My dear darlings, gather ’round as we sip our martinis and observe the utterly riveting spectacle of Bitcoin’s latest pas de deux with the $100,000 mark. 🥂 Yes, it’s holding steady, but darling, it’s struggling to pirouette past $105,000. How très dramatic! The market, after weeks of behaving like a tipsy debutante, appears to be steadying its tiara. Yet, the on-chain whispers suggest profit-taking is still the order of the day. According to the ever-so-clever Darkfost, since that exceptional liquidation soiree in October, investors are clutching their pearls and scaling back. The cycle, my loves, is nearing its grand finale. 🎭

Now, CryptoQuant, that darling data diva, reveals a notable uptick in Bitcoin inflows to Binance. The 30-day moving average, darling, has climbed sharper than a Cowardian wit, with 7,500 BTC waltzing into Binance daily. The highest since the March correction, no less! Selling pressure, you say? Mais oui, the traders are positioning themselves with all the caution of a society matron at a scandalous party. 🎩

But fear not, my cherubs, for Bitcoin’s consolidation near $100K suggests the buyers are still sipping champagne and absorbing the supply. A breakdown? Not just yet, darling. As the cycle matures, this phase may prove as critical as the final act of a Coward play-will it stabilize for another leg up, or shall we witness a prolonged correction? The suspense is exquisite. 🎭

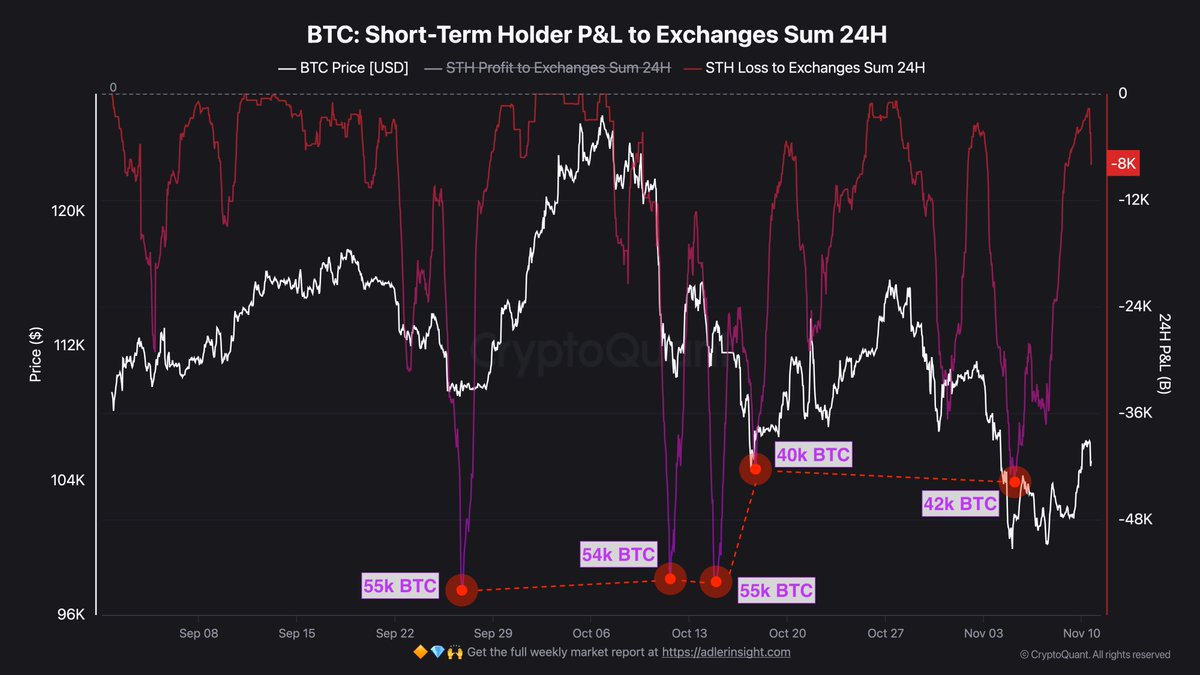

Short-Term Holders: The Drama Queens of the Market

Darkfost, that darling analyst, explains the surge in Bitcoin inflows to Binance and other exchanges is like a chorus of selling pressure. Yet, Bitcoin’s price consolidates with the grace of a Coward protagonist around $100,000. Demand, my dears, remains as sturdy as a Coward one-liner. This balance between distribution and accumulation? A structural reset, not a capitulation. How utterly civilized! 🧐

And who are the stars of this act? Short-term holders, of course! These darlings, with their realized price near $112,000, have been underwater for a month, prompting them to send BTC to exchanges at a loss. Historically, this behavior coincides with late-stage corrections-a “cleansing phase,” if you will. Speculative capital exits, while long-term investors quietly mop up the supply. Stability, my loves, is just around the corner. 🧹

If demand continues to offset this wave of selling, Bitcoin could form a base stronger than a Coward cocktail. A gradual recovery, darling, as selling pressure fades and confidence returns. How positively delightful! 🌟

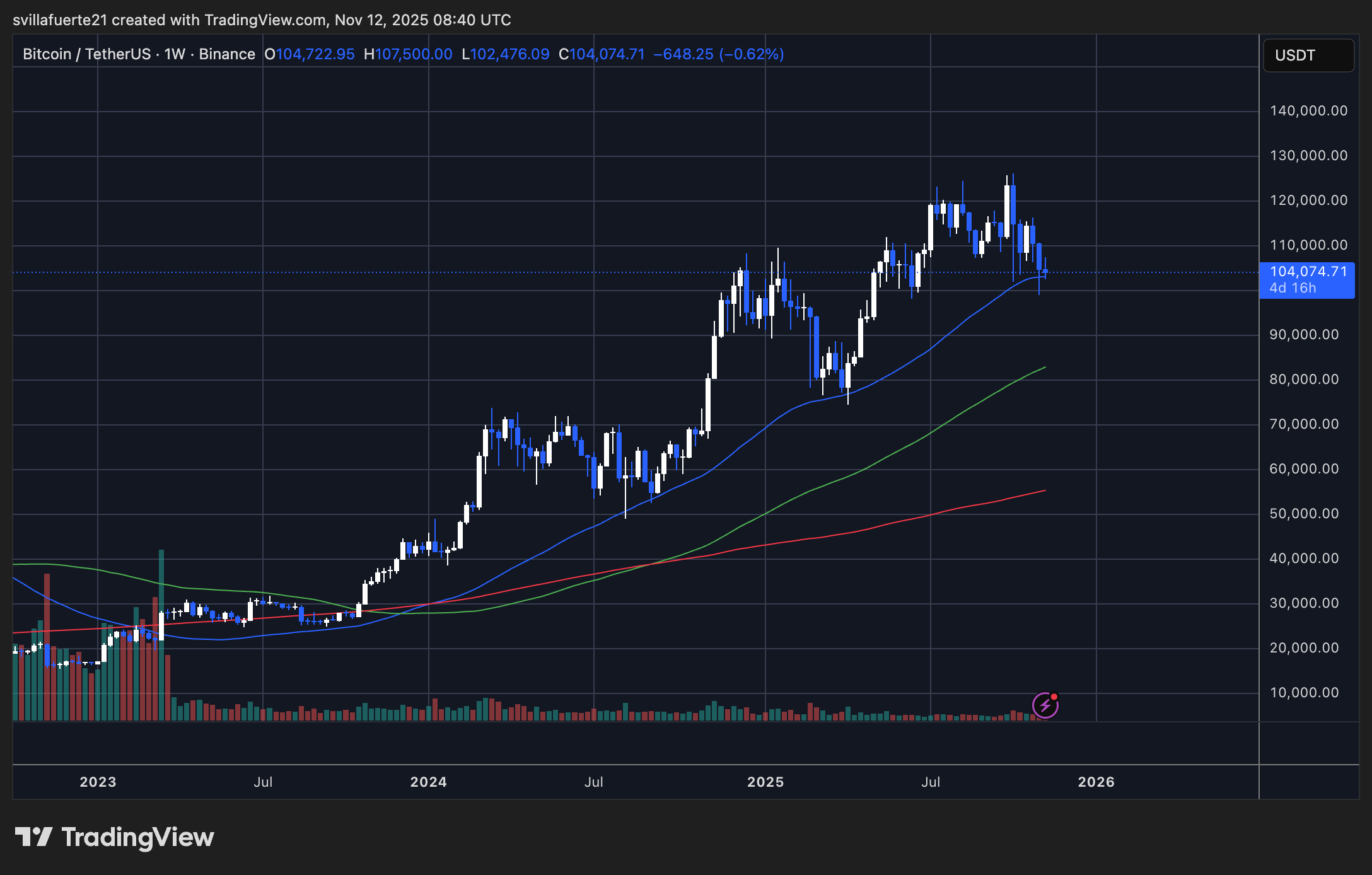

Weekly Chart: Holding the Line with Panache

Bitcoin, my darlings, consolidates between $102,000 and $107,000 with the resilience of a Coward leading lady. The 50-week moving average acts as a dynamic floor, and the bulls? They’ve defended it like a society hostess guarding her reputation. Underlying demand, my dears, remains intact. Bravo! 👏

The macro bias, my loves, remains bullish. The 100-week and 200-week moving averages slope upward like a Coward plot twist. Yet, volume during rebounds is as tepid as a Coward character’s apology. Market participants, it seems, are waiting for renewed momentum before committing. If Bitcoin reclaims $110K, it could trigger a recovery toward $117K-$120K. But a weekly close below $100K? Darling, that would be a technical breakdown of the highest order, potentially leading to a retrace toward $92K-$95K. 🌀

So, my darlings, as we watch this financial ballet unfold, remember: in the world of Bitcoin, as in a Coward play, the show must go on. And oh, what a show it is! 🎭✨

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- EUR HKD PREDICTION

- USD UAH PREDICTION

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

2025-11-13 04:18