Oh, what a curious tale this is! Tether, the world’s most mysterious stablecoin issuer (and a bit of a trickster), has snatched up senior metals traders from HSBC to oversee its gold reserves. Because who wouldn’t want to trade in gold when the world is on the brink of chaos? ⚠️🌍

Tether’s plan? To diversify its balance sheet with physical assets-because nothing says “safety” like hoarding gold while the economy wobbles like a drunken tightrope walker. With over $12 billion in gold, Tether now has more treasure than a pirate’s cave (and far fewer parrots). 💰💎

Tether Expands Gold Division with Veteran HSBC Traders

The new hires, seasoned in bullion trading and risk management, are like wizards with a wand made of gold. Tether aims to become a major player in the precious metals market, which is as exciting as a dragon’s hoard. 🐉

The gold rally? Prices have leaped higher than a kangaroo in a trampoline park! Geopolitical chaos and a government shutdown that’s as thrilling as a wet noodle have made gold the ultimate flight-to-safety asset. 🪙📉

By hiring HSBC’s finest, Tether is playing a high-stakes game of chess with a gold-plated king. Who knew stablecoins could be so… adventurous? 🧠🤖

According to Kitco.com (and a few anonymous sources), Vincent Domien, HSBC’s Global Head of Metals Trading, and Mathew O’Neill, the man who’s never met a precious metal he didn’t like, are joining Tether’s team. 🎩🧙♂️

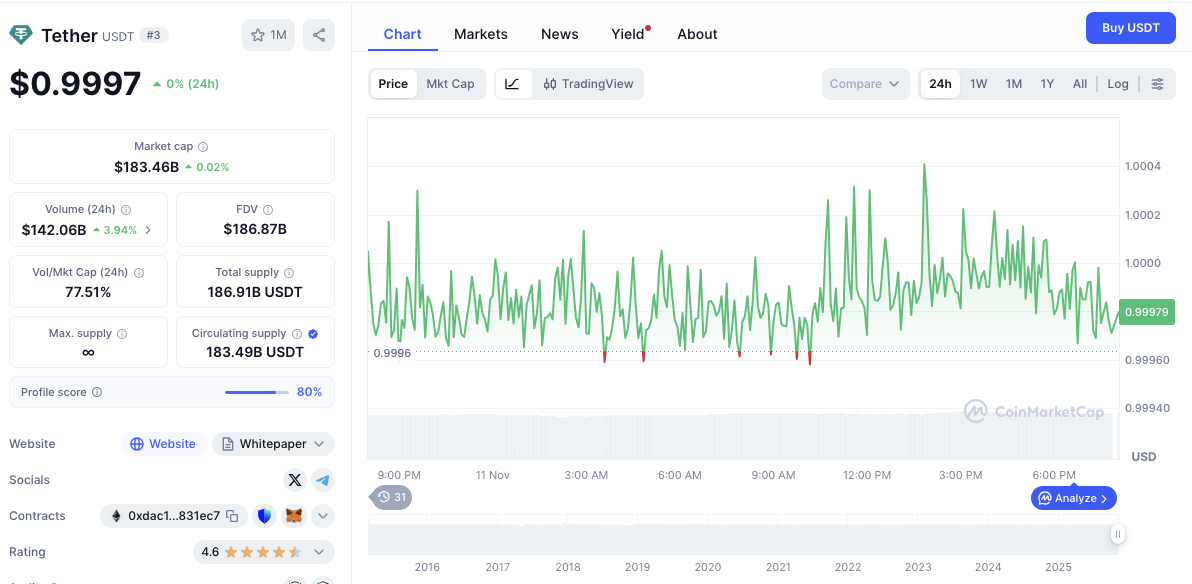

Tether market capitalization crossed $183B on Nov. 11 | Source: Coinmarketcap

Tether’s USDT market cap has soared past $183 billion, making it the financial equivalent of a superhero with a gold-plated cape. CEO Paolo Ardoino says the stablecoin supply grew by $17 billion in Q3-because who needs a budget when you’ve got a vault full of shiny coins? 💸

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- BONK Falls, Pump.fun Reclaims Throne – Can BONK_FUN Fight Back?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- XRP’s Little Dip: Oh, the Drama! 🎭

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

2025-11-12 01:29