Ah, Ethereum. Once a shining beacon of promise, now limping down the crypto highway like a tired old mule. With its attempt to stay above the $4,000 mark now a distant memory, ETH is trudging toward key support levels. A structural breakdown is underway, and with both the price and sentiment stuck in the quicksand of bearishness, ETH has entered a vulnerable stage. Volatility? Not much to see here, but the downside pressure is quietly building-like a storm on the horizon, but no one’s looking up.

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, Ethereum, like an awkward teenager trying to fit in, got rejected from the higher trendline of the descending channel. Now it’s heading toward a critical demand zone around $3,400. Not the $4K dream many had in mind, right? The asset’s attempt to reclaim the 100-day moving average failed, and it’s now hovering above the 200-day moving average around $3,300 like it’s trying to catch its breath.

The $3,500-$3,300 zone? It’s like the last line of defense, and it’s been successfully defended before, but there’s a catch. The RSI is at 38.68 and the lower highs on every bounce? That’s not the behavior of bulls on a rampage, my friends. No. Unless ETH can pull a rabbit out of its hat and bounce back from this level, breaking below this support-and the 200-day moving average-could pave the way for a trip toward $3,000 in the next few weeks. Prepare your seatbelts.

The 4-Hour Chart

The 4H chart is like that horror movie where you already know the plot twist. ETH is on the brink of sweeping up sell-side liquidity just below $3,700. A break below this level? Oh, that would confirm the weakness and send ETH into a downward spiral, establishing a lovely lower low, as if this wasn’t enough of a circus already.

The RSI is inching toward oversold territory, but it hasn’t even bothered to hint at a bullish divergence yet. After the dramatic rejection from $4,100-$4,200 and the shift in momentum, ETH is likely headed down to that $3,400-$3,500 demand zone again. Another test of the lower boundary of the channel? Highly probable. A breakdown below this level could push ETH into a nosedive-over 10% down, straight into that cozy support block around $3,000. Unless, of course, this is all just a fake-out. Wouldn’t that be fun?

Sentiment Analysis

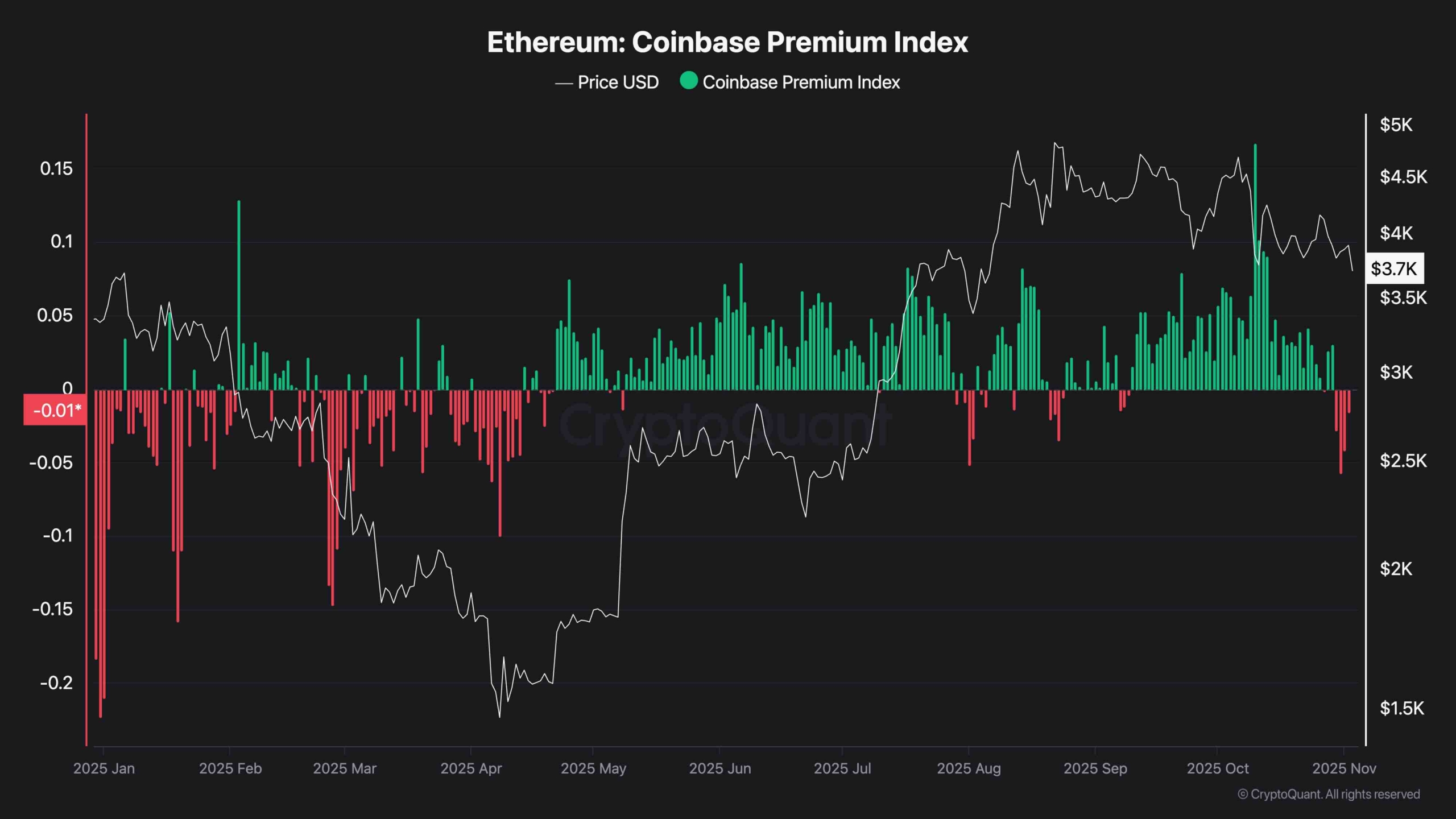

Coinbase Premium Index

The mood has soured. The Coinbase Premium Index has flipped deeply negative, which means that US buyers-bless their hearts-are no longer bidding aggressively. Historically, when the premium goes negative for too long, it’s like the market has already had its coffee and is settling in for a distribution phase or deeper pullback.

So, what does this tell us? The lack of demand from US markets is the first sign of a potential deep correction, and combined with a weak technical structure, the outlook remains as grim as ever unless some new miracle happens to save the day. Spoiler: No one’s holding their breath.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- XRP’s Little Dip: Oh, the Drama! 🎭

- Brent Oil Forecast

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- AAVE: Oh, the Drama!📉

2025-11-03 15:33