Despite all the happy talk about global liquidity and central banks relaxing, Wintermute’s own Jasper De Maere has some bad news: Crypto’s just entered a “self-funded” phase. In other words, the cash isn’t flooding in from new investors anymore. It’s just shuffling around like Monopoly money in a family game night.

ETF and DAT Growth Slow, Wintermute Warns of Internal Market Rotation

According to Wintermute, the algorithmic trading firm that’s apparently been reading the room correctly, crypto’s liquidity channels are slowing down, despite the fact that the broader economy is still feeling loose. Stablecoins took a bit of a hit this week-a reduction, the first in months-and that’s not the kind of news anyone wants to hear when they’re hoping for smooth sailing.

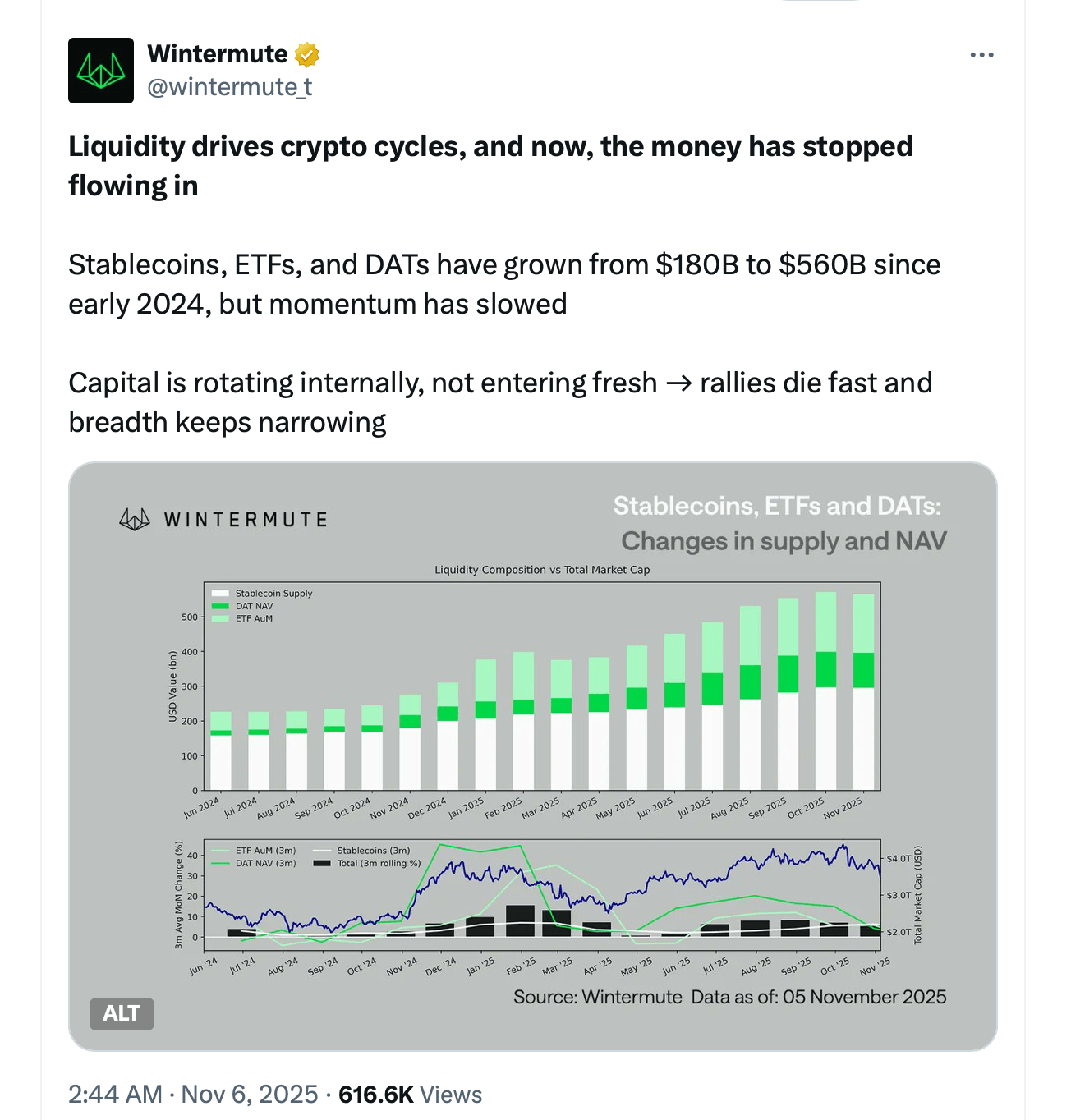

Jasper De Maere, the author who’s got his finger on the pulse, explained that, yes, adoption is great and all, but liquidity-that precious, fickle thing-still determines whether prices go up or down. Right now? Liquidity is simply recycling. It’s not expanding. In fact, all three liquidity channels-stablecoins, ETFs, and DATs-are plateauing after a nice run in late 2024 and early 2025.

Let’s break it down. DAT and ETF holdings skyrocketed from a modest $40 billion to $270 billion, while stablecoins doubled from $140 billion to $290 billion before coming to a screeching halt. And let’s be real, that slowdown? It’s not just some minor rotation of capital-it’s a clear sign that fresh money isn’t coming into the market right now.

Each of these channels shows something about who’s playing in the crypto pool, according to De Maere: stablecoins reflect the crypto-native crowd, DATs are the institutional yield-hungry folks, and ETFs are the big players from traditional finance. With all three flattening out, Wintermute’s saying the market’s now on life support-it’s running on the liquidity that’s been circulating, not any new capital coming in.

But don’t worry, there’s still some hope on the horizon. Outside the crypto world, global liquidity (M2) is still looking healthy, but thanks to high SOFR rates, everyone’s too busy parking their cash in Treasury bills to pay crypto any attention. Even with the end of U.S. quantitative tightening, De Maere notes that money is still opting for equities over crypto-for now.

This whole “internal liquidity cycle” explains why the market is acting all weird right now. Rallies are short-lived, volatility is spiking due to liquidations, and prices are basically zigzagging, even though assets under management are holding steady. Wintermute adds that new capital-whether through fresh stablecoin creation, ETF growth, or DAT issuances-will be the sign that external liquidity is finally making its grand return.

But until that moment arrives, De Maere says, crypto’s stuck in this “self-funded phase,” where liquidity is moving around in circles, not growing. If you’ve seen any of the previous cycles, this is the same old song and dance, folks.

FAQ ❓

- Who authored Wintermute’s report on crypto liquidity?

The report was written by Jasper De Maere, the guy who knows a thing or two about how crypto markets work. - What are the three liquidity channels that Wintermute focuses on?

Stablecoins, exchange-traded funds (ETFs), and digital asset treasuries (DATs). The holy trinity of liquidity. - Why does Wintermute say inflows have slowed?

Because SOFR rates are too high, and investors are choosing equities over digital assets. It’s a tough world out there. - When will liquidity return to crypto markets?

According to De Maere, the return of stablecoin minting, ETF inflows, or DAT growth will signal the comeback of external liquidity. So… basically, when it’s not being stubborn.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Silver Rate Forecast

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- Flipster’s Bold Leap: Zero-Spread Crypto Trading Unveiled! 🚀

2025-11-08 23:08