-it’s a dare, a challenge to the market’s collective sanity. A close above it would signal not a triumph, but a bureaucratic shift from “accumulation” to “markup,” a phrase that sounds suspiciously like a cover letter for a tax audit.

His forecast? A breakout to “new levels,” provided the demand base doesn’t crumble like a poorly baked pie. One suspects the universe is laughing at the naivety of such hopes.

Price Dips 4%-A Whimper or a Warning?

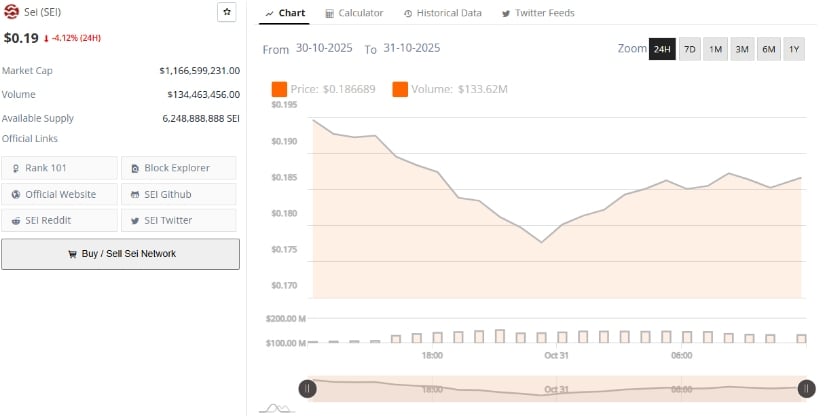

At $0.19, Sei’s price now resembles a deflated balloon at a child’s birthday party. A 4.12% drop in 24 hours? That’s not just a stumble; it’s a full-bodied apology to the bulls. With a market cap of $1.16 billion and a rank of #101, Sei dances on the edge of irrelevance, its daily volume ($134 million) a mere flicker in the cryptocurrency inferno. Traders, ever the optimists, cling to “minor rebounds” like sailors to a life raft, even as the waves of uncertainty rise.

The $0.18 support level is less a safety net and more a dare from the market: “Jump, and I’ll catch you-or not.” A rebound toward $0.20-$0.22? Possible, if the bulls can muster the courage. But should sellers gain the upper hand, $0.16 awaits like a grim reaper with a calculator. Yet, amid this chaos, long-term investors sip their tea, unfazed. “High-speed blockchain performance,” they mutter, as if speed alone could outrun the laws of economics.

TD Sequential Signal: The Market’s Midnight Bell

Analyst Ali, a prophet of Fibonacci proportions, has detected a TD sequential buy signal-a technical indicator so cryptic it might as well be written in hieroglyphs. “Sellers are tired,” he proclaims, as if the market were a weary horse at the end of a long race. At $0.19, the token teeters on the edge of a potential reversal, a moment where hope and despair share a cigarette and debate who gets to light it.

Ali’s projections-$0.25, then $0.31-sound like a fairy tale, a tale of Fibonacci retraces and “healthy structure.” Yet the path is littered with “corrective rests,” a euphemism for the market’s habit of tripping over its own feet. If Sei can hold above $0.19, the TD signal’s bullish whispers might grow louder. Or it might all be a fool’s errand, a crypto-era “Icarus complex” with more charts than wings.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Brent Oil Forecast

- USD HKD PREDICTION

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Tron’s TRX Soars: A Tale of 13 Billion Transactions and Bullish Signals 🚀💰

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Silver Rate Forecast

2025-11-01 01:32