Markets

What to know:

- Traders are starting to panic in the bitcoin options market, with an alarming rise in demand for lower strike put options on Deribit. 🧐

- Bitcoin’s price is down over 18% from its peak, dragged down by a combination of global economic hiccups and dwindling interest in spot ETFs. 📉

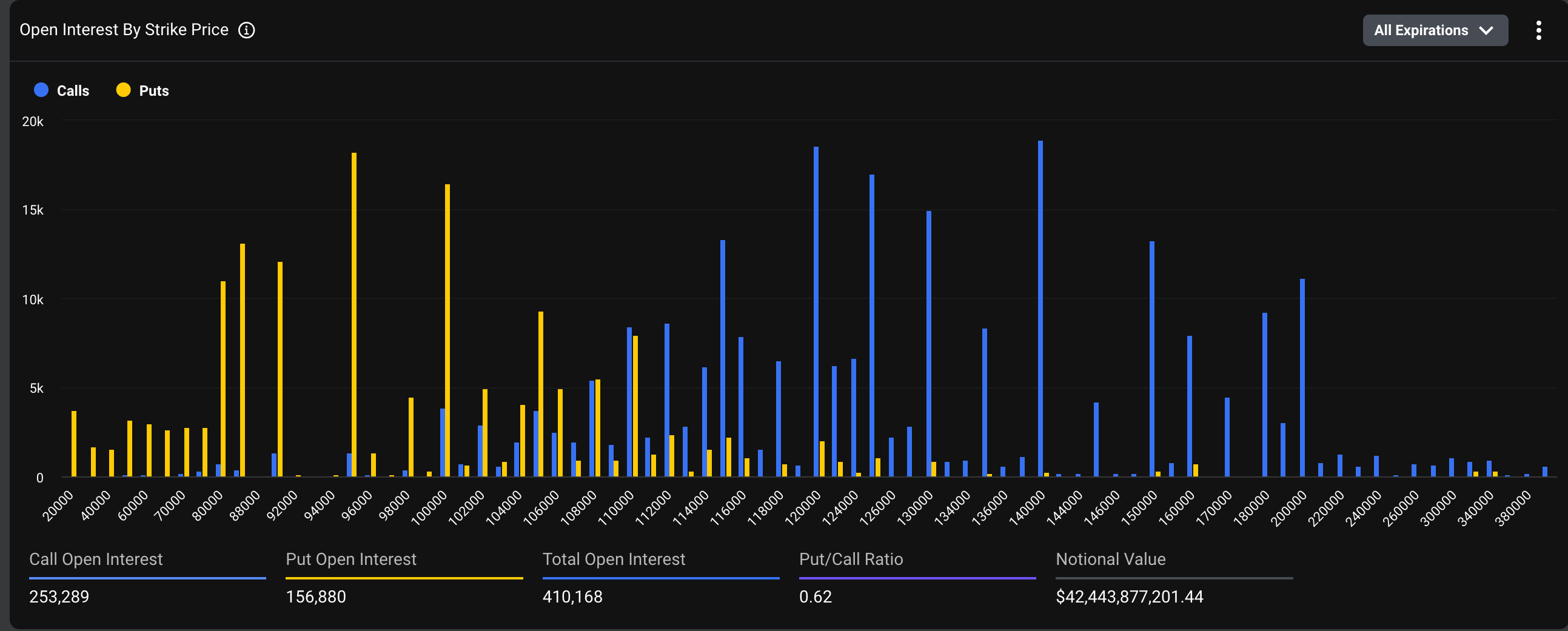

- Open interest in $80,000 and $90,000 put options is skyrocketing, suggesting traders are bracing for even worse news. 🛑

The Deribit bitcoin options market is now a battleground, where traders are preparing for the worst: a drop to $80,000 as spot prices show clear signs of weakness. 😱

The dollar value of active BTC contracts is still holding steady at more than $40 billion on Deribit, with the majority of action focusing on November and December contracts hovering near $110,000. However, demand for the $80,000 strike is steadily climbing, pointing to growing fear that the fall isn’t over yet. 🙄

“A significant uptick in put options near the $80,000 mark indicates that traders are taking serious precautions against further drops,” Deribit explains, perhaps sounding a bit too confident for comfort. Deribit, the world’s largest crypto options exchange, controls over 80% of global options activity. 🌍

Options, in case you didn’t know, are a type of bet where traders try to hedge their positions or speculate on price movements. A put option is like insurance against price drops. You buy the right to sell at a certain price, while a call option is more about hoping the price goes up. Fingers crossed! 🤞

The $80,000 put? It’s basically a bet that the spot price will tumble below that level before the option expires. Oh, the drama! 🎭

As of now, the $80,000 put option on Deribit has open interest (OI) exceeding $1 billion, while the $90,000 put is flirting with $1.9 billion. These figures almost match the combined open interest of the heavily favored $120,000 and $140,000 call options. Quite the contrast, right? 😏

Oh, and remember: some of these higher strike call options are not exactly bullish bets. They’re more like “let’s short the heck out of these calls to make some extra change” from people who already hold BTC. Classic move. 😆

Down 18%

Bitcoin’s price has taken a massive hit-over 18% since hitting its record-breaking high of $126,000 just four weeks ago. At one point, it even dipped below $100,000. Oops. 😬

This sudden sell-off seems to have been caused by broader macroeconomic pressures, especially thanks to the Fed’s Jerome Powell making everyone nervous. This has dampened demand for those oh-so-popular spot ETFs. 💸

“The macro pressure spilled right into crypto, causing around $1.3 billion in net outflows from U.S. spot Bitcoin ETFs. What was once one of 2025’s strongest tailwinds is now looking like a serious headwind,” noted QCP Capital in their Wednesday market update. 🤷♂️

“We also saw forced liquidations of over $1 billion at the lows, just to make things even more chaotic,” they added. Classic crypto mayhem. 🙄

As for Bitcoin’s current status, it’s floating around $103,200, showing a tiny 1.9% gain in the last 24 hours. Well, at least it’s not going to zero-yet. 😅

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Silver Rate Forecast

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- GBP USD PREDICTION

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

2025-11-06 05:30